Question: PART B,C,D PLEASE Part A: Suppose you have three projects with the following cash flows: Today Year 1 Year 2 Year 3 Project One $150

PART B,C,D PLEASE

PART B,C,D PLEASE

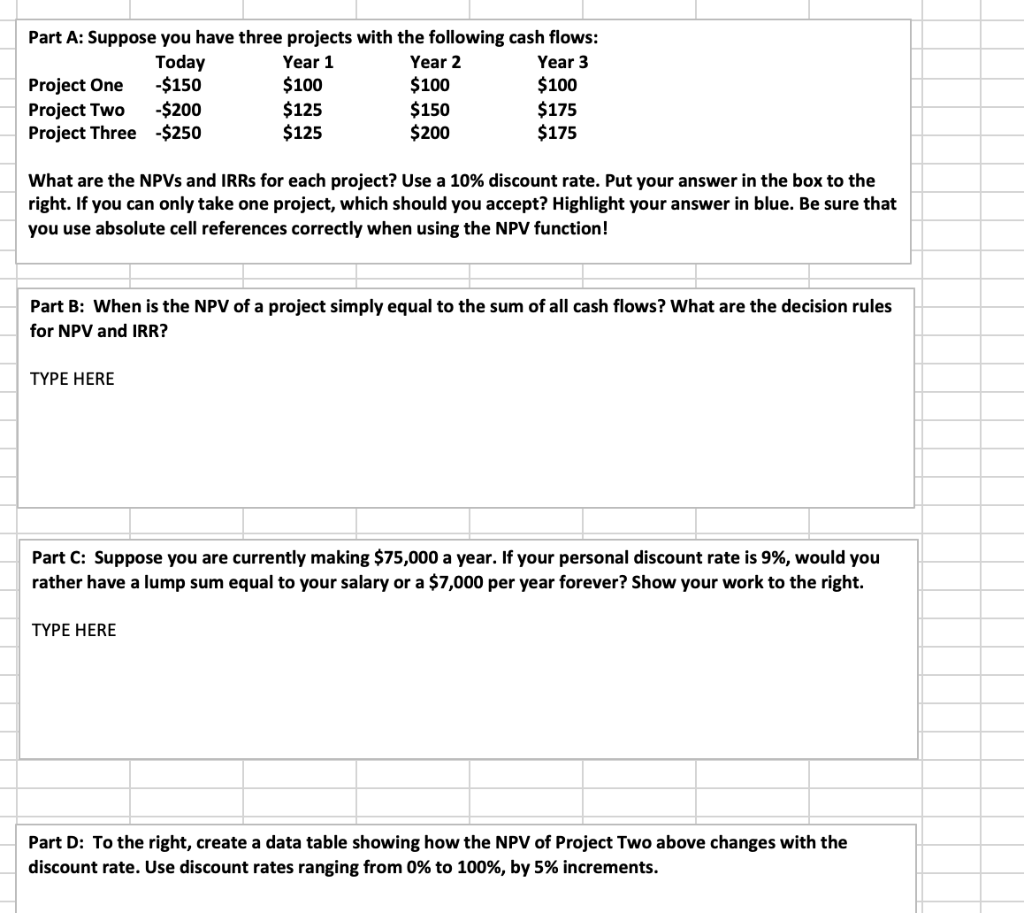

Part A: Suppose you have three projects with the following cash flows: Today Year 1 Year 2 Year 3 Project One $150 $100 $100 $100 Project Two -$200 $125 $ 150 $175 Project Three $250 $125 $200 $175 What are the NPVs and IRRs for each project? Use a 10% discount rate. Put your answer in the box to the right. If you can only take one project, which should you accept? Highlight your answer in blue. Be sure that you use absolute cell references correctly when using the NPV function! Part B: When is the NPV of a project simply equal to the sum of all cash flows? What are the decision rules for NPV and IRR? TYPE HERE Part C: Suppose you are currently making $75,000 a year. If your personal discount rate is 9%, would you rather have a lump sum equal to your salary or a $7,000 per year forever? Show your work to the right. TYPE HERE Part D: To the right, create a data table showing how the NPV of Project Two above changes with the discount rate. Use discount rates ranging from 0% to 100%, by 5% increments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts