Question: PART C and E. Need help for PART C and E. Thanks Consider a European-type derivative security with maturity Ton a non-dividend paying stock The

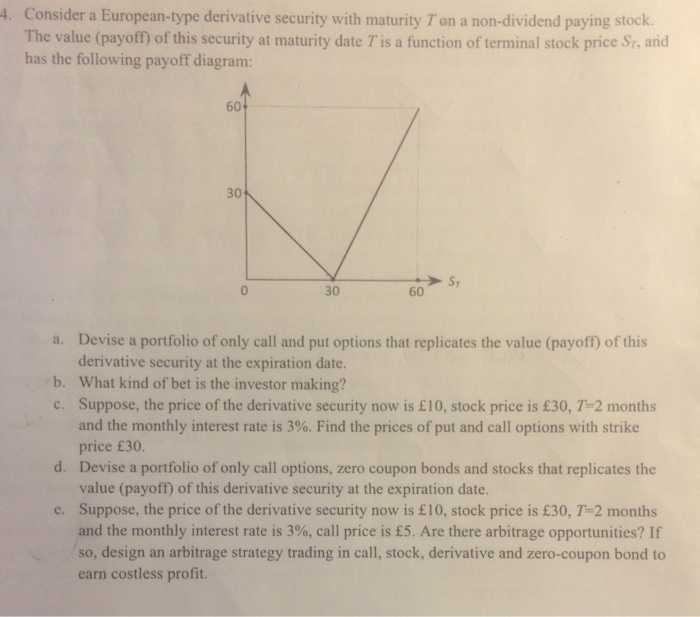

Consider a European-type derivative security with maturity Ton a non-dividend paying stock The value (payoff) of this security at maturity date T is a function of terminal stock price S and has the following payoff diagram: Devise a portfolio of only call and put options that replicates the value (payoff) of this derivative security at the expiration date. What kind of bet is the investor making? Suppose, the price of the derivative security now is pound 10, stock price is pound 30, T = 2 months and the monthly interest rate is 3%. Find the prices of put and call options with strike price pound 30. Devise a portfolio of only call options, zero coupon bonds and stocks that replicates the value (payoff) of this derivative security at the expiration date. Suppose, the price of the derivative security now is pound 10, stock price is pound 30, T = 2 months and the monthly interest rate is 3%, call price is pound 5. Are there arbitrage opportunities? If so, design an arbitrage strategy trading in call, stock, derivative and zero-coupon bond to cam costless profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts