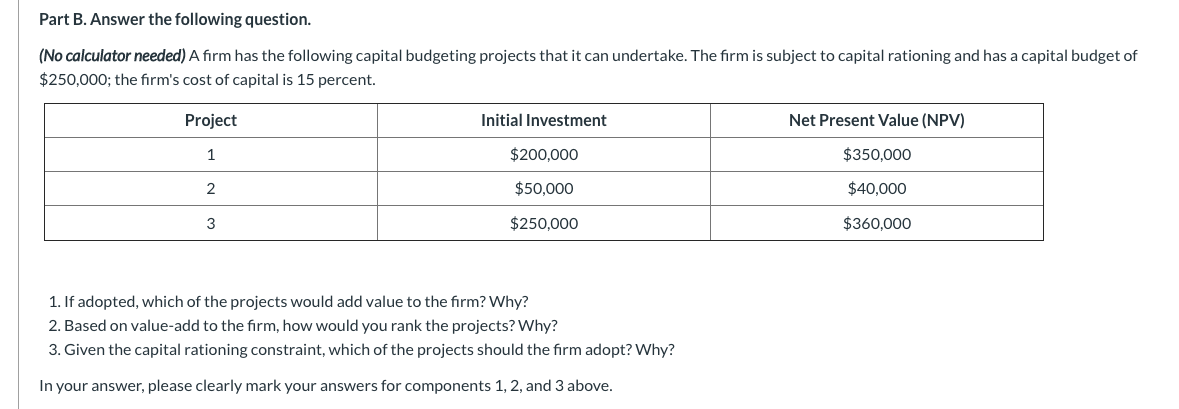

Question: Part B. Answer the following question. (No calculator needed) A firm has the following capital budgeting projects that it can undertake. The firm is subject

Part B. Answer the following question. (No calculator needed) A firm has the following capital budgeting projects that it can undertake. The firm is subject to capital rationing and has a capital budget of $250,000; the firm's cost of capital is 15 percent. Project Initial Investment Net Present Value (NPV) $200,000 $350,000 2 $50,000 $40,000 3 $250,000 $360,000 1. If adopted, which of the projects would add value to the firm? Why? 2. Based on value-add to the firm, how would you rank the projects? Why? 3. Given the capital rationing constraint, which of the projects should the firm adopt? Why? In your answer, please clearly mark your answers for components 1, 2, and 3 above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts