Question: Part A Part B Part C Required information Suppose Jim worked 62 hours during this payroll period and is paid $15.00 per hour. Assume FICA

Part A

Part B

Part C

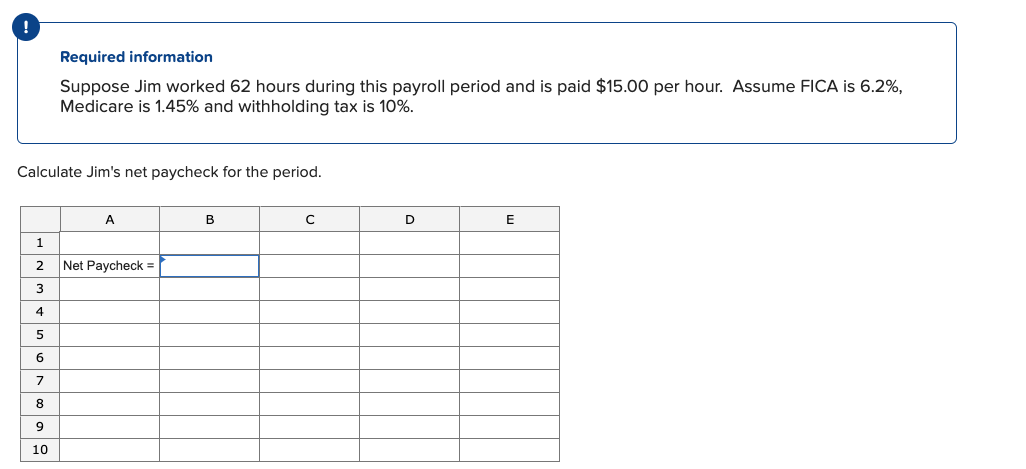

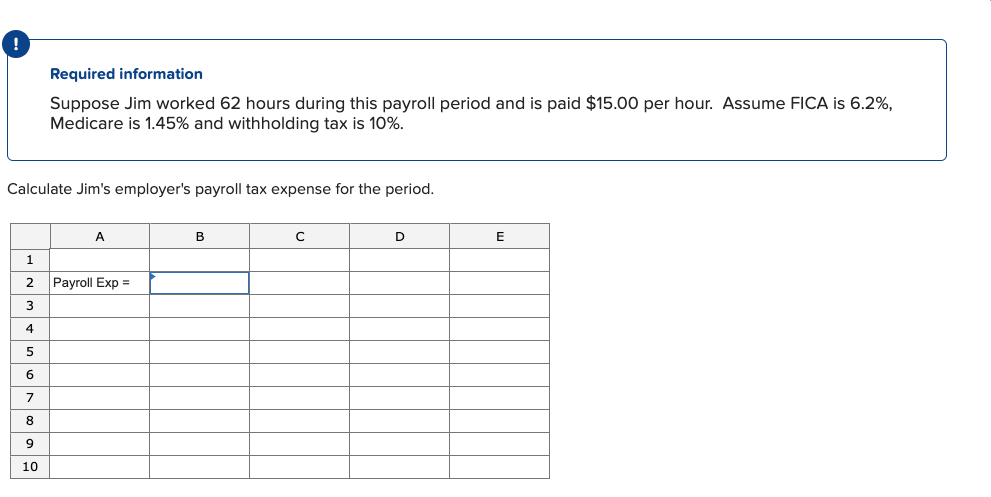

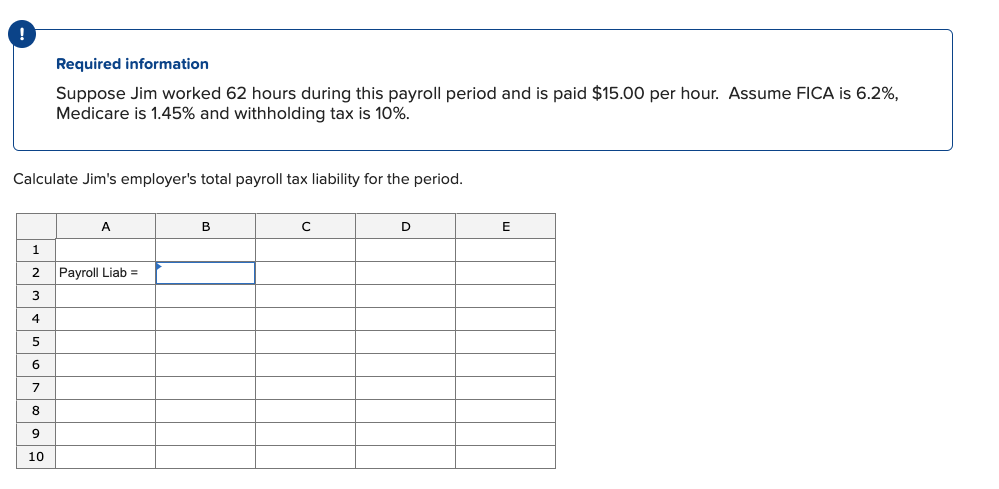

Required information Suppose Jim worked 62 hours during this payroll period and is paid $15.00 per hour. Assume FICA is 6.2%, Medicare is 1.45% and withholding tax is 10%. Calculate Jim's net paycheck for the period. A B D E 1 2 Net Paycheck = 4 5 6 7 8 9 10 Required information Suppose Jim worked 62 hours during this payroll period and is paid $15.00 per hour. Assume FICA is 6.2%, Medicare is 1.45% and withholding tax is 10%. Calculate Jim's employer's payroll tax expense for the period. A B D E 1 2 Payroll Exp = 3 4 5 6 7 8 9 10 Required information Suppose Jim worked 62 hours during this payroll period and is paid $15.00 per hour. Assume FICA is 6.2%, Medicare is 1.45% and withholding tax is 10%. Calculate Jim's employer's total payroll tax liability for the period. A B D E 1 2 Payroll Liab = 3 4 5 6 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts