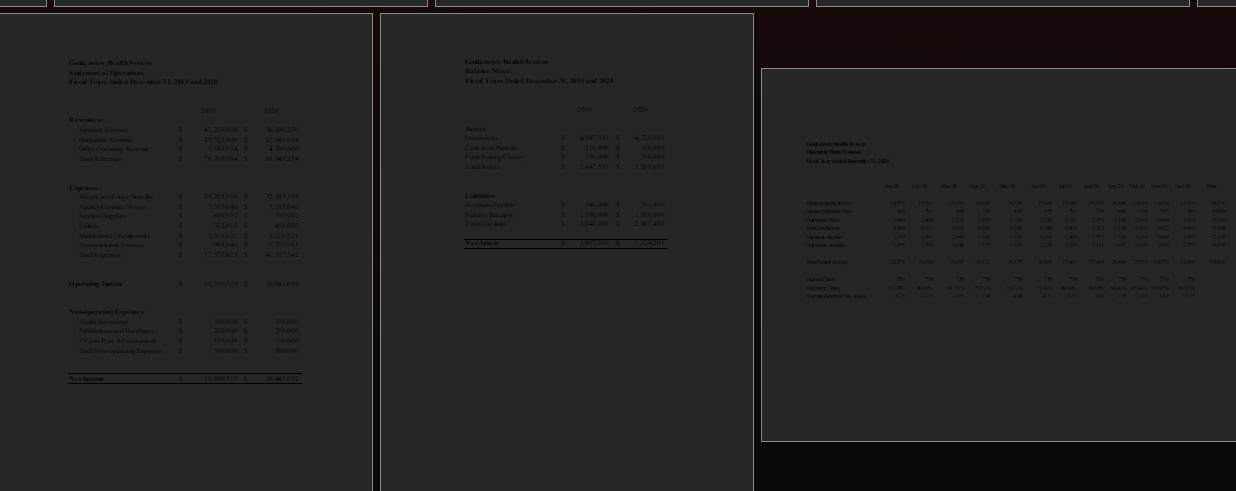

Question: Part A: Financial Statement Analysis - Analyze and explain the content of financial statements and financial ratios for this healthcare organization. *** Goldenviews Financial Statements

Part A: Financial Statement Analysis - Analyze and explain the content of financial statements and financial ratios for this healthcare organization. *** Goldenviews Financial Statements Provided Above.

1. Identify at least three financial strengths and three financial weaknesses for Goldenview Health System. Support your claims with specific information presented in the financial or operating data statements and cite reasoning from your textbook. (20 pts)

2. Calculate the following profitability ratio for 2020: a) total margin and b) the return on equity (ROE). (10 pts)

3. Calculate the following debt and asset management ratios for 2020: a) total asset turnover, b) debt to equity ratio. (10 pts)

4. Calculate the following operating indicators for 2020: a) revenue per discharge, b) profit per discharge, c) expense per discharge. (10 pts)

5. Discuss whats changed from one fiscal year to the next. How have these changes impacted the organizations financial standing? (20 pts)

Part B: Labor and Workload Analysis (30 pts) Perform basic budgeting tasks for this healthcare organization. *** Goldenviews New Service Line ~ PET Scans.

In 2009, the Centers for Medicare and Medicaid Services (CMS) expanded its Imaging payment coverage for cancer patients. Goldenview is considering the implementation of PET Scans (Positron Emission Tomography) for its growing cancer patient population, and to hopefully boost their revenue. It already offers MRI and CT scans, but this new service will require a separate staff to accommodate the volume of patients. The financial analysis team must estimate the impacts of the new service line and determine its feasibility for the organization. These services will be offered in-house, to avoid complications with the Stark Law, which prohibits physician referrals to their entities in which they may have financial interest. There are still CMS Medicare physician fee schedule (PFS) capped payment rates to consider, so the labor costs are the first category to be examined. Financial guidance from the U.S. Government Accountability Office (GAO) encourages zero-based budgeting for government programs, so this must be a ground-up calculation.

Based upon the annual outpatient ancillary volume shown in the above data, calculate total labor cost using the following FTE categories:

- (1) Medical Doctor/Radiologist @ $175.00 per hour

- (1) Registered Nurse @$70.00 per hour

- (2) Imaging Technicians @ $40.00 per hour

- 3 hours per patient/imaging procedure

- Assume fringe benefit percentage of 33%.

Costs must be calculated for each labor category separately, monthly, and totaled at the end of the fiscal year.

I know what the answers are but cannot find where the numbers go to get them. HELP plz.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts