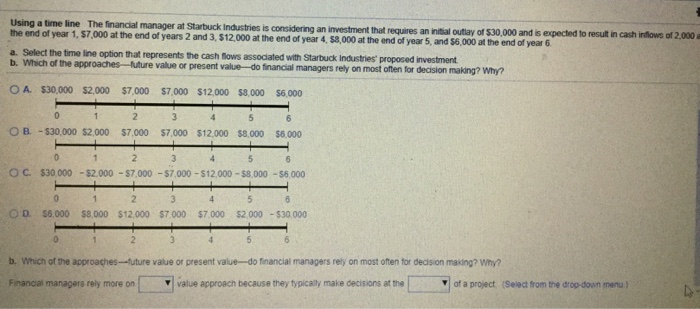

Question: Part B Using a time line The financial manager at Starbuck Industries is considering an investment that requires an inital at the end of years

Using a time line The financial manager at Starbuck Industries is considering an investment that requires an inital at the end of years 2 and 3, $12,000a the end of year 4, 58.,00 at the end of year 5, and $6,000at the end of year 6 a. Select the time ine option that represents the cash lows asociated with Starbuck Industries' proposed investment b. Which of the approaches-future value or present value -do financial managers rely on most often for decision making? Why? O A $30,000 $2,000 $7,000 $7.000 $12000 $8,000 $6,000 ??.-530.000 $2.000 s7.000 s7,000 $12.000 s8000 s6000 O C. $30,000-$2000-$7,000 -$7.000-$12,000-$8.000-$6,000 O D $6.000 $8,000 $12,000 $7.000 $7,000 $2.000-$30,000 b. Which of he approaches-future value or present value-do financial managers rely on most often for decision making? why? Finanoal managers rely more on value approach because they typically make decisions at the of a project (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts