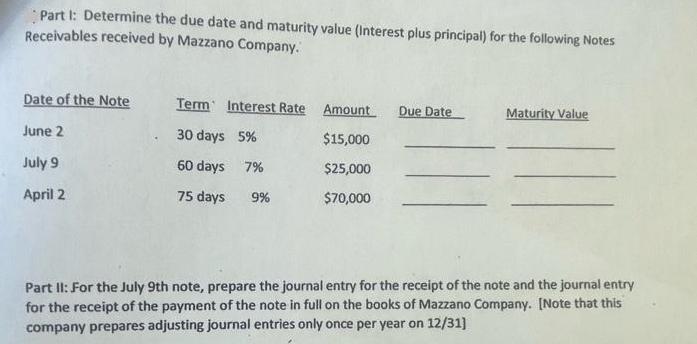

Question: Part I: Determine the due date and maturity value (Interest plus principal) for the following Notes Receivables received by Mazzano Company. Date of the

Part I: Determine the due date and maturity value (Interest plus principal) for the following Notes Receivables received by Mazzano Company. Date of the Note June 2 July 9 April 2 Term Interest Rate 30 days 5% 60 days 7% 75 days 9% Amount Due Date $15,000 $25,000 $70,000 Maturity Value Part II: For the July 9th note, prepare the journal entry for the receipt of the note and the journal entry for the receipt of the payment of the note in full on the books of Mazzano Company. [Note that this company prepares adjusting journal entries only once per year on 12/31]

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Part 1 To determine the due date and maturity value for the Notes Receivables received by Mazzano Co... View full answer

Get step-by-step solutions from verified subject matter experts