Question: Part D: Working with Financial Tools and Functions & Performing What If 12.00 Analysis Alfred is a new Taxi driver. He aims to buy his

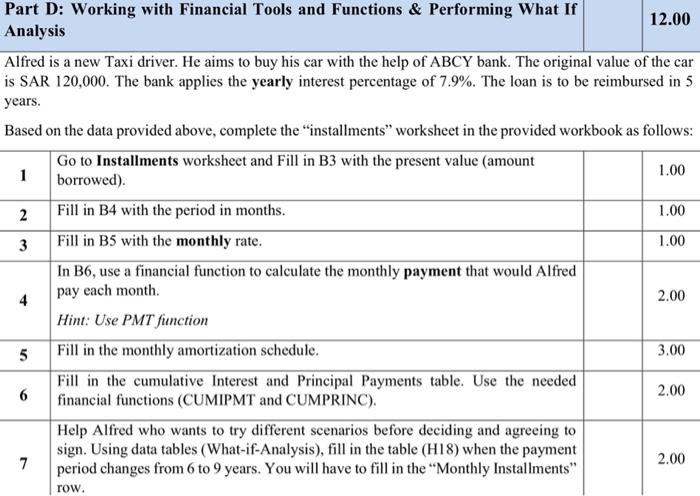

Part D: Working with Financial Tools and Functions & Performing What If 12.00 Analysis Alfred is a new Taxi driver. He aims to buy his car with the help of ABCY bank. The original value of the car is SAR 120,000. The bank applies the yearly interest percentage of 7.9%. The loan is to be reimbursed in 5 years. Based on the data provided above, complete the installments worksheet in the provided workbook as follows: Go to Installments worksheet and Fill in B3 with the present value (amount 1 borrowed). 1.00 2 Fill in B4 with the period in months. 1.00 3 Fill in B5 with the monthly rate. 1.00 In B6, use a financial function to calculate the monthly payment that would Alfred pay each month. 4 2.00 Hint: Use PMT function 5 Fill in the monthly amortization schedule. 3.00 Fill in the cumulative Interest and Principal Payments table. Use the needed 6 financial functions (CUMIPMT and CUMPRINC). 2.00 Help Alfred who wants to try different scenarios before deciding and agreeing to sign. Using data tables (What-if-Analysis), fill in the table (H18) when the payment 7 period changes from 6 to 9 years. You will have to fill in the "Monthly Installments" 2.00 row. Car Installment Amount borrowed Periods Rate Payment Presen Male 11 months expressed away Monthly Installeen MT Interet Principal ding Balance Monthly Amortization Schedule Month Beginning 1 2 3 Years 49 Cumulative Interest & Principal Payments Year 1 Year 2 Year 3 Year 4 13 25 37 Months 12 24 48 Cumulative Interest Cumulative Principal Principal Remaining $ 6 7 X 9 10 11 12 13 14 15 Number of years Number of months Monthly installment 5 60 Data Table 6 72 7 84 8 96 9 108

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts