Question: Part I. Comprehensive Questions (50%) Provide comprehensive answer for each question. 1. Please explain why the e-commerce / industrial revolution can create more International tax-related

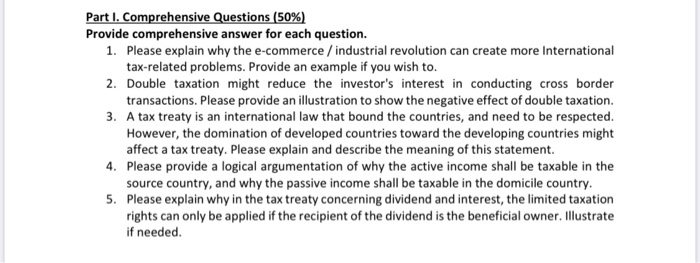

Part I. Comprehensive Questions (50%) Provide comprehensive answer for each question. 1. Please explain why the e-commerce / industrial revolution can create more International tax-related problems. Provide an example if you wish to. 2. Double taxation might reduce the investor's interest in conducting cross border transactions. Please provide an illustration to show the negative effect of double taxation 3. A tax treaty is an international law that bound the countries, and need to be respected. However, the domination of developed countries toward the developing countries might affect a tax treaty. Please explain and describe the meaning of this statement. 4. Please provide a logical argumentation of why the active income shall be taxable in the source country, and why the passive income shall be taxable in the domicile country. 5. Please explain why in the tax treaty concerning dividend and interest, the limited taxation rights can only be applied if the recipient of the dividend is the beneficial owner. Illustrate if needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts