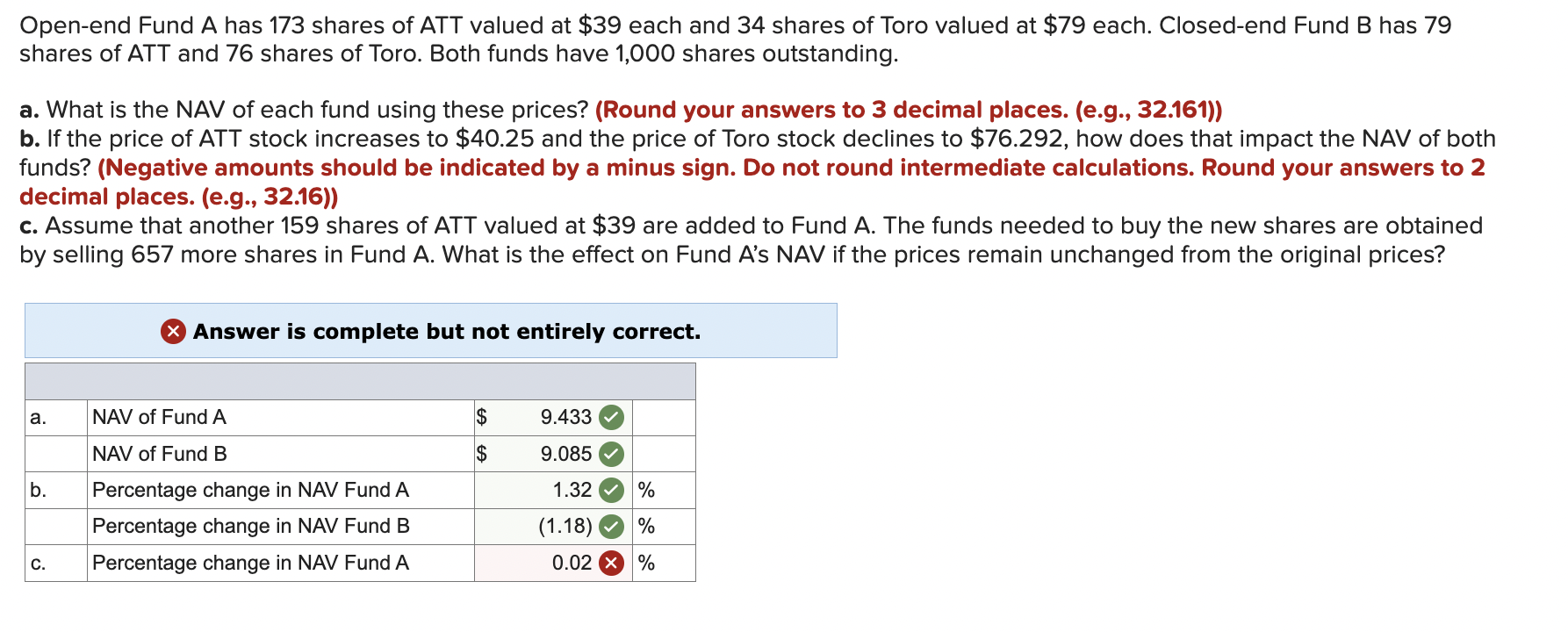

Question: part c is wrong. can you please help me solve it . Open - end Fund A has 1 7 3 shares of ATT valued

part c is wrong. can you please help me solve it Openend Fund A has shares of ATT valued at $ each and shares of Toro valued at $ each. Closedend Fund B has

shares of ATT and shares of Toro. Both funds have shares outstanding.

a What is the NAV of each fund using these prices? Round your answers to decimal places. eg

b If the price of ATT stock increases to $ and the price of Toro stock declines to $ how does that impact the NAV of both

funds? Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to

decimal places. eg

c Assume that another shares of ATT valued at $ are added to Fund The funds needed to buy the new shares are obtained

by selling more shares in Fund A What is the effect on Fund As NAV if the prices remain unchanged from the original prices?

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock