Question: PART A : options for A: accept / reject & options for B: accept / reject PART B : True or False: The NPV and

PART A: options for A: accept / reject & options for B: accept / reject

PART B: True or False: The NPV and IRR methods can lead to conflicting decisions for mutually exclusive projects. true / false

PLEASE ANSWER BOTH PARTS OF QUESTION, PLEASE NO HANDWRITING, I WILL UPVOTE IF CORRECT. THANK YOU SO MUCH

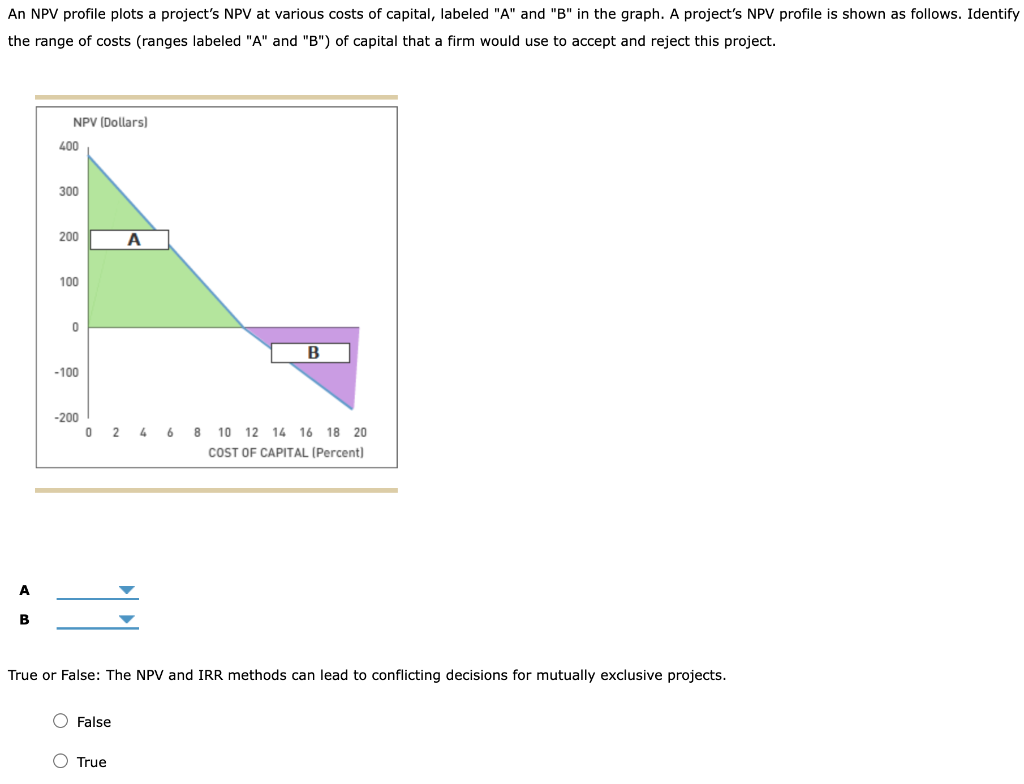

An NPV profile plots a project's NPV at various costs of capital, labeled "A" and "B" in the graph. A project's NPV profile is shown as follows. Identify the range of costs (ranges labeled "A" and "B") of capital that a firm would use to accept and reject this project. NPV (Dollars) 400 300 200 A 100 0 3 B -100 -200 0 2 4 6 8 10 12 14 16 18 20 COST OF CAPITAL (Percent) B True or False: The NPV and IRR methods can lead to conflicting decisions for mutually exclusive projects. O False O True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts