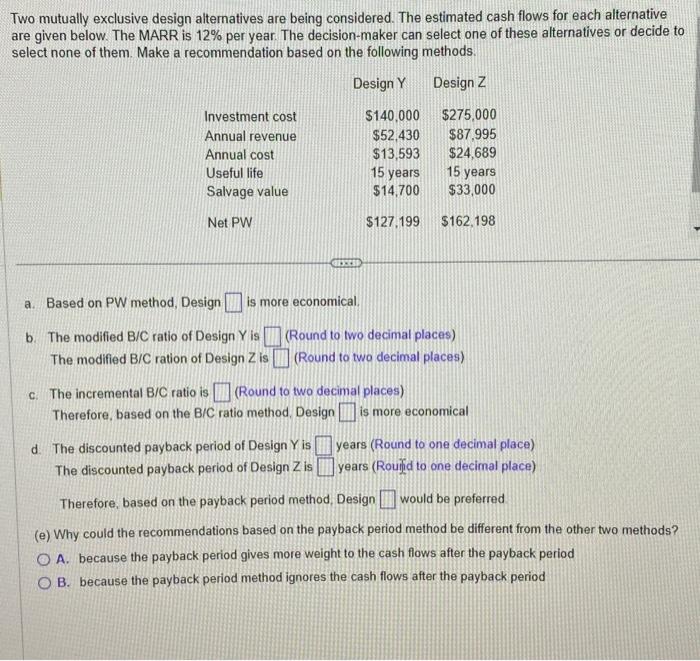

Question: Two mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 12% per year.

Two mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 12% per year. The decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation based on the following methods. Design Y Design Z Investment cost Annual revenue Annual cost $140,000 $275,000 $52,430 $87,995 $13,593 $24,689 Useful life 15 years 15 years Salvage value $14,700 $33,000 Net PW $127,199 $162,198 a. Based on PW method, Design is more economical. b. The modified B/C ratio of Design Y is The modified B/C ration of Design Z is (Round to two decimal places) (Round to two decimal places) c. The incremental B/C ratio is (Round to two decimal places) Therefore, based on the B/C ratio method, Design d. The discounted payback period of Design Y is The discounted payback period of Design Z is is more economical years (Round to one decimal place) years (Round to one decimal place) Therefore, based on the payback period method, Design would be preferred (e) Why could the recommendations based on the payback period method be different from the other two methods? OA. because the payback period gives more weight to the cash flows after the payback period OB. because the payback period method ignores the cash flows after the payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts