Question: Part . FASB Codification Research The FASB codification's topic 8 4 2 governs the accounting for leases. this part the project, you will investigate the

Part FASB Codification Research

The FASB codification's topic governs the accounting for leases. this part the project,

you will investigate the codification and answer the following questions. Please make sure

clearly quote relevant text from the codification support your answers.

Using the codification's search tool, identify the specific paragraphs that discuss how

classify a lease. Where the codification are the five criteria lease classification

discussed class Can a lease change classification subsequently did not discuss

this class

Demonstration problem version and lessor versionrelated the

accounting for operating leases. For this problem, provide detailed explanation for the

solutions from the lessee's perspective. You should cite relevant text from the codification

support your explanation. example when you discuss the calculation initial

lease payable, you can cite the following text from paragraph about discount

rate: "A lessee should use the rate implicit the lease whenever that rate readily

determinable. the rate implicit the lease not readily determinable, a lessee uses its

incremental borrowing rate".

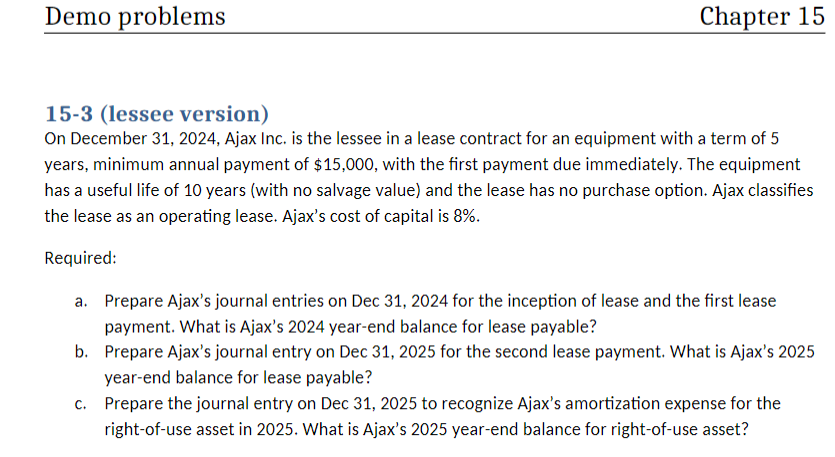

lessee version

On December Ajax Inc. is the lessee in a lease contract for an equipment with a term of years, minimum annual payment of $ with the first payment due immediately. The equipment has a useful life of years with no salvage value and the lease has no purchase option. Ajax classifies the lease as an operating lease. Ajax's cost of capital is

Required:

a Prepare Ajax's journal entries on Dec for the inception of lease and the first lease payment. What is Ajax's yearend balance for lease payable?

b Prepare Ajax's journal entry on Dec for the second lease payment. What is Ajax's yearend balance for lease payable?

c Prepare the journal entry on Dec to recognize Ajax's amortization expense for the rightofuse asset in What is Ajax's yearend balance for rightofuse asset?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock