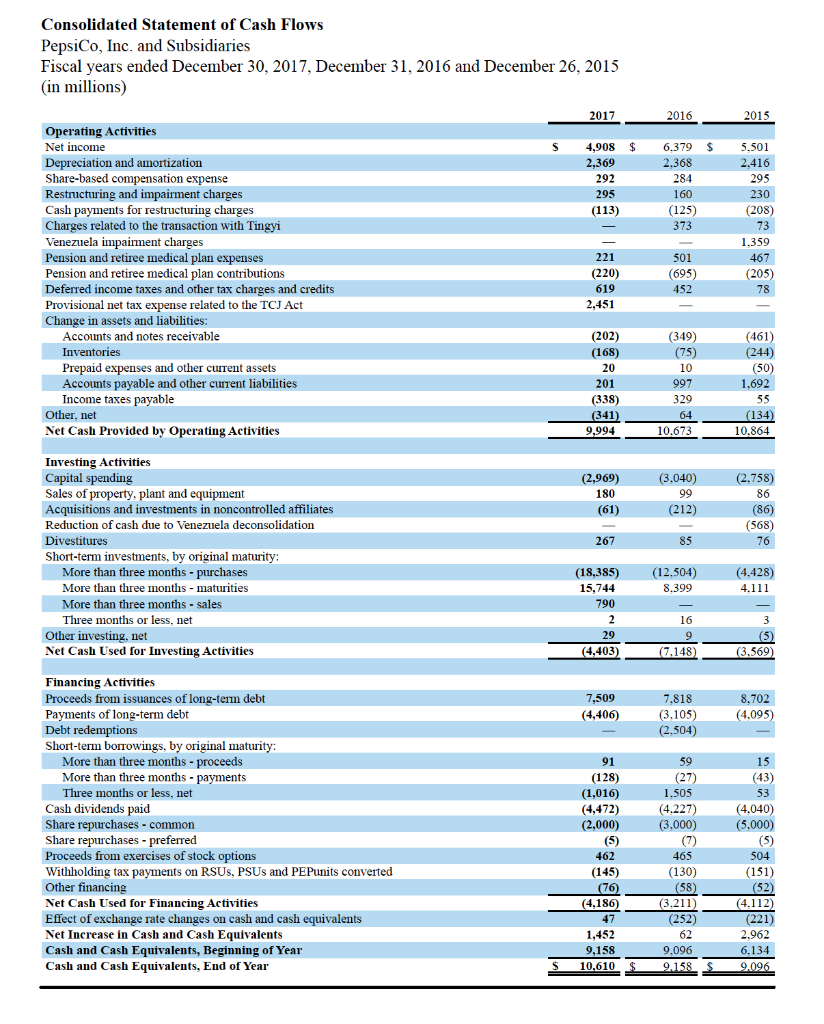

Question: Part I: Financial Statement Analysis [60 marks] You are required to apply the tools of analysis learnt in the course to analyze and assess the

Part I: Financial Statement Analysis [60 marks]

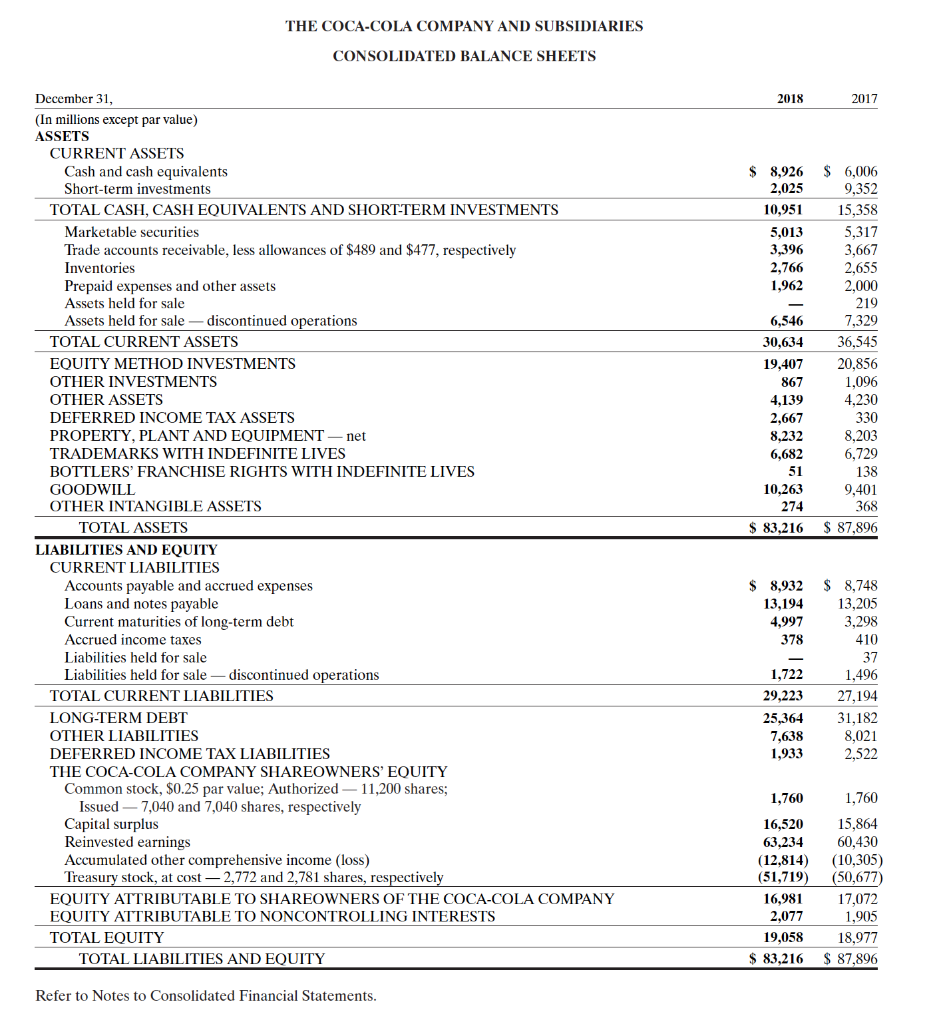

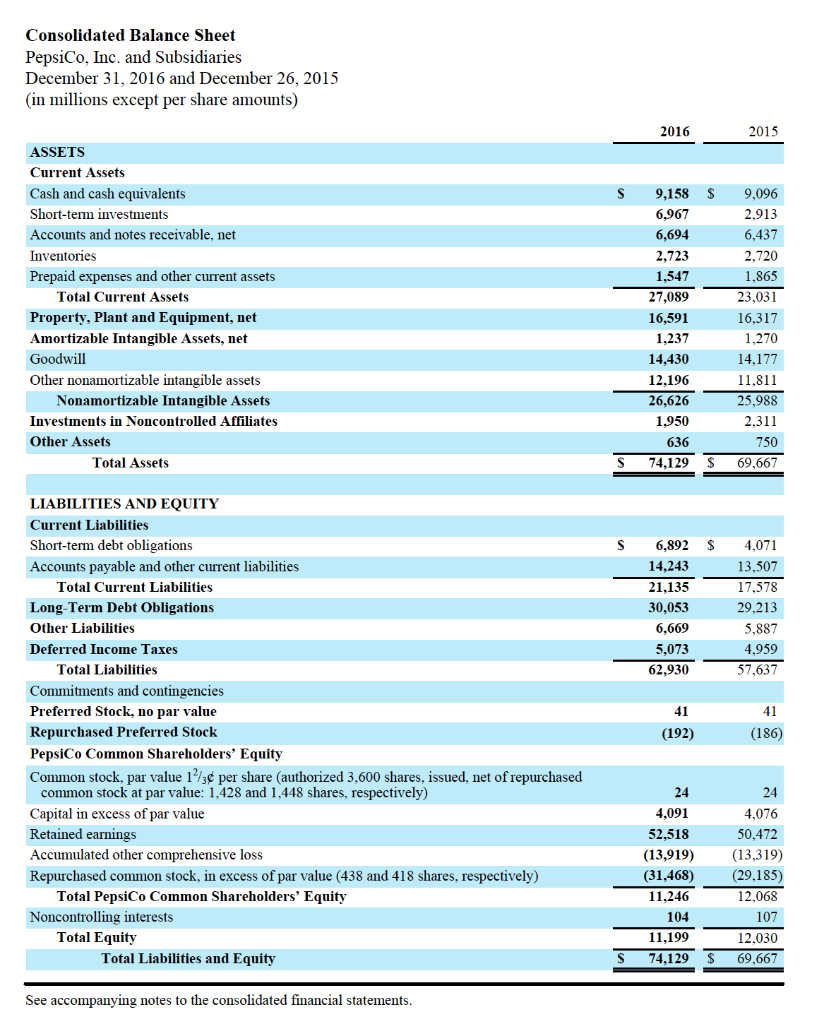

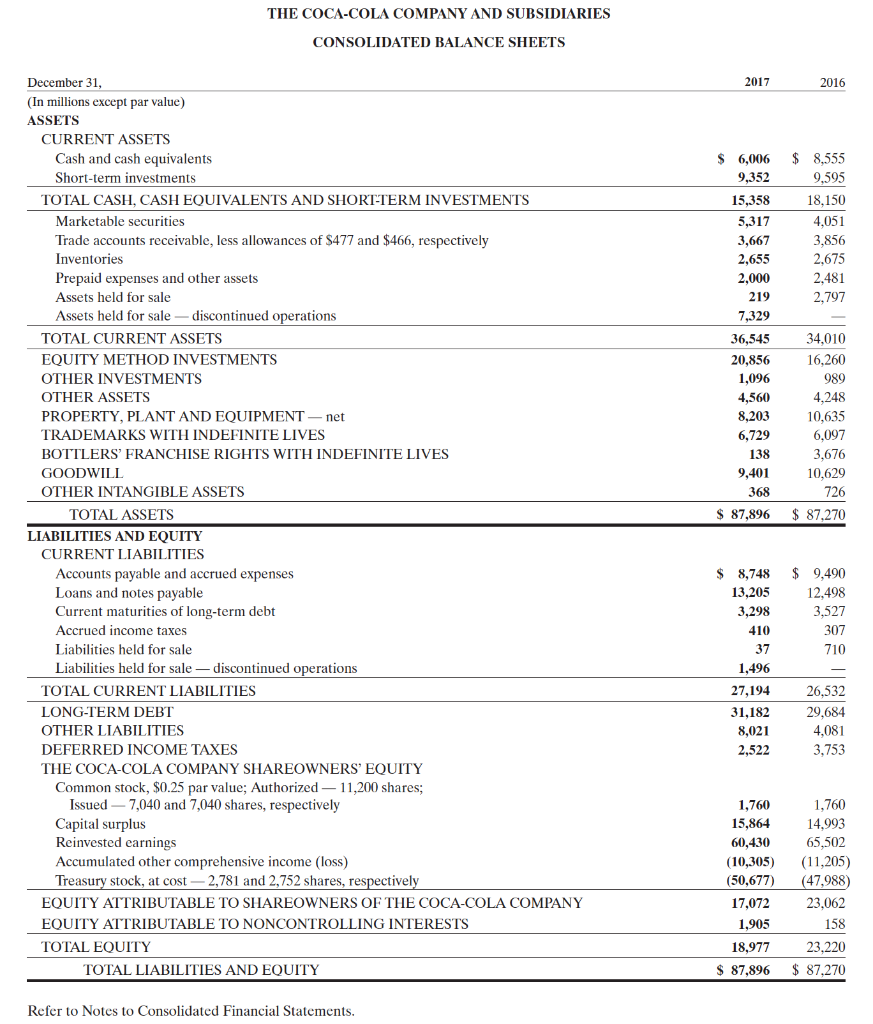

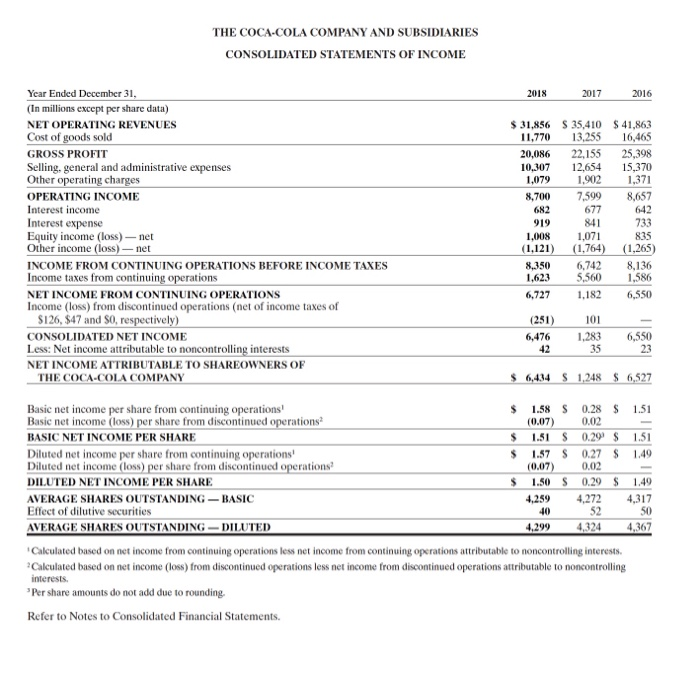

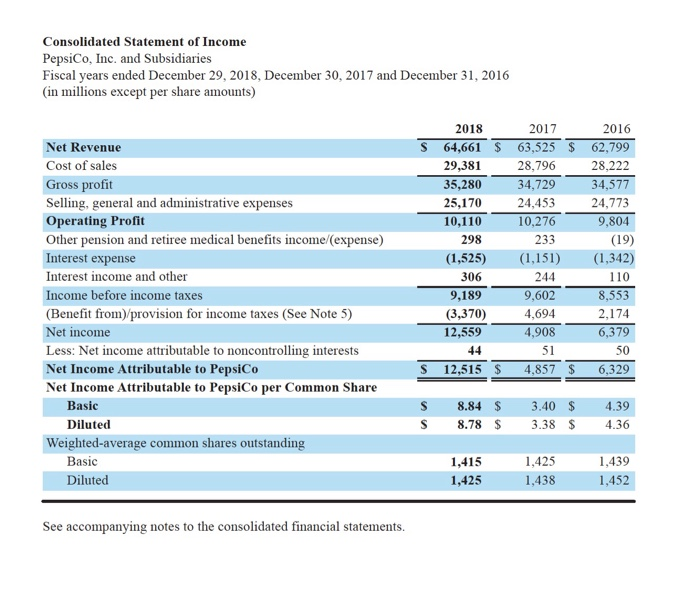

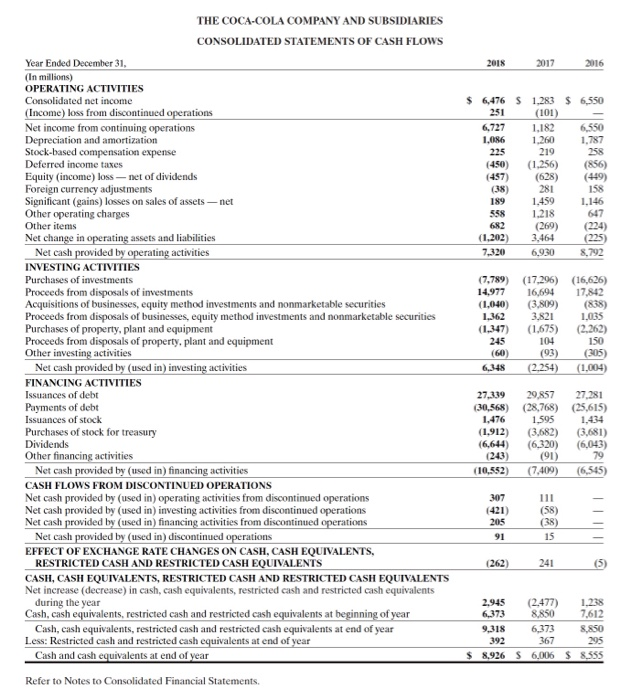

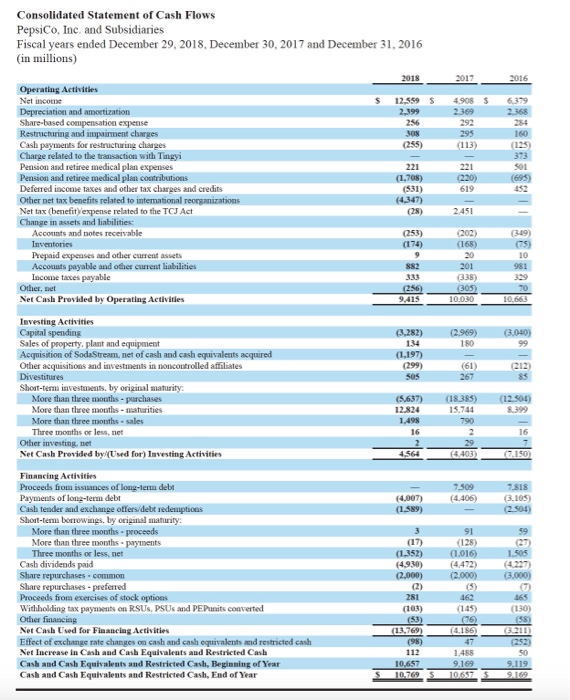

You are required to apply the tools of analysis learnt in the course to analyze and assess the financial performance of The Coca-Cola Company and PepsiCo, Inc. for the years 2016 2018.

Requirement (1):

Compute and classify the following financial ratios for each company for the fiscal years 2016, 2017, and 2018 based on their respective annual reports. [15 marks]

Return on total assets (profitability)

Debt ratio ( solvency)

Profit margin ratio (profitability)

Current ratio (liquidity)

Acid-test ratio (liquidity)

Gross margin ratio (profitability)

Inventory turnover (efficiency)

Days sales in inventory (efficiency)

Accounts receivable turnover (efficiency)

Total asset turnover (efficiency)

Times interest earned (solvency)

Debt-to-equity ratio (solvency)

Book value per ordinary share ( market prospect)

Basic earnings per share (market prospect)

Price-earnings ratio (market prospect)

Dividend yield (Market prospects)

Cash flow on total assets (liquidity)

![Part I: Financial Statement Analysis [60 marks] You are required to apply](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f80d71ebf95_40166f80d7150021.jpg)

![on their respective annual reports. [15 marks] Return on total assets (profitability)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f80d7626b70_40566f80d75e2368.jpg)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts