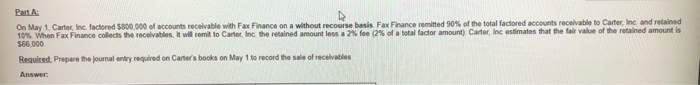

Question: Part B: Assume the same facts as in Part A above, except that Carter, Inc. factored the receivable with recourse and estimated the recourse obligation

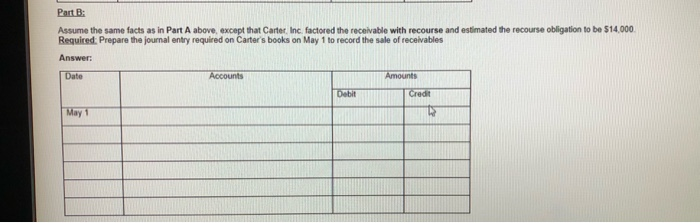

Part B: Assume the same facts as in Part A above, except that Carter, Inc. factored the receivable with recourse and estimated the recourse obligation to be $14.000 Required: Prepare the journal entry required on Carter's books on May 1 to record the sale of receivables Answer: Date Accounts Amounts Debit Credit May 1 Part A On May 1. Carter, Inc. factored 5800,000 of accounts receivable with Fax Finance on a without recourse basis. Fax Finance remitted 90% of the total factored accounts receivable to Carter Inc and retained 10% When Fax Finance collects the receivables, it will remito Carter, Inc. the retained amountless a 2% fee (2% of a total factor amount). Carter, Inc estimates that the fair value of the retained amount is 566,000 Required. Prepare the journal entry required on Carter's books on May 1 to record the sale of receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts