Question: Problem 17-2 (LG 17-5) Open end Fund A has 175 shares of ATT valued at $40 each and 35 shares of Toro valued at $80

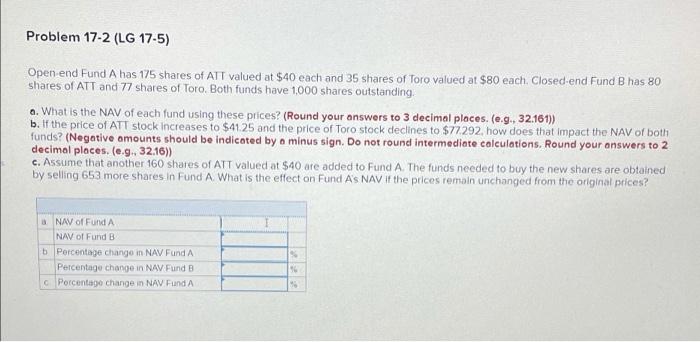

Problem 17-2 (LG 17-5) Open end Fund A has 175 shares of ATT valued at $40 each and 35 shares of Toro valued at $80 each. Closed end Fund B has 80 shares of ATT and 77 shares of Toro. Both funds have 1,000 shares outstanding a. What is the NAV of each fund using these prices? (Round your answers to 3 decimal places. (e.g., 32.161)) b. If the price of ATT stock Increases to $41.25 and the price of Toro stock declines to $77.292. how does that impact the NAV of both funds? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. (.9., 32.16)) c. Assume that another 160 shares of ATT Valued at $40 are added to Fund A. The funds needed to buy the new shares are obtained by selling 653 more shares in Fund A What is the effect on Fund As NAV If the prices remain unchanged from the original prices? # NAV of Fund A NAV of Fund B b Percentage change in NAV Fund A Percentage change in NAV Fund B Porcentago change in NAV Fund A 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts