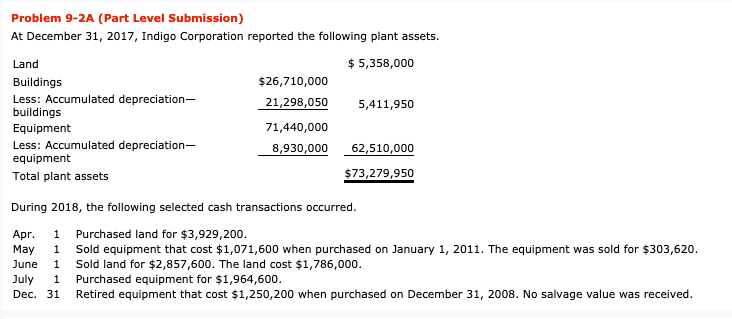

Question: Part B Question Problem 9-2A (Part Level Submission) At December 31, 2017, Indigo Corporation reported the following plant assets. Land $ 5,358,000 Buildings $26,710,000 Less:

Part B Question

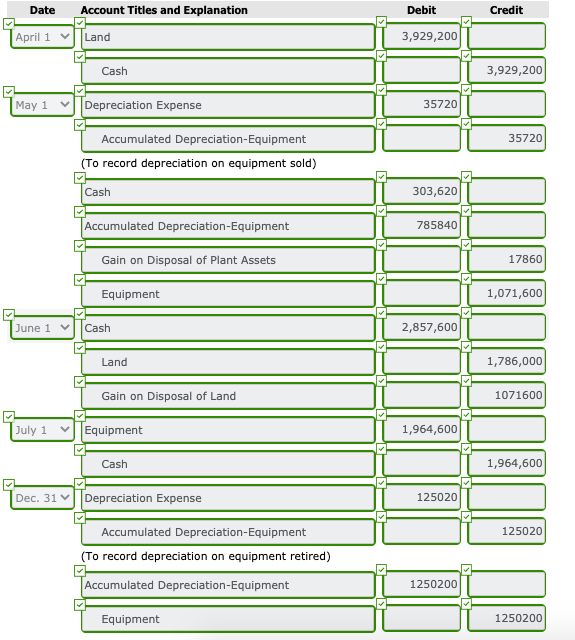

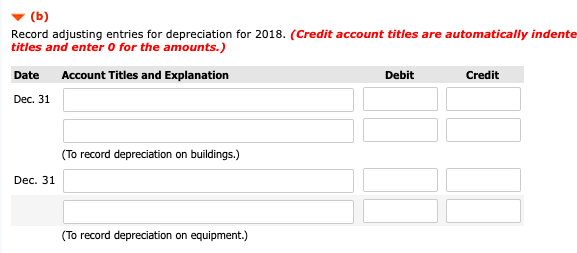

Problem 9-2A (Part Level Submission) At December 31, 2017, Indigo Corporation reported the following plant assets. Land $ 5,358,000 Buildings $26,710,000 Less: Accumulated depreciation- 21,298,050 5,411,950 buildings Equipment 71,440,000 Less: Accumulated depreciation- 8,930,000 62,510,000 equipment Total plant assets $73,279,950 1 During 2018, the following selected cash transactions occurred. Apr. Purchased land for $3,929,200. May 1 Sold equipment that cost $1,071,600 when purchased on January 1, 2011. The equipment was sold for $303,620. June 1 Sold land for $2,857,600. The land cost $1,786,000. July 1 Purchased equipment for $1,964,600. Dec. 31 Retired equipment that cost $1,250,200 when purchased on December 31, 2008. No salvage value was received. Date Account Titles and Explanation Debit Credit April 1 Land 3,929,200 Cash 3,929,200 May 1 Depreciation Expense 35720 35720 Accumulated Depreciation Equipment (To record depreciation on equipment sold) Cash 303,620 Accumulated Depreciation Equipment 785840 Gain on Disposal of Plant Assets 17860 Equipment 1,071,600 June 1 Cash 2,857,600 Land 1,786,000 Gain on Disposal of Land 1071600 July 1 Equipment 1,964,600 Cash 1,964,600 Dec. 31 Depreciation Expense 125020 125020 Accumulated Depreciation-Equipment (To record depreciation on equipment retired) Accumulated Depreciation Equipment 1250200 Equipment 1250200 (b) Record adjusting entries for depreciation for 2018. (Credit account titles are automatically indente titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 (To record depreciation on buildings.) Dec. 31 (To record depreciation on equipment.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts