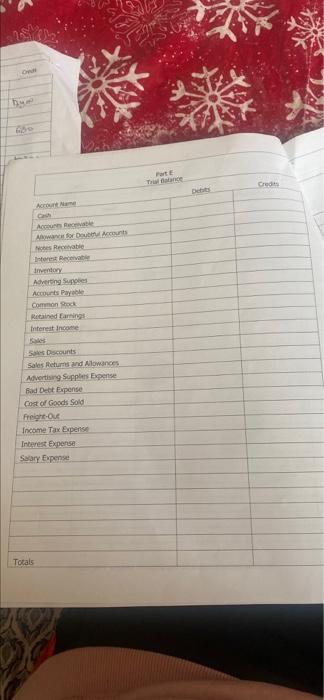

Question: part e please bur Parte Tee Credits Acre for DA Interesa ny Adverting Super Accounts Payable Common Rock Retained Faring Interest income Sao Decounts Sales

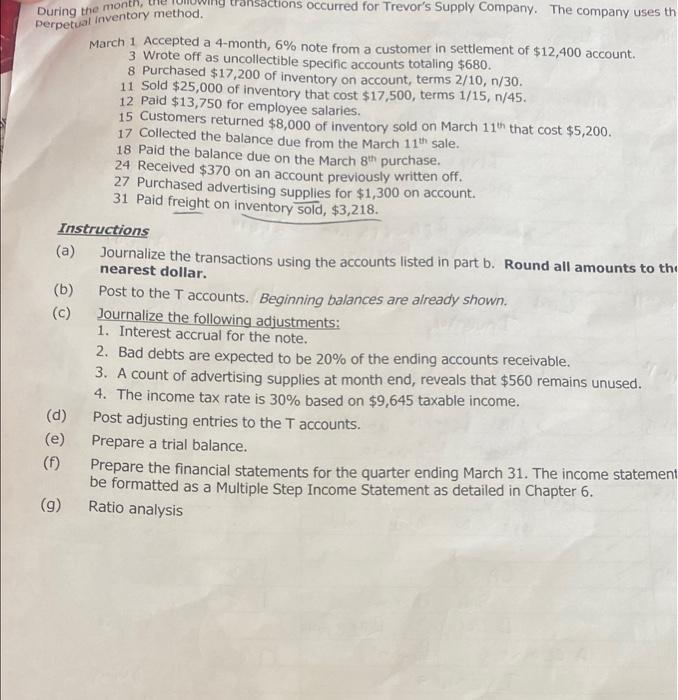

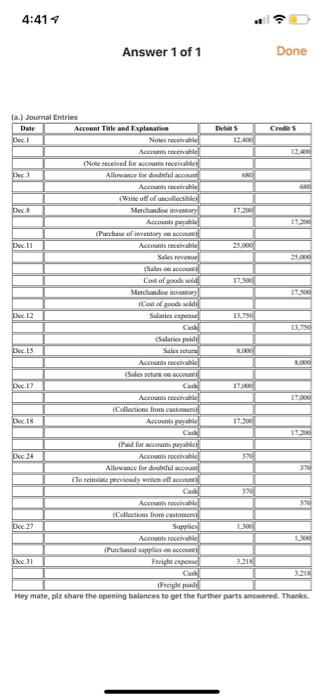

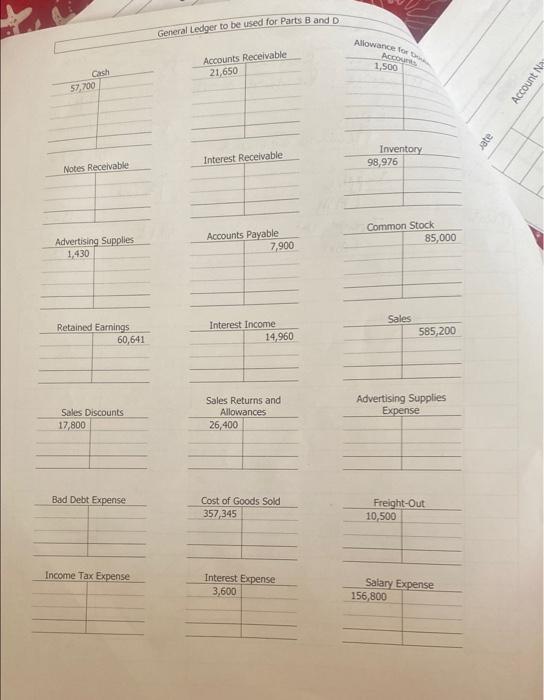

bur Parte Tee Credits Acre for DA Interesa ny Adverting Super Accounts Payable Common Rock Retained Faring Interest income Sao Decounts Sales Returns and Allowances Advertising Supplies Expense Bad Debt ponse Cost of Goods Sold Freightou Income Tax Expense Interest Expense Salary Expense Totals ansactions occurred for Trevor's Supply Company. The company uses th During the month Perpetual inventory method. March 1 Accepted a 4-month, 6% note from a customer in settlement of $12,400 account. 3 Wrote off as uncollectible specific accounts totaling $680. 8 Purchased $17,200 of inventory on account, terms 2/10, 1/30. 11 Sold $25,000 of inventory that cost $17,500, terms 1/15, n/45. 12 Paid $13,750 for employee salaries. 15 Customers returned $8,000 of inventory sold on March 11th that cost $5,200. 17 Collected the balance due from the March 11th sale. 18 Paid the balance due on the March 8th purchase. 24 Received $370 on an account previously written off. 27 Purchased advertising Supplies for $1,300 on account. 31 Paid freight on inventory sold, $3,218. Instructions (a) Journalize the transactions using the accounts listed in part b. Round all amounts to the nearest dollar. (b) Post to the T accounts. Beginning balances are already shown. (C) Journalize the following adjustments: 1. Interest accrual for the note. 2. Bad debts are expected to be 20% of the ending accounts receivable. 3. A count of advertising supplies at month end, reveals that $560 remains unused. 4. The income tax rate is 30% based on $9,645 taxable income. (d) Post adjusting entries to the T accounts. (e) Prepare a trial balance. (1) Prepare the financial statements for the quarter ending March 31. The income statement be formatted as a Multiple Step Income Statement as detailed in Chapter 6. (9) Ratio analysis 4:414 Answer 1 of 1 Done Cres 12.400 19.2001 11 25.000 17.500 17.00 LLLLLLLL (a) Journal Entries Date Account Thile and Txplanation De ! Notes Accounts recente (Not received for receive Tac Allowance for do Accounts receivable We of of collect Dess Merchandise Account (Paschase o ven com Dec. 11 Acce Sales Sales Cost of goods Merchandise Cost good 12 Sweeped C Sabaries | bec.15 Sales Accueil (Sales return 17 Aceh Collections from custom Account C id for at payable Cc 24 Acolo Allowance for double (losite penult Cash Aceh Collections from casa Dec 27 Supplies Acontenir (Purchased applican Dec II Freight 13,75 1 17000 320 3 330 100 2 Fresh pidi Hey mate, plz share the opening balances to get the further parts answered. Thanks General Ledger to be used for Parts B and D Allowance for Account Accounts Receivable 21,650 1,500 Cash Account Na 57,200 azer Interest Receivable Inventory 98,976 Notes Receivable Common Stock 85,000 Accounts Payable 7,900 Advertising Supplies 1.430 Retained Earnings 60,641 Interest Income 14,960 Sales 585,200 Sales Returns and Allowances 26,400 Advertising Supplies Expense Sales Discounts 17,800 Bad Debt Expense Cost of Goods Sold 357,345 Freight-Out 10,500 Income Tax Expense Interest Expense 3,600 Salary Expense 156,800 btful Part Adjusting Entries Date Credit Debit Account Name Post the entries above to the General Ledger T-accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts