Question: Part I - Basic general knowledge (Total 150 points, 10 points each) Exhibits 1 and 2 contain option prices for Silicon Valley Financial Group stock,

Part I - Basic general knowledge (Total 150 points, 10 points each)

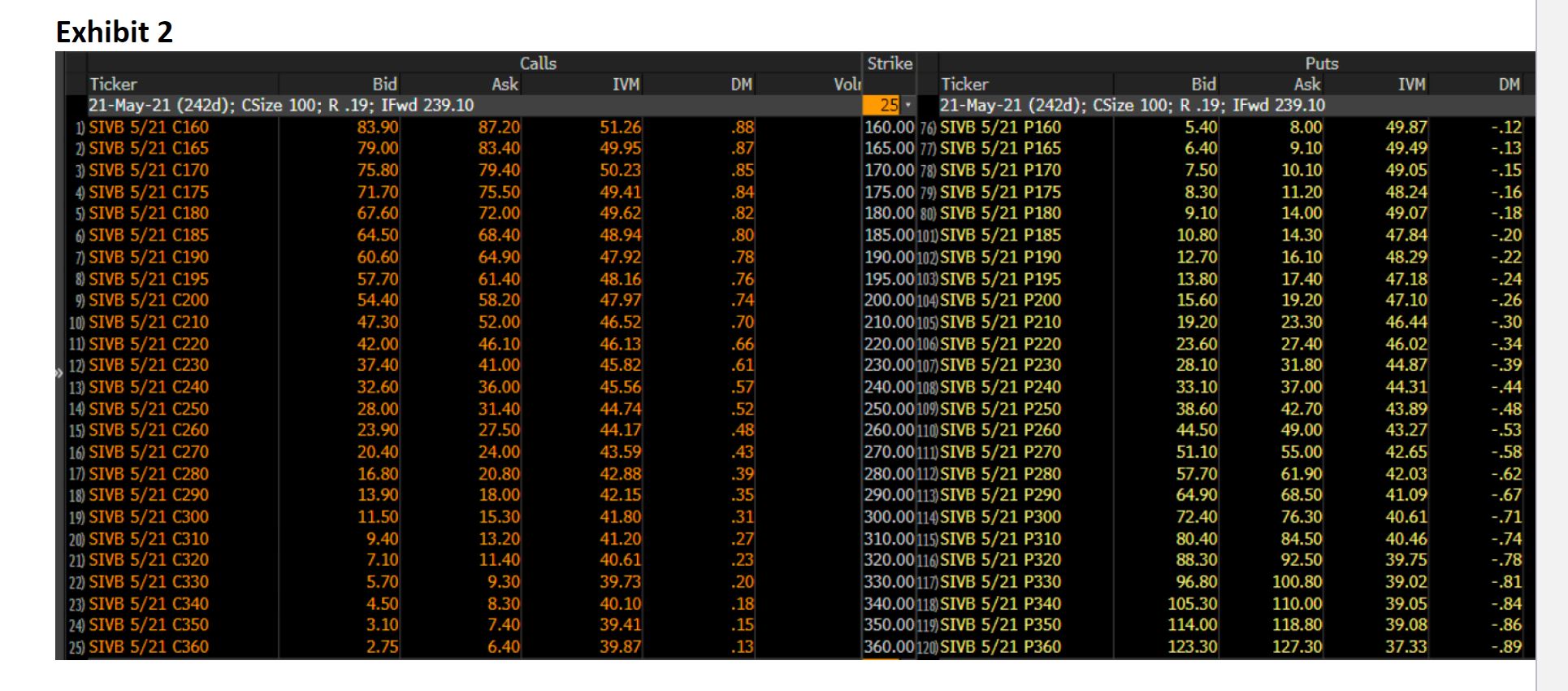

Exhibits 1 and 2 contain option prices for Silicon Valley Financial Group stock, for two different expiry dates, as of 21-Sep-2020, 11:00a.m. EST. Spot reference rate is 239.15, the US risk-free interest rate is 0.30%, and the bank pays no dividends.

QUESTIONS:

PLEASE REFER THE IMAGES BELOW:

1.9. As of 21-Sep-2020, the reference date for the pricing in Exhibits 1 and 2, give an example that crystallizes that implied volatility is higher for puts than calls.

2.10. Is the implied volatility term structure upward or downward sloping? Give an example that justifies your answer.

3.11. Is this statement True or False? One insight gained from the Monte Carlo approach to option pricing is that the price of an option equals the dealer or seller's profit.

4.12. Is this statement True or False? An option market-maker ideally has no view on the future spot price when managing the risk of his/her options portfolio.

5.13. Which option has the higher theta: a) at-the-money call, expiry 16-Oct2020, or b) at-the-money call, expiry 21-May-2021?

6.14. Which put option contract that expires on 16-Oct-2020 has the delta that is 'most sensitive' to changes in spot price?

7.15. Which call option contract that expires on 16-Oct-2020 has the delta that is 'least sensitive' to changes in implied volatility?

Exhibit 1 Calls Strike Puts Ticker Bid Ask IVM DM Vol Ticker Bid Ask IVM DM 16-Oct-20 (25d); CSize 100; R .22; IFwd 238.31 25 . 16-Oct-20 (25d); CSize 100; R .22; IFwd 238.31 26) SIVB 10 C160 75.60 80.30 75.90 1.00 160.00121) SIVB 10 P160 1.50 100.47 .05 27) SIVB 10 C165 70.70 75.50 59.61 .99 165.00122) SIVB 10 P165 1.50 94.04 -.05 28) SIVB 10 C170 65.50 70.20 59.45 .99 170.00123) SIVB 10 P170 1.50 87.75 .06 29) SIVB 10 C175 60.70 65.10 46.74 1.00 175.00124) SIVB 10 P175 1.50 81.61 -.06 30) SIVB 10 C180 55.80 60.20 55.51 .98 180.00 125) SIVB 10 P180 1.50 75.58 -.07 31) SIVB 10 C185 51.10 56.00 61.45 .95 185.00 126) SIVB 10 P185 1.50 69.66 -.07 32) SIVB 10 C190 46.10 50.80 54.63 .95 190.00 127) SIVB 10 P190 05 4.40 71.41 -.10 33) SIVB 10 C195 41.50 45.80 46.66 .95 195.00 128) SIVB 10 P195 .05 1.55 50.13 -.06 34 SIVB 10 C200 37.10 41.30 48.81 .92 200.00 129) SIVB 10 P200 10 3.90 57.47 -.11 35) SIVB 10 C210 28.00 32.60 49.12 .85 210.00 130) SIVB 10 P210 1.85 3.20 49.11 -.15 36) SIVB 10 C220 21.30 24.80 51.00 .74 220.00131) SIVB 10 P220 3.90 6.10 50.01 -.25 37) SIVB 10 C230 15.20 17.80 50.17 62 230.00132) SIVB 10 P230 7.00 10.20 49.22 -.37 38) SIVB 10 C240 10.00 11.00 45.83 .50 240.00133) SIVB 10 P240 11.10 13.10 44.62 -.50 39) SIVB 10 C250 5.30 7.80 44.86 .36 250.00 134) SIVB 10 P250 16.50 20.10 43.35 -.65 40) SIVB 10 C260 2.35 4.30 42.60 .23 260.00135) SIVB 10 P260 23.20 27.20 40.49 -.78 41) SIVB 10 C270 .50 2.30 39.49 .12 270.00136) SIVB 10 P270 31.50 35.50 38.12 -.89 42) SIVB 10 C280 .05 1.35 39.77 .07 7280.00137) SIVB 10 P280 40.50 45.20 37.86 -.95 43) SIVB 10 C290 1.35 53.86 .09 290.00 138) SIVB 10 P290 50.00 54.80 32.37 -.99 44) SIVB 10 C300 1.50 62.12 09 300.00139) SIVB 10 P300 60.00 64.80 37.08 -.99 45) SIVB 10 C310 1.50 68.35 08 310.00140) SIVB 10 P310 70.00 74.60 52.09 -1.00 46) SIVB 10 C320 1.50 74.34 08 320.00141) SIVB 10 P320 80.00 84.80 45.88 -.99 47) SIVB 10 C330 1.50 80.03 .07 330.00142) SIVB 10 P330 89.70 94.50 64.41 -1.00 48) SIVB 10 C340 1.50 85.55 .07 340.00 143) SIVB 10 P340 99.70 104.50 66.63 -.97 49) SIVB 10 C350 1.50 90.73 .07 350.00144) SIVB 10 P350 109.80 114.50 65.11 -1.00 50) SIVB 10 C360 1.50 95.59 06 360.00145) SIVB 10 P360 120.00 124.60 66.66 -1.00Exhibit 2 Calls Strike Puts Ticker Bid Ask IVM DM Vol Ticker Bid Ask IVM DM 21-May-21 (242d); CSize 100; R .19; IFwd 239.10 25 . 21-May-21 (242d); CSize 100; R .19; IFwd 239.10 1) SIVB 5/21 C160 83.90 87.20 51.26 88 160.00 76) SIVB 5/21 P160 5.40 8.00 49.87 -.12 2) SIVB 5/21 C165 79.00 83.40 49.95 .87 165.00 77) SIVB 5/21 P165 6.40 9.10 49.49 -.13 3) SIVB 5/21 C170 75.80 79.40 50.23 .85 170.00 78) SIVB 5/21 P170 7.50 10.10 49.05 -.15 4 SIVB 5/21 C175 71.70 75.50 49.41 84 175.00 79) SIVB 5/21 P175 8.30 11.20 48.24 .16 5) SIVB 5/21 C180 67.60 72.00 49.62 82 180.00 80) SIVB 5/21 P180 9.10 14.00 49.07 -.18 6) SIVB 5/21 C185 64.50 68.40 48.94 180 185.00101) SIVB 5/21 P185 10.80 14.30 47.84 -.20 7) SIVB 5/21 C190 60.60 64.90 47.92 78 190.00 102) SIVB 5/21 P190 12.70 16.10 48.29 .22 8) SIVB 5/21 C195 57.70 61.40 48.16 76 195.00103) SIVB 5/21 P195 13.80 17.40 47.18 -.24 9) SIVB 5/21 C200 54.40 58.20 47.97 74 200.00104) SIVB 5/21 P200 15.60 19.20 47.10 -.26 10) SIVB 5/21 C210 47.30 52.00 46.52 70 210.00 105) SIVB 5/21 P210 19.20 23.30 46.44 -.30 11) SIVB 5/21 C220 42.00 46.10 46.13 66 220.00106) SIVB 5/21 P220 23.60 27.40 46.02 -.34 12) SIVB 5/21 C230 37.40 41.00 45.82 .61 230.00107) SIVB 5/21 P230 28.10 31.80 44.87 -.39 13) SIVB 5/21 C240 32.60 36.00 45.56 57 240.00 108) SIVB 5/21 P240 33.10 37.00 44.31 -.44 14 SIVB 5/21 C250 28.00 31.40 44.74 52 250.00109) SIVB 5/21 P250 38.60 42.70 43.89 -.48 15) SIVB 5/21 C260 23.90 27.50 44.17 48 260.00110) SIVB 5/21 P260 44.50 49.00 43.27 .53 16) SIVB 5/21 C270 20.40 24.00 43.59 43 270.00111) SIVB 5/21 P270 51.10 55.00 42.65 -.58 17) SIVB 5/21 C280 16.80 20.80 42.88 .39 280.00112) SIVB 5/21 P280 57.70 61.90 42.03 -.62 18) SIVB 5/21 C290 13.90 18.00 42.15 .35 290.00 113) SIVB 5/21 P290 64.90 68.50 41.09 .67 19) SIVB 5/21 C300 11.50 15.30 41.80 .31 300.00114) SIVB 5/21 P300 72.40 76.30 40.61 -.71 20) SIVB 5/21 C310 9.40 13.20 41.20 .27 310.00115) SIVB 5/21 P310 80.40 84.50 40.46 -.74 21) SIVB 5/21 C320 7.10 11.40 40.61 .23 320.00116) SIVB 5/21 P320 88.30 92.50 39.75 -.78 22) SIVB 5/21 C330 5.70 9.30 39.73 .20 330.00117) SIVB 5/21 P330 96.80 100.80 39.02 -.81 23) SIVB 5/21 C340 4.50 8.30 40.10 18 340.00 118) SIVB 5/21 P340 105.30 110.00 39.05 -.84 24) SIVB 5/21 C350 3.10 7.40 39.41 15 350.00 119) SIVB 5/21 P350 114.00 118.80 39.08 -.86 25) SIVB 5/21 C360 2.75 6.40 39.87 13 360.00120) SIVB 5/21 P360 123.30 127.30 37.33 -.89Exhibit 3 Commodity Futures Price Quotes Wheat (CBOT) (Price quotes for CBOT Wheat delayed at least 10 minutes a Also available: electronic Session Quotes Trade Wheat now with: " TradeStation Click for Current S Chart Open High Low Last Cash 5.1699 5.1778 5.1136 5.1702 Dec'19 532 4/8 532 4/8 532 4/8 Mar'20 524 4/8 524 4/8 524 4/8 May'20 527 6/8 527 6/8 527 6/ 8 Jul'20 530 /8 530 /8 530 /8 Sep 20 536 2/8 536 2/8 536 2/8 Dec'20 546 4/8 546 4/8 546 4/8 Mar'21 554 6/8 554 6/8 554 6/8 May'21 554 /8 554 /8 554 /8 Jul'21 544 4/8 544 4/8 544 4/8 Sep 21 547 2/8 547 2/8 547 2 / 8 Dec'21 560 4/8 560 4/8 560 4/8