Question: Part C Open ended problem 1: (20%) Suppose, you are an Investment analyst at JP Morgan Chase collecting information and analyzing stocks for investment purposes.

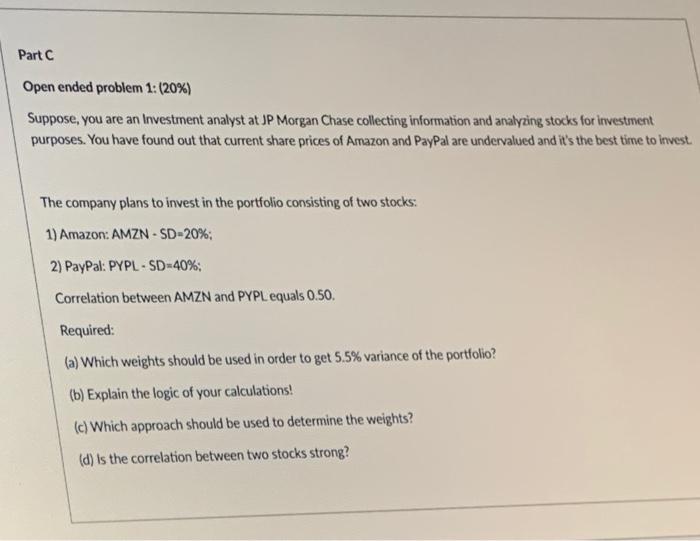

Part C Open ended problem 1: (20%) Suppose, you are an Investment analyst at JP Morgan Chase collecting information and analyzing stocks for investment purposes. You have found out that current share prices of Amazon and PayPal are undervalued and it's the best time to invest The company plans to invest in the portfolio consisting of two stocks: 1) Amazon: AMZN - SD-20%; 2) PayPal: PYPL-SD-40%; Correlation between AMZN and PYPL equals 0.50. Required: (a) Which weights should be used in order to get 5.5% variance of the portfolio? (b) Explain the logic of your calculations! (c) Which approach should be used to determine the weights? (d) is the correlation between two stocks strong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts