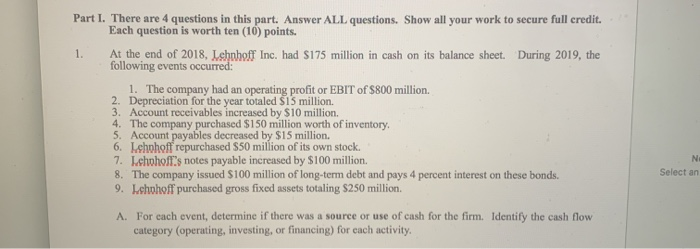

Question: Part I. There are 4 questions in this part. Answer ALL questions. Show all your work to secure full credit. Each question is worth ten

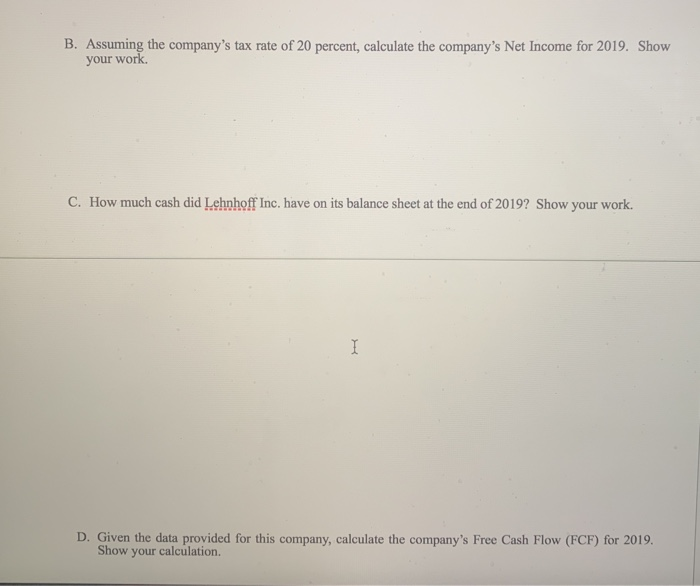

Part I. There are 4 questions in this part. Answer ALL questions. Show all your work to secure full credit. Each question is worth ten (10) points. 1. At the end of 2018, Lehnhoff Inc. had $175 million in cash on its balance sheet. During 2019, the following events occurred: 1. The company had an operating profit or EBIT of $800 million. 2. Depreciation for the year totaled $15 million. 3. Account receivables increased by $10 million. 4. The company purchased $150 million worth of inventory. 5. Account payables decreased by $15 million. 6. Lehnhoff repurchased $50 million of its own stock. 7. Ichohoff's notes payable increased by $100 million. 8. The company issued $100 million of long-term debt and pays 4 percent interest on these bonds. 9. Lchohoff purchased gross fixed assets totaling $250 million A. For each event, determine if there was a source or use of cash for the firm. Identify the cash flow category (operating, investing, or financing) for each activity. NI Select an B. Assuming the company's tax rate of 20 percent, calculate the company's Net Income for 2019. Show your work C. How much cash did Lehnhoff Inc. have on its balance sheet at the end of 2019? Show your work. I D. Given the data provided for this company, calculate the company's Free Cash Flow (FCF) for 2019. Show your calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts