Question: Part a is all completed and correct PART B IS THE PART I NEED HELP WITH it is neither complete but everything i have plugged

Part a is all completed and correct

PART B IS THE PART I NEED HELP WITH it is neither complete but everything i have plugged in till now are correct

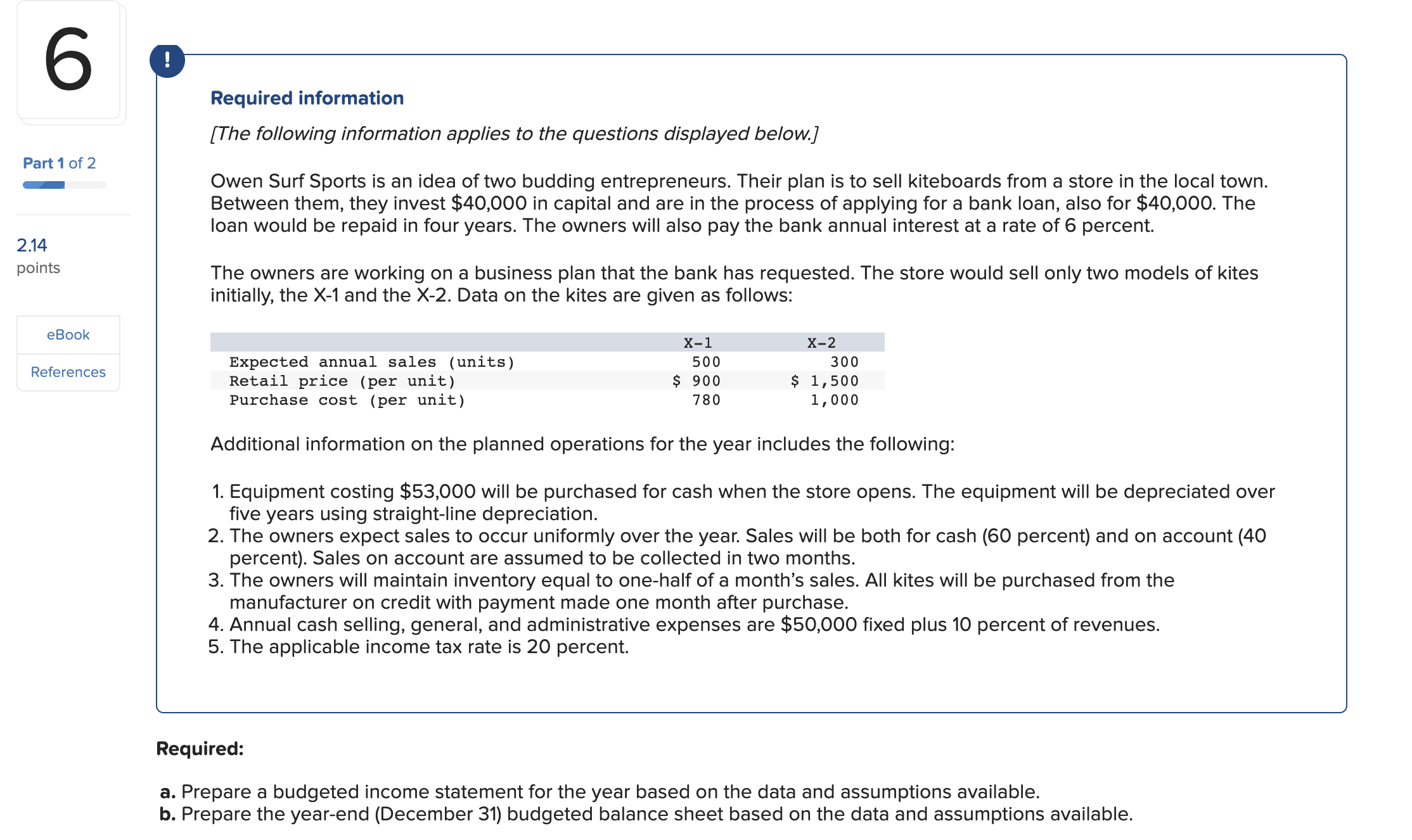

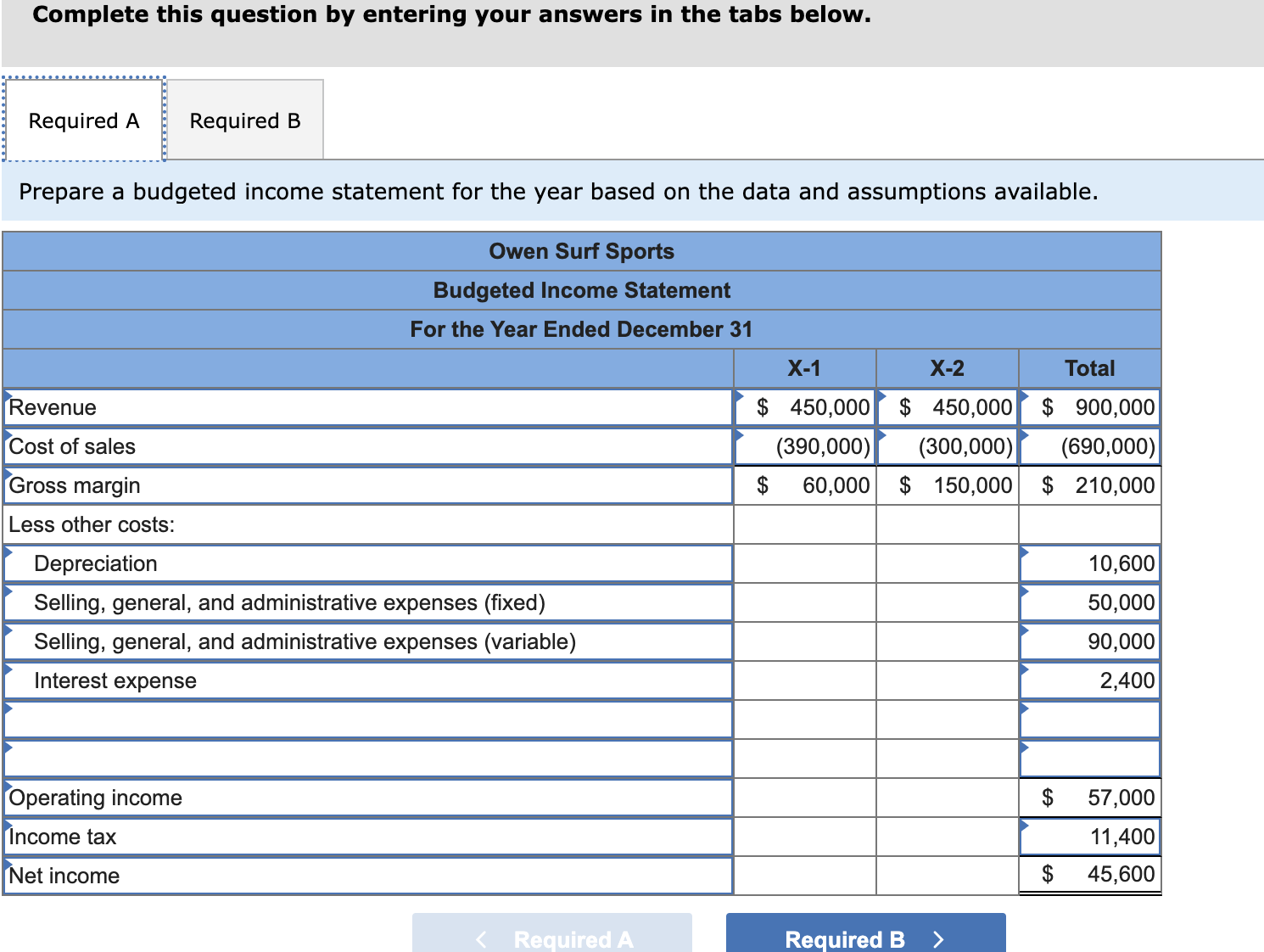

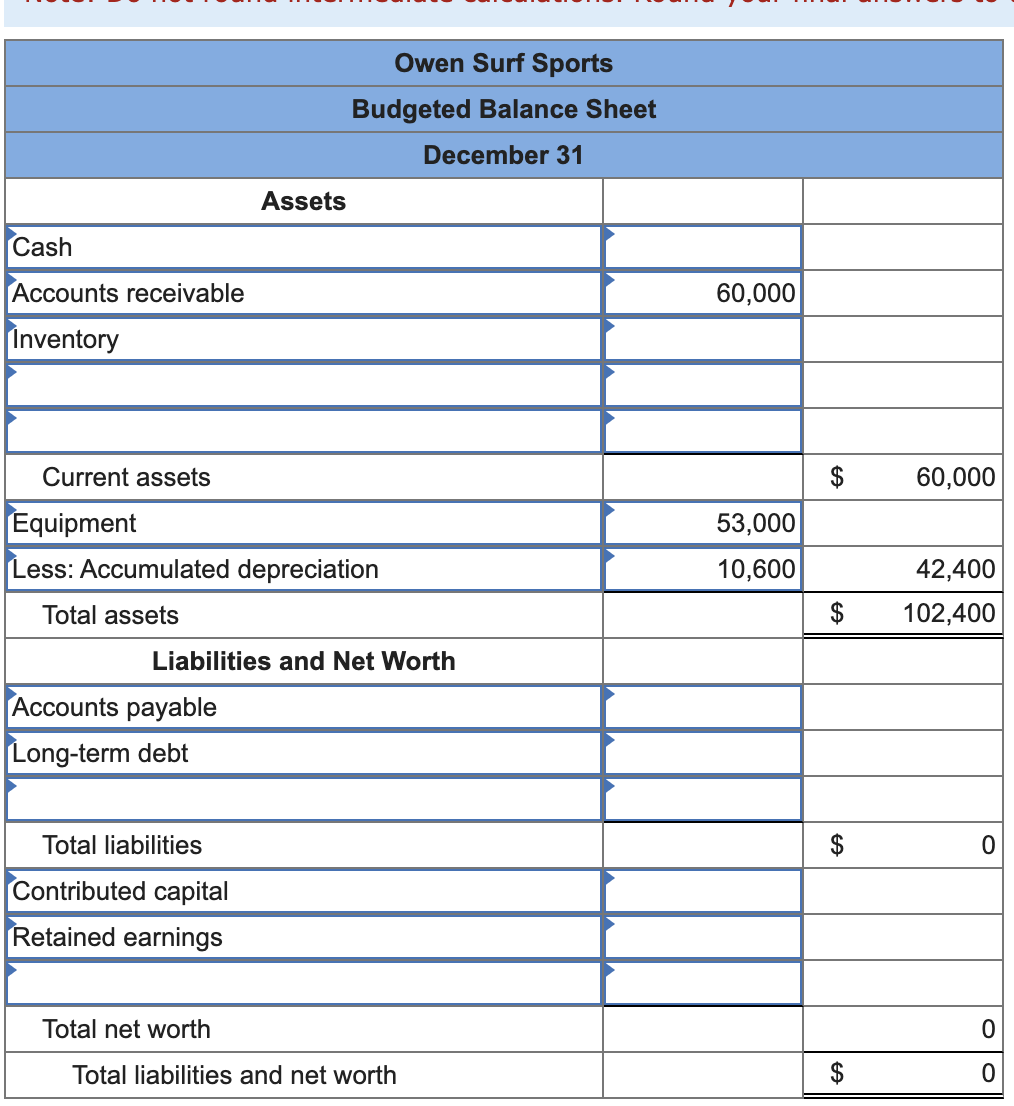

Required information [The following information applies to the questions displayed below.] Owen Surf Sports is an idea of two budding entrepreneurs. Their plan is to sell kiteboards from a store in the local town. Between them, they invest $40,000 in capital and are in the process of applying for a bank loan, also for $40,000. The loan would be repaid in four years. The owners will also pay the bank annual interest at a rate of 6 percent. The owners are working on a business plan that the bank has requested. The store would sell only two models of kites initially, the X1 and the X2. Data on the kites are given as follows: Additional information on the planned operations for the year includes the following: 1. Equipment costing $53,000 will be purchased for cash when the store opens. The equipment will be depreciated over five years using straight-line depreciation. 2. The owners expect sales to occur uniformly over the year. Sales will be both for cash ( 60 percent) and on account (40 percent). Sales on account are assumed to be collected in two months. 3. The owners will maintain inventory equal to one-half of a month's sales. All kites will be purchased from the manufacturer on credit with payment made one month after purchase. 4. Annual cash selling, general, and administrative expenses are $50,000 fixed plus 10 percent of revenues. 5. The applicable income tax rate is 20 percent. Required: a. Prepare a budgeted income statement for the year based on the data and assumptions available. b. Prepare the year-end (December 31) budgeted balance sheet based on the data and assumptions available. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Owen Surf Sports } \\ \hline \multicolumn{4}{|c|}{ Budgeted Balance Sheet } \\ \hline \multicolumn{4}{|c|}{ December 31} \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline \multicolumn{4}{|l|}{ Cash } \\ \hline Accounts receivable & 60,000 & & \\ \hline \multicolumn{4}{|l|}{ Inventory } \\ \hline & & & \\ \hline \multicolumn{4}{|l|}{ F } \\ \hline Current assets & & $ & 60,000 \\ \hline Equipment & 53,000 & & \\ \hline Less: Accumulated depreciation & 10,600 & & 42,400 \\ \hline Total assets & & $ & 102,400 \\ \hline \multicolumn{4}{|c|}{ Liabilities and Net Worth } \\ \hline \multicolumn{4}{|l|}{ Accounts payable } \\ \hline \multicolumn{4}{|l|}{ Long-term debt } \\ \hline & & & \\ \hline Total liabilities & & $ & 0 \\ \hline \multicolumn{4}{|l|}{ Contributed capital } \\ \hline \multicolumn{4}{|l|}{ Retained earnings } \\ \hline & & & \\ \hline Total net worth & & & 0 \\ \hline Total liabilities and net worth & & $ & 0 \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Prepare a budgeted income statement for the year based on the data and assumptions available. Required information [The following information applies to the questions displayed below.] Owen Surf Sports is an idea of two budding entrepreneurs. Their plan is to sell kiteboards from a store in the local town. Between them, they invest $40,000 in capital and are in the process of applying for a bank loan, also for $40,000. The loan would be repaid in four years. The owners will also pay the bank annual interest at a rate of 6 percent. The owners are working on a business plan that the bank has requested. The store would sell only two models of kites initially, the X1 and the X2. Data on the kites are given as follows: Additional information on the planned operations for the year includes the following: 1. Equipment costing $53,000 will be purchased for cash when the store opens. The equipment will be depreciated over five years using straight-line depreciation. 2. The owners expect sales to occur uniformly over the year. Sales will be both for cash ( 60 percent) and on account (40 percent). Sales on account are assumed to be collected in two months. 3. The owners will maintain inventory equal to one-half of a month's sales. All kites will be purchased from the manufacturer on credit with payment made one month after purchase. 4. Annual cash selling, general, and administrative expenses are $50,000 fixed plus 10 percent of revenues. 5. The applicable income tax rate is 20 percent. Required: a. Prepare a budgeted income statement for the year based on the data and assumptions available. b. Prepare the year-end (December 31) budgeted balance sheet based on the data and assumptions available. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Owen Surf Sports } \\ \hline \multicolumn{4}{|c|}{ Budgeted Balance Sheet } \\ \hline \multicolumn{4}{|c|}{ December 31} \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline \multicolumn{4}{|l|}{ Cash } \\ \hline Accounts receivable & 60,000 & & \\ \hline \multicolumn{4}{|l|}{ Inventory } \\ \hline & & & \\ \hline \multicolumn{4}{|l|}{ F } \\ \hline Current assets & & $ & 60,000 \\ \hline Equipment & 53,000 & & \\ \hline Less: Accumulated depreciation & 10,600 & & 42,400 \\ \hline Total assets & & $ & 102,400 \\ \hline \multicolumn{4}{|c|}{ Liabilities and Net Worth } \\ \hline \multicolumn{4}{|l|}{ Accounts payable } \\ \hline \multicolumn{4}{|l|}{ Long-term debt } \\ \hline & & & \\ \hline Total liabilities & & $ & 0 \\ \hline \multicolumn{4}{|l|}{ Contributed capital } \\ \hline \multicolumn{4}{|l|}{ Retained earnings } \\ \hline & & & \\ \hline Total net worth & & & 0 \\ \hline Total liabilities and net worth & & $ & 0 \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Prepare a budgeted income statement for the year based on the data and assumptions available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts