Question: Part C: Long question The current time period is 1 = 0 and assume that the following spot rates are available to you. All rates

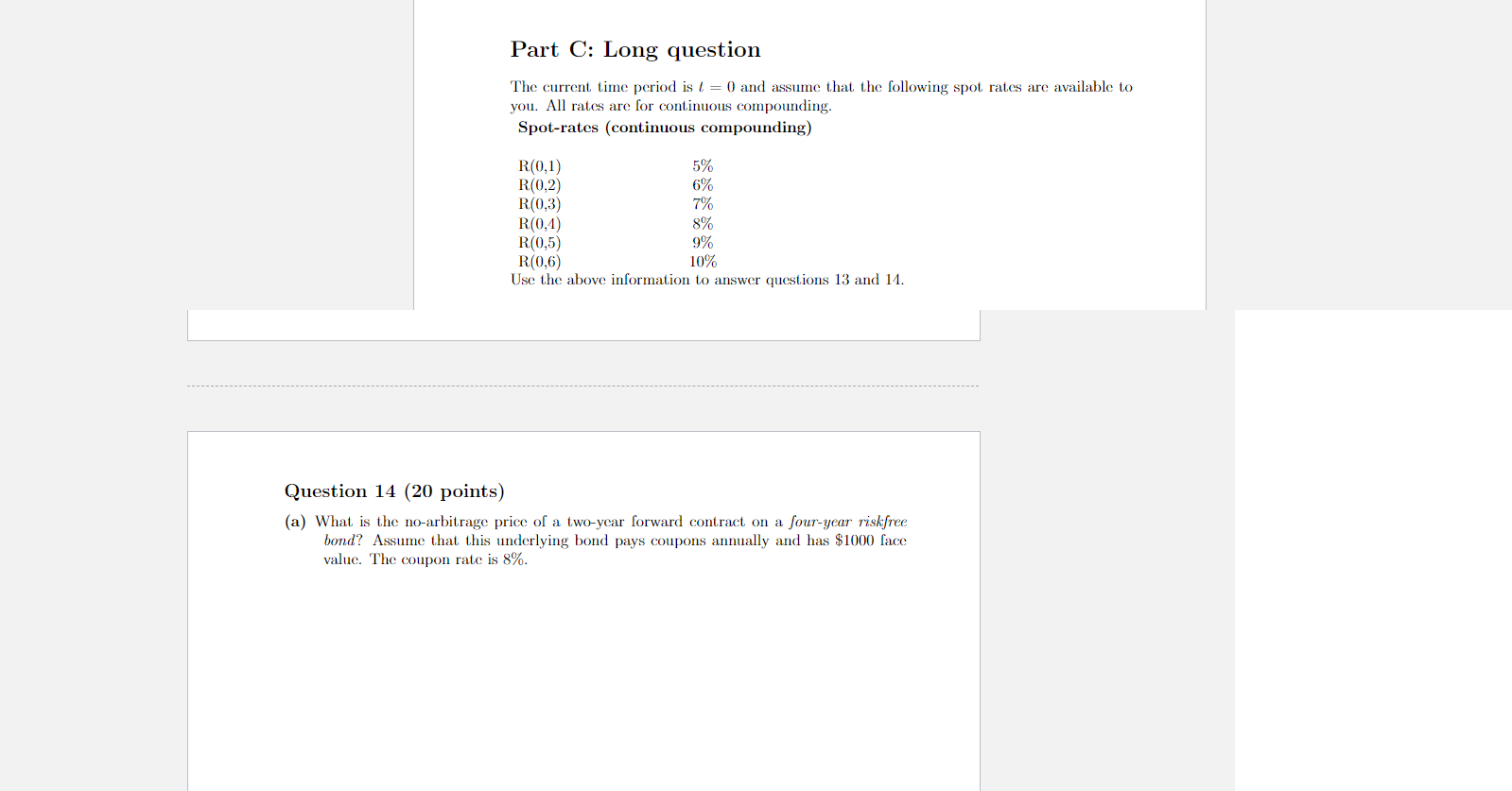

Part C: Long question The current time period is 1 = 0 and assume that the following spot rates are available to you. All rates are for continuous compounding. Spot-rates (continuous compounding) R(0,1) 5% R(0,2) 6% R(0,3) 7% R(0,1) 8% R(0,5) 9% R(0,6) 10% Use the above information to answer questions 13 and 11. Question 14 (20 points) (a) What is the no-arbitrage price of a two-year forward contract on a four-year riskfree bond? Assume that this underlying bond pays coupons annually and has $1000 face value. The coupon rate is 8%. Part C: Long question The current time period is 1 = 0 and assume that the following spot rates are available to you. All rates are for continuous compounding. Spot-rates (continuous compounding) R(0,1) 5% R(0,2) 6% R(0,3) 7% R(0,1) 8% R(0,5) 9% R(0,6) 10% Use the above information to answer questions 13 and 11. Question 14 (20 points) (a) What is the no-arbitrage price of a two-year forward contract on a four-year riskfree bond? Assume that this underlying bond pays coupons annually and has $1000 face value. The coupon rate is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts