Question: Part I - Definition (35%) Differentiate the following terms: 1. Futures and Forwards (10%) 2. Debt and Equity (10%) 3. Corporation, general partnership and limited

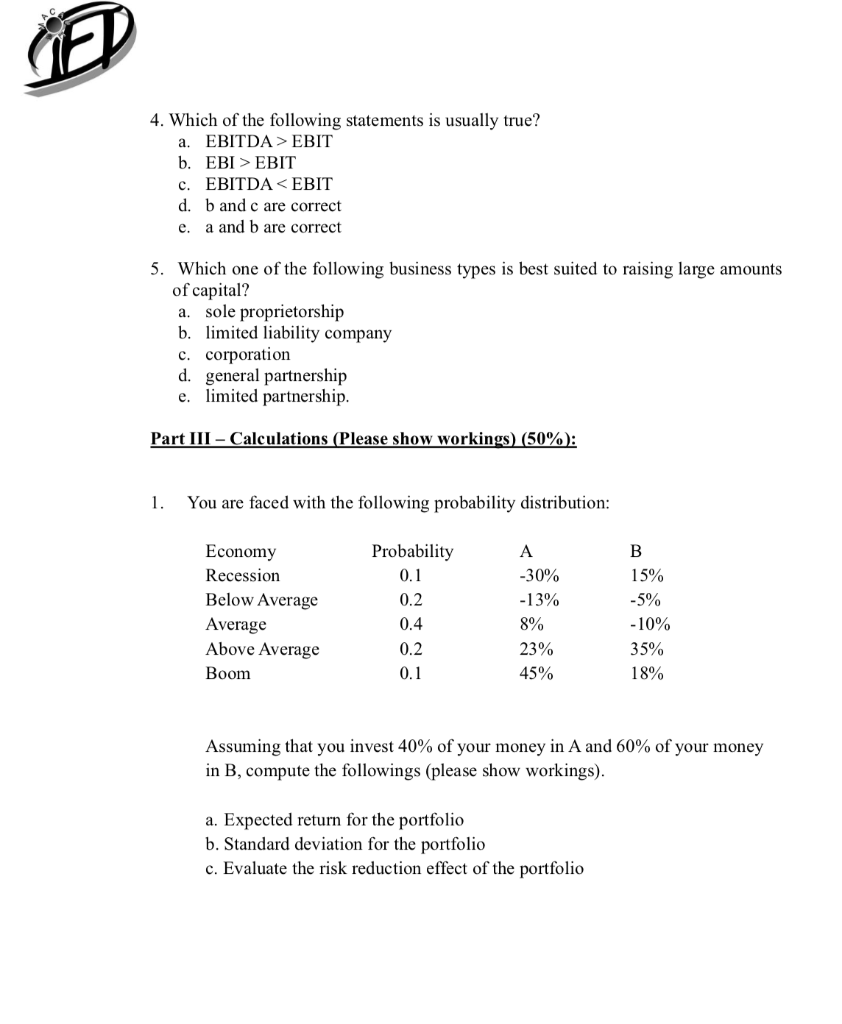

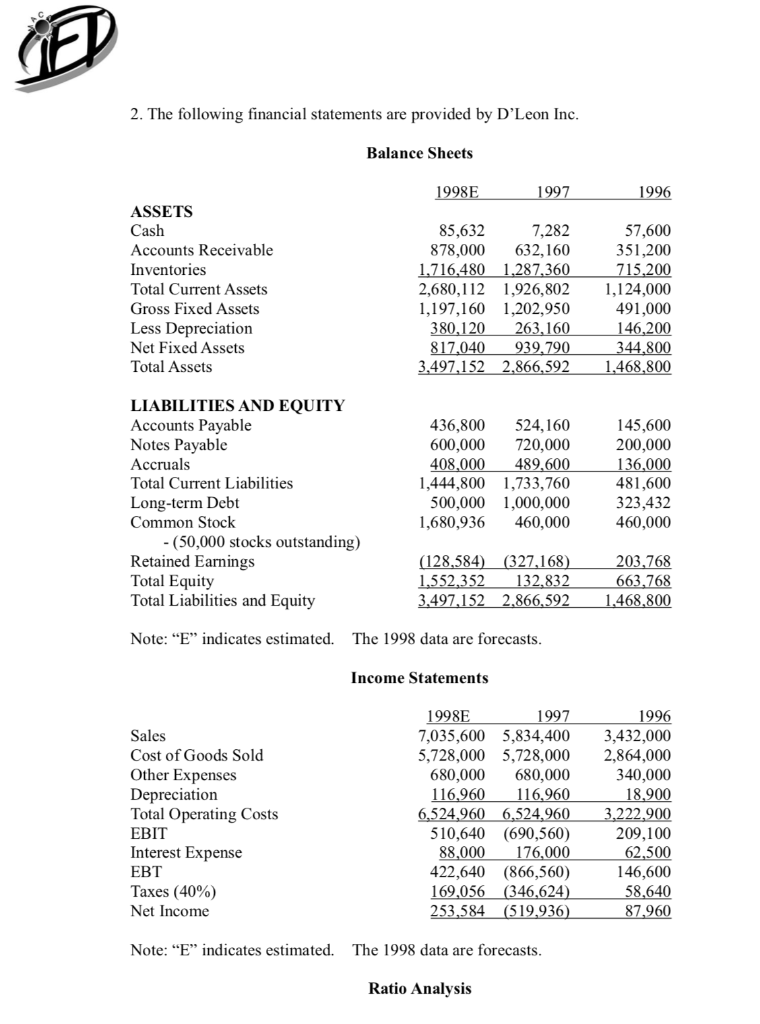

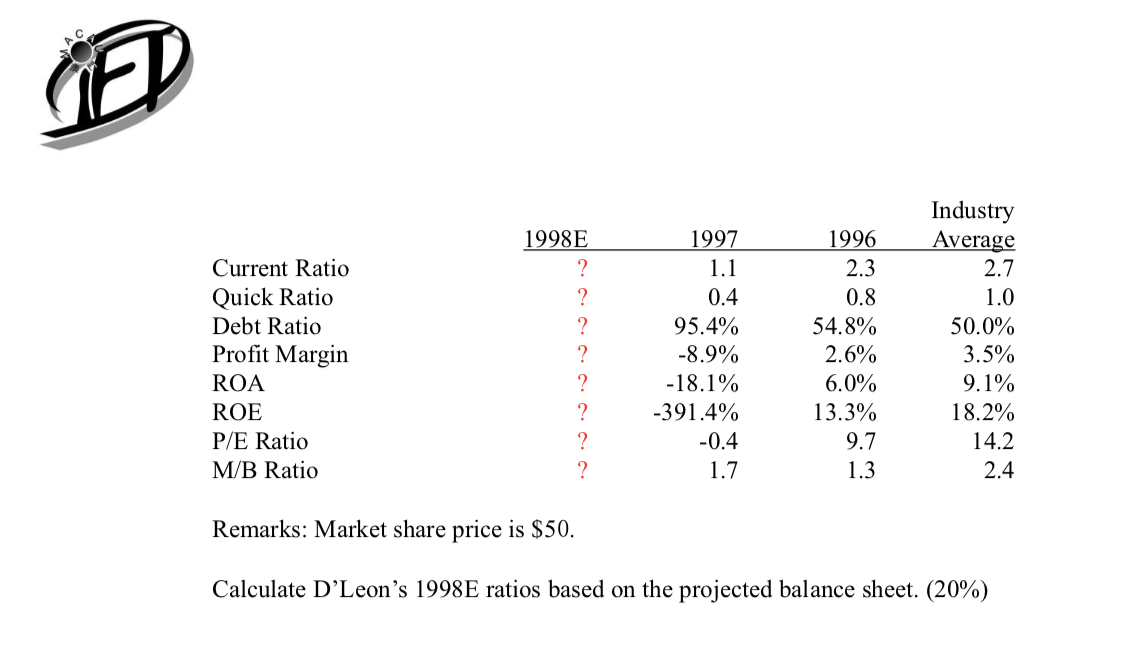

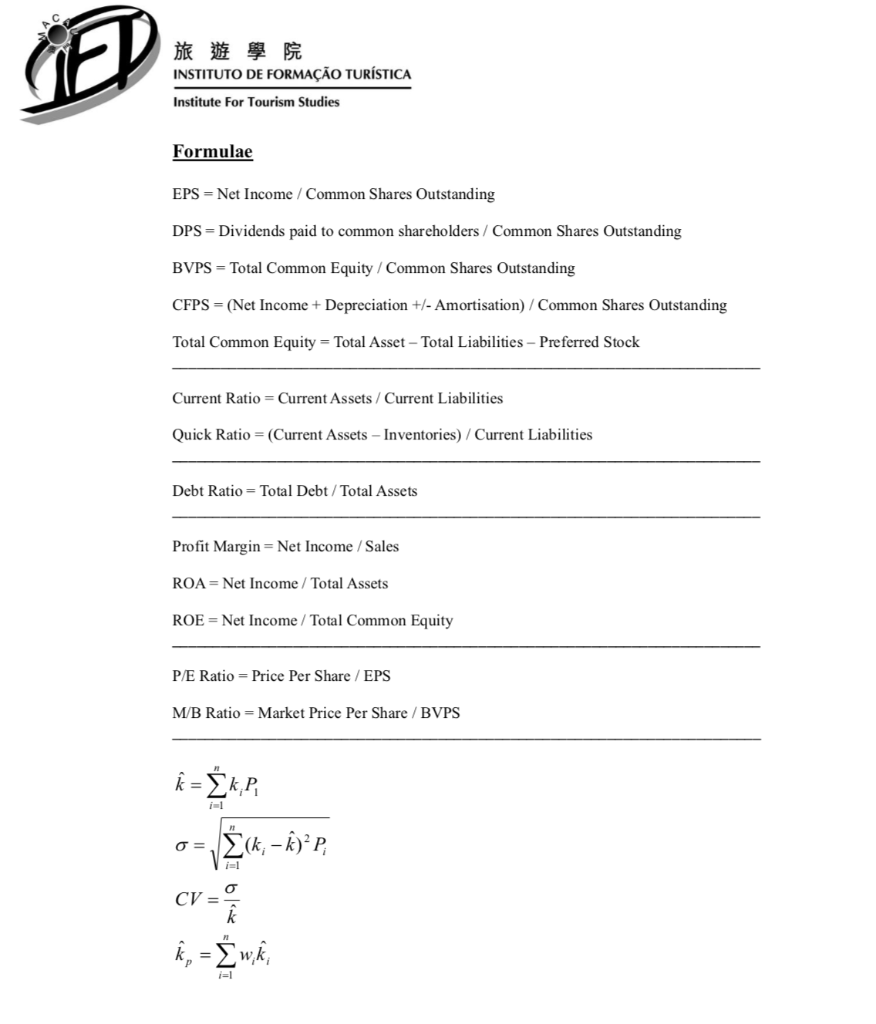

Part I - Definition (35%) Differentiate the following terms: 1. Futures and Forwards (10%) 2. Debt and Equity (10%) 3. Corporation, general partnership and limited partnership (15%) Part II - Multiple Choice: (15%) 1. If current liabilities exceed current assets, then the: a. current ratio will be less than one. b. current ratio will be more than one. c. quick ratio will be more than one. d. quick ratio will be less than one. e. none of the above. 2. What does "EBITDA" stand for? a. Earnings Before Interest, Taxation, Depreciation and Amortisation b. Earnings Before Interest, Taxes, Depreciation and Amortisation c. Earnings Before Income, Taxes, Depreciation and Amortisation d. Earnings Before Interest, Tariff, Depreciation and Amortisation e. None of the above 3. Which of the following is (are) most correct concerning investment risk? a. Market risk systematically affects most stocks in the market so it is impossible to diversify away through adding more stock in the portfolio. b. Random events as lawsuits, strikes, successful and unsuccessful marketing programs that affect individual firm/industry is example of market risk. c. It is possible to form a completely riskless portfolio by adding a very large number of security to the portfolio d. Risk reduction effects increase as more and more stocks are added to the portfolio because firm-specific risks comprise of most of the portfolio risk. e. All of the above are correct 4. Which of the following statements is usually true? a. EBITDA > EBIT b. EBI > EBIT c. EBITDA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts