Question: Part I (Evening)-40 Points INSTRUCTIONS: Prepare adjusting entries and complete the worksheet for Meister Inc, a merchandising company, for the year ended December 31, 2018,using

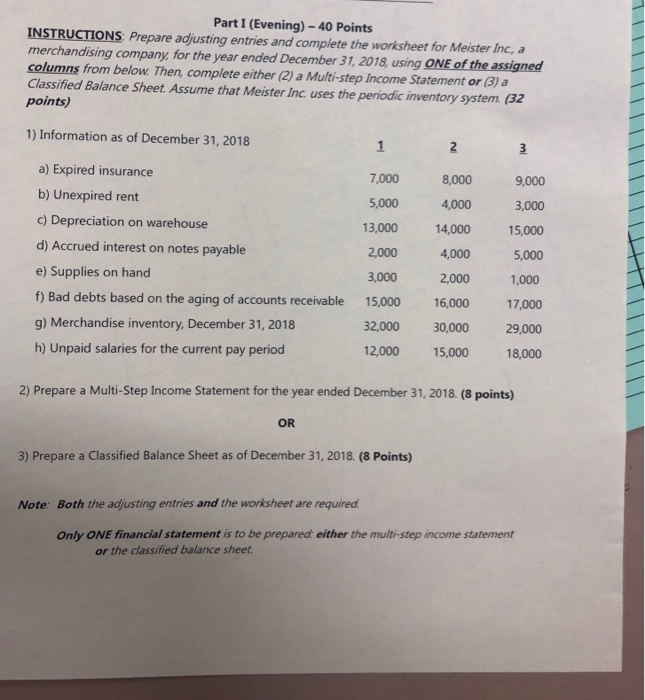

Part I (Evening)-40 Points INSTRUCTIONS: Prepare adjusting entries and complete the worksheet for Meister Inc, a merchandising company, for the year ended December 31, 2018,using ONE of the assigned columns from below. Then, complete either (2) a Multi-step Income Statement or (3) a Classified Balance Sheet. Assume that Meister Inc uses the periodic inventory system. (32 points) 1) Information as of December 31, 2018 a) Expired insurance b) Unexpired rent c) Depreciation on warehouse d) Accrued interest on notes payable e) Supplies on hand f) Bad debts based on the aging of accounts receivable 15,000 g) Merchandise inventory, December 31, 2018 h) Unpaid salaries for the current pay period 7,000 8,000 9,000 3,000 13,000 14,000 15,000 5,000 1,000 17,000 32,000 30,000 29,000 12,000 15,000 18,000 5,000 4,000 2,000 4,000 2,000 16,000 3,000 17 2) Prepare a Multi-Step Income Statement for the year ended December 31, 2018. (8 points) OR 3) Prepare a Classified Balance Sheet as of December 31, 2018. (8 Points) Note: Both the adjusting entries and the worksheet are required Only ONE financial statement is to be prepared either the multi-step income statement or the classified balance sheet Part I (Evening)-40 Points INSTRUCTIONS: Prepare adjusting entries and complete the worksheet for Meister Inc, a merchandising company, for the year ended December 31, 2018,using ONE of the assigned columns from below. Then, complete either (2) a Multi-step Income Statement or (3) a Classified Balance Sheet. Assume that Meister Inc uses the periodic inventory system. (32 points) 1) Information as of December 31, 2018 a) Expired insurance b) Unexpired rent c) Depreciation on warehouse d) Accrued interest on notes payable e) Supplies on hand f) Bad debts based on the aging of accounts receivable 15,000 g) Merchandise inventory, December 31, 2018 h) Unpaid salaries for the current pay period 7,000 8,000 9,000 3,000 13,000 14,000 15,000 5,000 1,000 17,000 32,000 30,000 29,000 12,000 15,000 18,000 5,000 4,000 2,000 4,000 2,000 16,000 3,000 17 2) Prepare a Multi-Step Income Statement for the year ended December 31, 2018. (8 points) OR 3) Prepare a Classified Balance Sheet as of December 31, 2018. (8 Points) Note: Both the adjusting entries and the worksheet are required Only ONE financial statement is to be prepared either the multi-step income statement or the classified balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts