Question: Part I: (20pts) Consider a portfolio that invests 100 w% of its fund into Amazon, 100 w2% into American Airlines, and the rest into

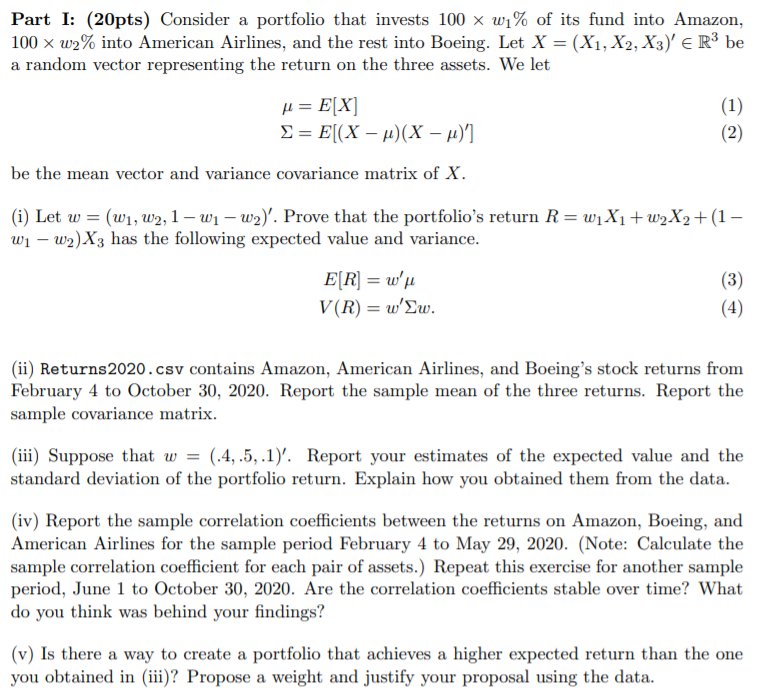

Part I: (20pts) Consider a portfolio that invests 100 w% of its fund into Amazon, 100 w2% into American Airlines, and the rest into Boeing. Let X = (X1, X2, X3)' = R be a random vector representing the return on the three assets. We let = E[X] =E[(X)(X - )'] be the mean vector and variance covariance matrix of X. (1) (2) (i) Let w = (w1, W2, 1w1w2)'. Prove that the portfolio's return R = wX1+w2X2+ (1 - w1w2)X3 has the following expected value and variance. E[R] = w' V(R) = w'w. (3) (4) (ii) Returns 2020.csv contains Amazon, American Airlines, and Boeing's stock returns from February 4 to October 30, 2020. Report the sample mean of the three returns. Report the sample covariance matrix. (iii) Suppose that w = (.4, .5, .1)'. Report your estimates of the expected value and the standard deviation of the portfolio return. Explain how you obtained them from the data. (iv) Report the sample correlation coefficients between the returns on Amazon, Boeing, and American Airlines for the sample period February 4 to May 29, 2020. (Note: Calculate the sample correlation coefficient for each pair of assets.) Repeat this exercise for another sample period, June 1 to October 30, 2020. Are the correlation coefficients stable over time? What do you think was behind your findings? (v) Is there a way to create a portfolio that achieves a higher expected return than the one you obtained in (iii)? Propose a weight and justify your proposal using the data.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Part I i To prove ER w mu ER Ew1X1 w2X2 1w1w2X3 w1EX1 w2EX2 1w1w2EX3 by linearity of expectation w1m... View full answer

Get step-by-step solutions from verified subject matter experts