Question: PART B: MULTIPLE CHOICE. USE THE ANSWER SHEET PROVIDED BELOW. 1. Which of the following statements is correct? a. Preferred stock is generally less risky

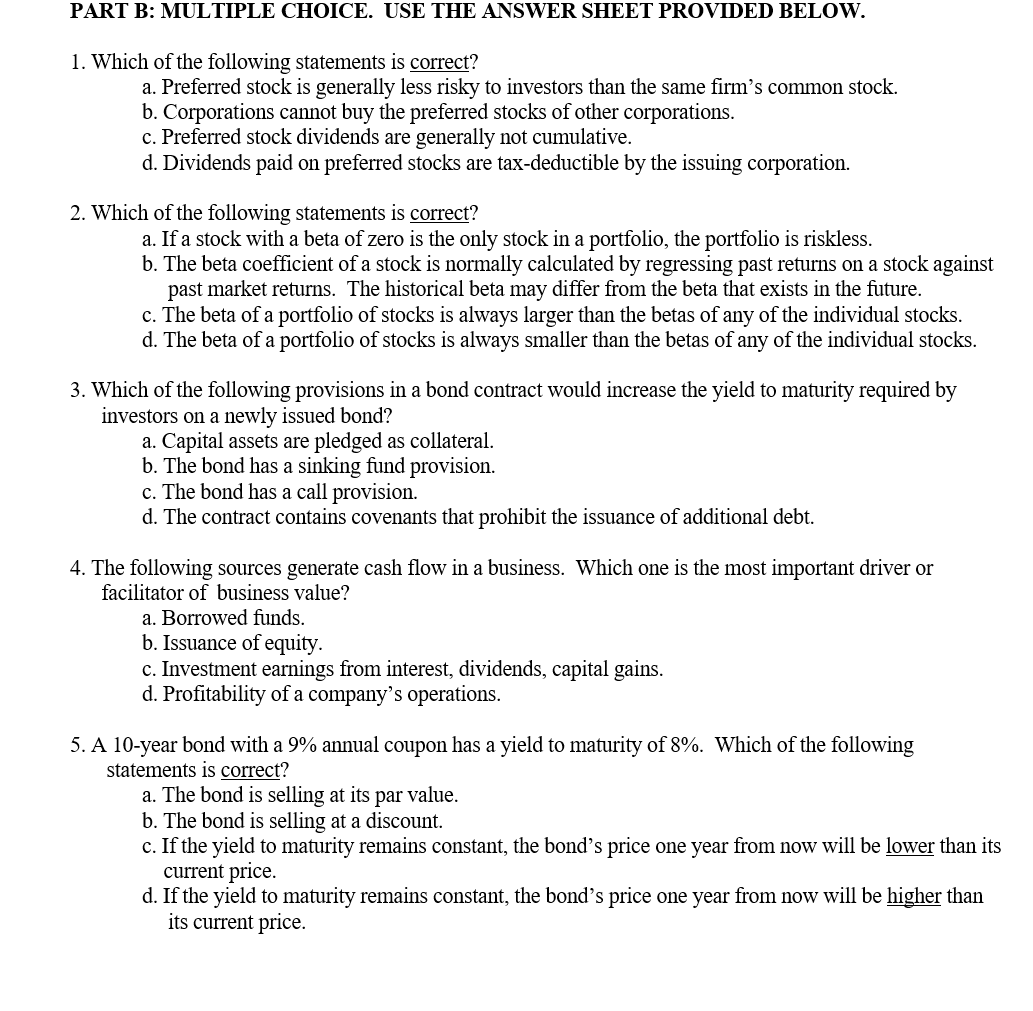

PART B: MULTIPLE CHOICE. USE THE ANSWER SHEET PROVIDED BELOW. 1. Which of the following statements is correct? a. Preferred stock is generally less risky to investors than the same firm's common stock. b. Corporations cannot buy the preferred stocks of other corporations. c. Preferred stock dividends are generally not cumulative. d. Dividends paid on preferred stocks are tax-deductible by the issuing corporation. 2. Which of the following statements is correct? a. If a stock with a beta of zero is the only stock in a portfolio, the portfolio is riskless. b. The beta coefficient of a stock is normally calculated by regressing past returns on a stock against past market returns. The historical beta may differ from the beta that exists in the future. c. The beta of a portfolio of stocks is always larger than the betas of any of the individual stocks. d. The beta of a portfolio of stocks is always smaller than the betas of any of the individual stocks. 3. Which of the following provisions in a bond contract would increase the yield to maturity required by investors on a newly issued bond? a. Capital assets are pledged as collateral. b. The bond has a sinking fund provision. c. The bond has a call provision. d. The contract contains covenants that prohibit the issuance of additional debt. 4. The following sources generate cash flow in a business. Which one is the most important driver or facilitator of business value? a. Borrowed funds. b. Issuance of equity. c. Investment earnings from interest, dividends, capital gains. d. Profitability of a company's operations. 5. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is correct? a. The bond is selling at its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts