Question: Part B - Case Study Questions (Total: 20 marks) Question 7 (10 marks) Jeremy is going to retire in the near future and had

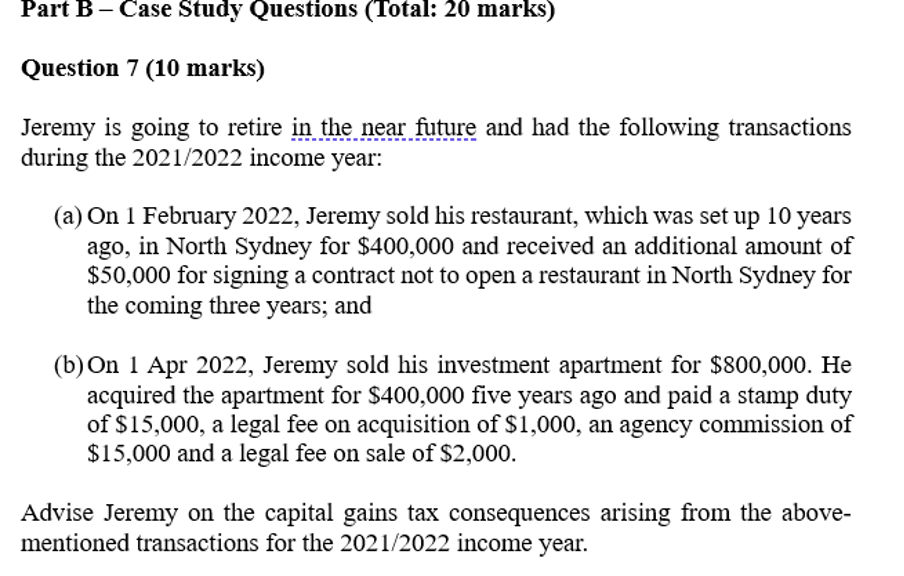

Part B - Case Study Questions (Total: 20 marks) Question 7 (10 marks) Jeremy is going to retire in the near future and had the following transactions during the 2021/2022 income year: (a) On 1 February 2022, Jeremy sold his restaurant, which was set up 10 years ago, in North Sydney for $400,000 and received an additional amount of $50,000 for signing a contract not to open a restaurant in North Sydney for the coming three years; and (b) On 1 Apr 2022, Jeremy sold his investment apartment for $800,000. He acquired the apartment for $400,000 five years ago and paid a stamp duty of $15,000, a legal fee on acquisition of $1,000, an agency commission of $15,000 and a legal fee on sale of $2,000. Advise Jeremy on the capital gains tax consequences arising from the above- mentioned transactions for the 2021/2022 income year.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts