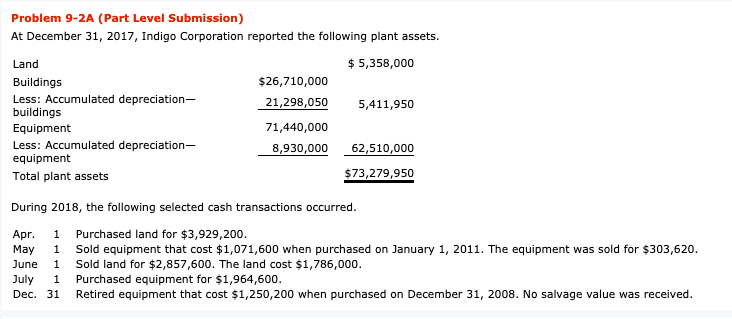

Question: Problem 9-2A (Part Level Submission) At December 31, 2017, Indigo Corporation reported the following plant assets. Land $ 5,358,000 Buildings $26,710,000 Less: Accumulated depreciation- 21,298,050

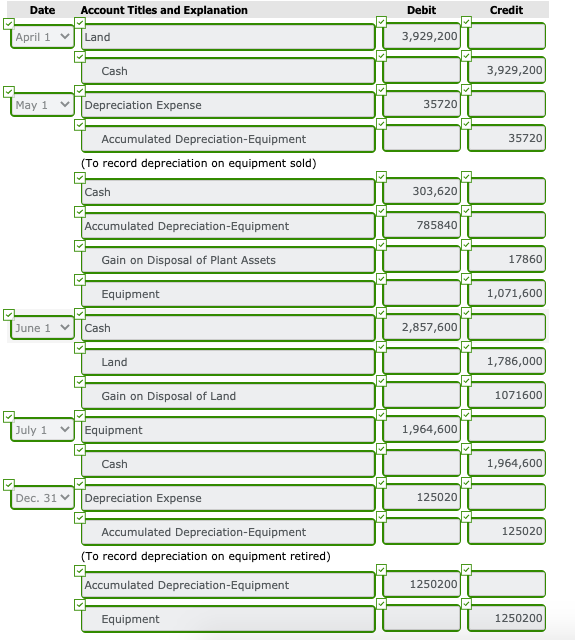

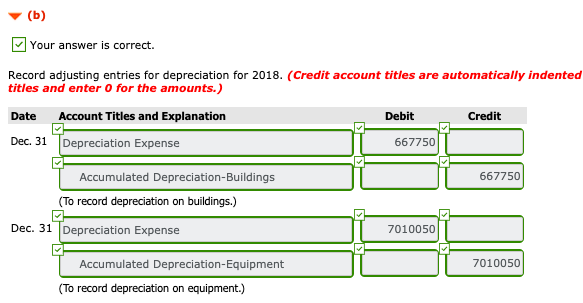

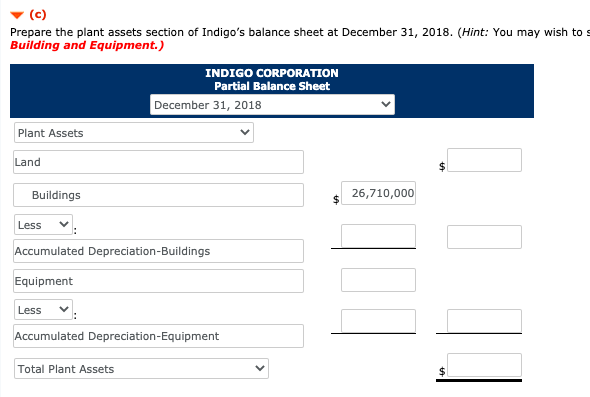

Problem 9-2A (Part Level Submission) At December 31, 2017, Indigo Corporation reported the following plant assets. Land $ 5,358,000 Buildings $26,710,000 Less: Accumulated depreciation- 21,298,050 5,411,950 buildings Equipment 71,440,000 Less: Accumulated depreciation- 8,930,000 62,510,000 equipment Total plant assets $73,279,950 1 During 2018, the following selected cash transactions occurred. Apr. Purchased land for $3,929,200. May 1 Sold equipment that cost $1,071,600 when purchased on January 1, 2011. The equipment was sold for $303,620. June 1 Sold land for $2,857,600. The land cost $1,786,000. July 1 Purchased equipment for $1,964,600. Dec. 31 Retired equipment that cost $1,250,200 when purchased on December 31, 2008. No salvage value was received. Date Account Titles and Explanation Debit Credit April 1 Land 3,929,200 Cash 3,929,200 May 1 Depreciation Expense 35720 35720 Accumulated Depreciation Equipment (To record depreciation on equipment sold) Cash 303,620 Accumulated Depreciation Equipment 785840 Gain on Disposal of Plant Assets 17860 Equipment 1,071,600 June 1 Cash 2,857,600 Land 1,786,000 Gain on Disposal of Land 1071600 July 1 Equipment 1,964,600 Cash 1,964,600 Dec. 31 Depreciation Expense 125020 125020 Accumulated Depreciation-Equipment (To record depreciation on equipment retired) Accumulated Depreciation Equipment 1250200 Equipment 1250200 (b) Your answer is correct. Record adjusting entries for depreciation for 2018. (Credit account titles are automatically indented titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Depreciation Expense 667750 667750 Accumulated Depreciation-Buildings (To record depreciation on buildings.) Dec. 31 Depreciation Expense 7010050 7010050 Accumulated Depreciation Equipment (To record depreciation on equipment.) (c) Prepare the plant assets section of Indigo's balance sheet at December 31, 2018. (Hint: You may wish to Building and Equipment.) INDIGO CORPORATION Partial Balance Sheet December 31, 2018 Plant Assets Land $ Buildings 26,710,000 Less Accumulated Depreciation-Buildings Equipment Less Accumulated Depreciation-Equipment Total Plant Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts