Question: ( Part A, Part B, Part C, and Part D) Im having trouble with this four part problem on accounting. If anyone get help me

( Part A, Part B, Part C, and Part D) Im having trouble with this four part problem on accounting. If anyone get help me with this question this will be greatly appreciated. Please make sure its correct because I'm trying to learn from this. The couple of times I've posted this in the past they have been wrong. Again, please make sure it's correct and box the final answer. Thank you

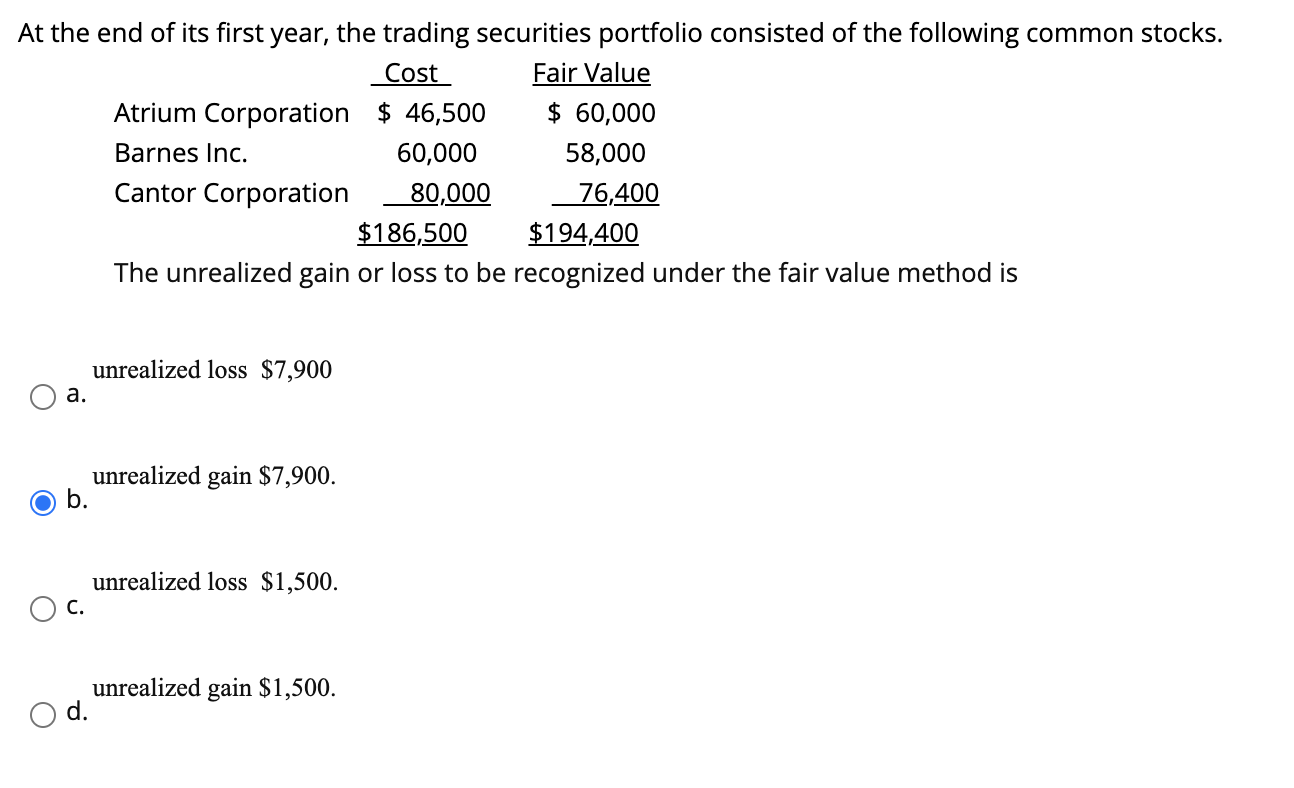

Part A

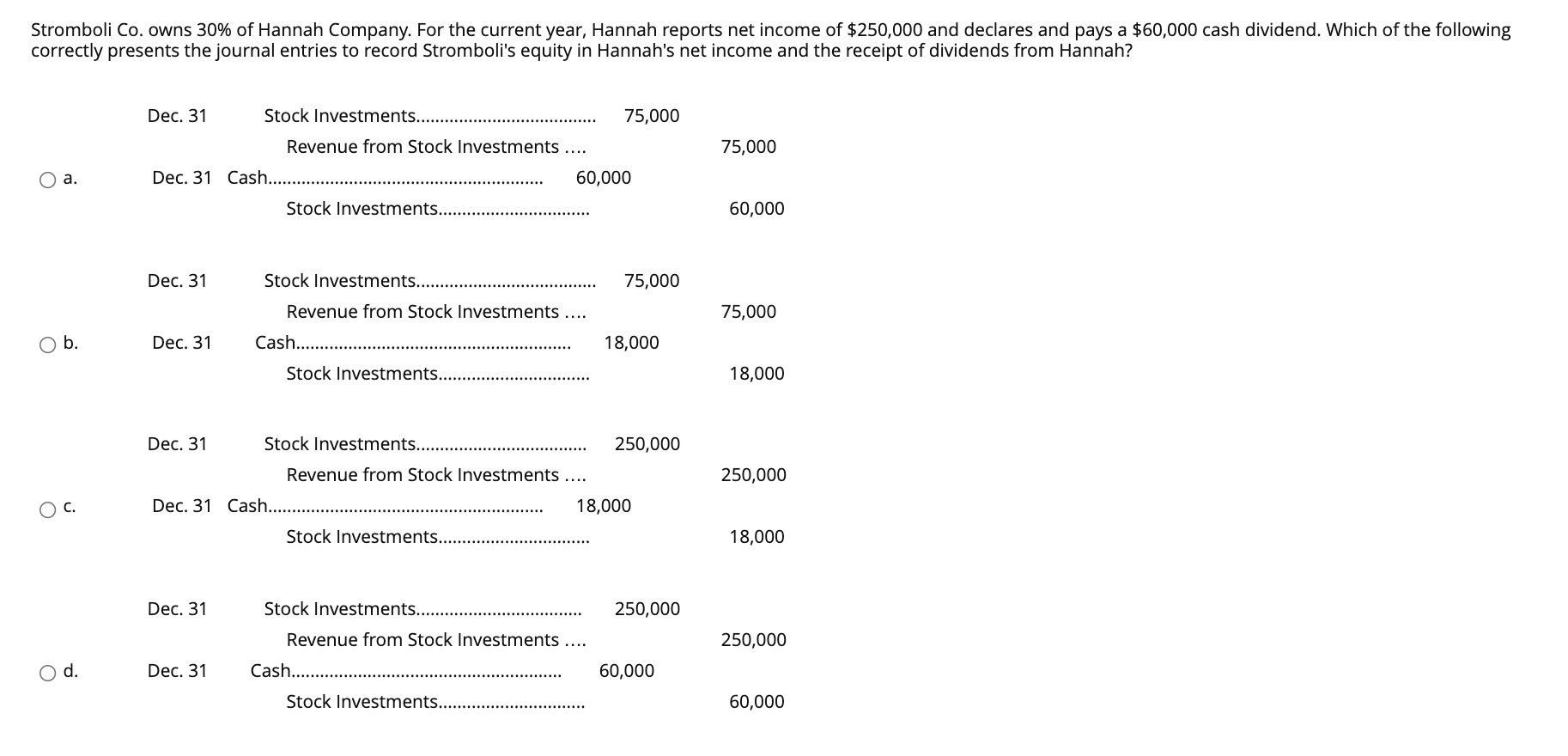

Part B

Part B

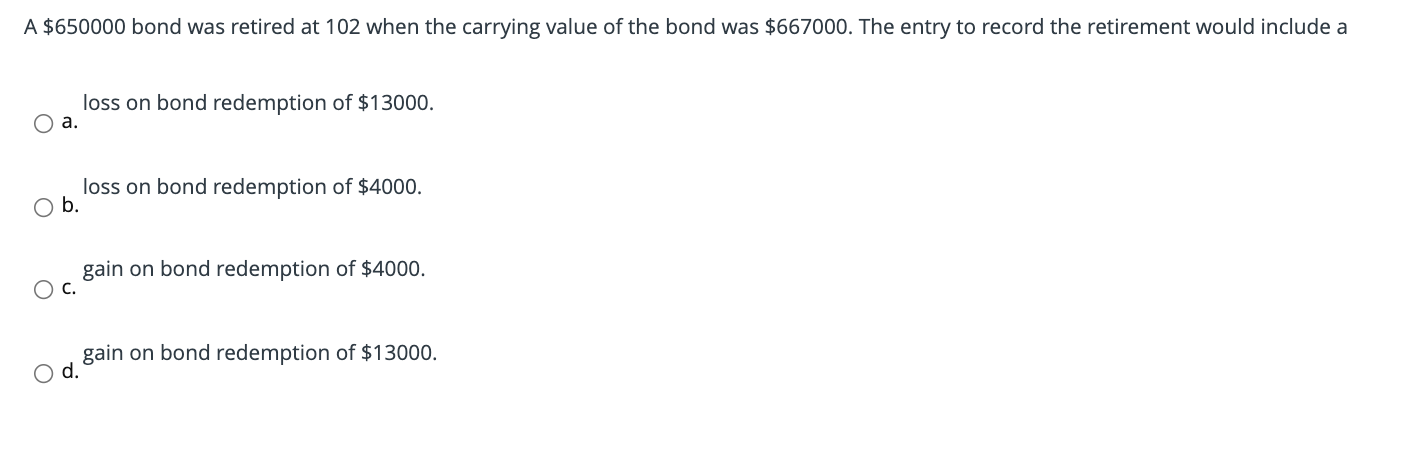

Part C

Part C

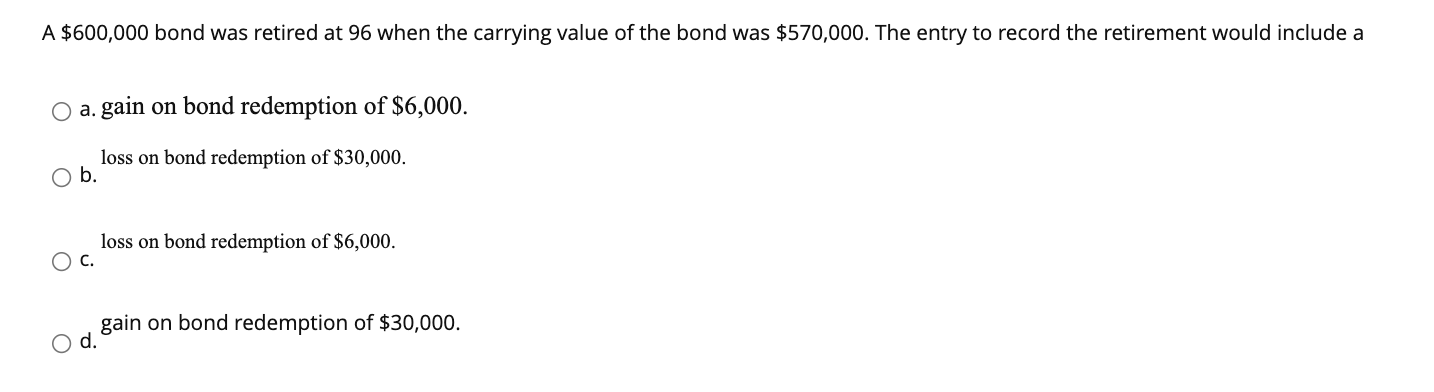

Part D

Part D

At the end of its first year, the trading securities portfolio consisted of the following common stocks. Cost Fair Value Atrium Corporation $ 46,500 $ 60,000 Barnes Inc. 60,000 58,000 Cantor Corporation 80,000 76,400 $186,500 $194,400 The unrealized gain or loss to be recognized under the fair value method is unrealized loss $7,900 a. unrealized gain $7,900. b. unrealized loss $1,500. C. unrealized gain $1,500. O d. Stromboli Co. owns 30% of Hannah Company. For the current year, Hannah reports net income of $250,000 and declares and pays a $60,000 cash dividend. Which of the following correctly presents the journal entries to record Stromboli's equity in Hannah's net income and the receipt of dividends from Hannah? Dec. 31 Stock Investments. 75,000 Revenue from Stock Investments .... Dec. 31 Cash. 60,000 75,000 a. Stock Investments... 60,000 Dec. 31 Stock Investments.. 75,000 Revenue from Stock Investments .... 75,000 b. Dec. 31 Cash..... 18,000 Stock Investments... 18,000 Dec. 31 250,000 Stock Investments...... Revenue from Stock Investments .... 250,000 C. Dec. 31 Cash. 18,000 Stock Investments...... 18,000 Dec. 31 Stock Investments...... 250,000 Revenue from Stock Investments .... 250,000 O d. Dec. 31 Cash... 60,000 Stock Investments.......... 60,000 A $650000 bond was retired at 102 when the carrying value of the bond was $667000. The entry to record the retirement would include a loss on bond redemption of $13000. O a. loss on bond redemption of $4000. O b. gain on bond redemption of $4000. c. gain on bond redemption of $13000. O d. A $600,000 bond was retired at 96 when the carrying value of the bond was $570,000. The entry to record the retirement would include a a. gain on bond redemption of $6,000. loss on bond redemption of $30,000. b. loss on bond redemption of $6,000. O c. gain on bond redemption of $30,000. O d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts