Question: Part B 15 marks) Answer the following question and provide numerical support where appropriate. (Maximum of 1,000 English words without the need of citing references)!

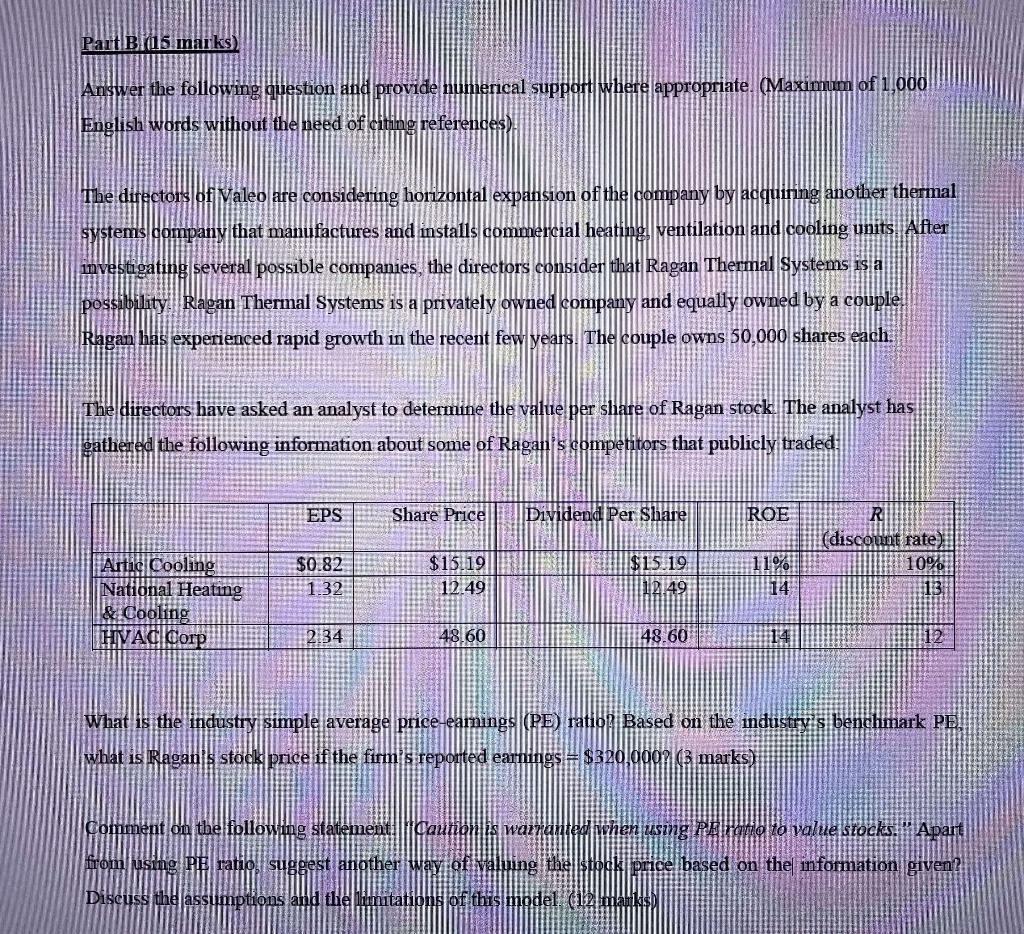

Part B 15 marks) Answer the following question and provide numerical support where appropriate. (Maximum of 1,000 English words without the need of citing references)! The directors of Valeo are considering horizontal expansion of the company by acquiring another thermal systems company that manufactures and installs commercial heating, ventilation and cooling units. After investigating several possible companies, the directors consider that Ragan Thermal Systems is a possibility. Ragan Thermal Systems is a privately owned company and equally owned by a couple. Ragan has experienced rapid growth in the recent few years. The couple owns 50,000 shares each. The directors have asked an analyst to determine the value per share of Ragan stock. The analyst has gathered the following information about some of Ragan's competitors that publicly traded: EPS Share Price Dividend Per Share ROE R (discount rate) 10% $15.19 $15.19 $0.82 1.32 11% 14 12.49 112.49 Artie Cooling National Heating & Cooling HVAC Corp 2.34 48.60 48.60 14 12 What is the industry simple average price-eamings (PE) ratio. Based on the industry's benchmark PE what is Raganis stock price if the firm's reported earnings = $320,00091 (3 marks) Comment on the following statement:|| Caution is warranted when using Paradd to value stocks." Apart from using Pratio suggest another way ofwaliing thelstek price based on the information given? Discuss the assumptions and the limitations of this model. (12 mankis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts