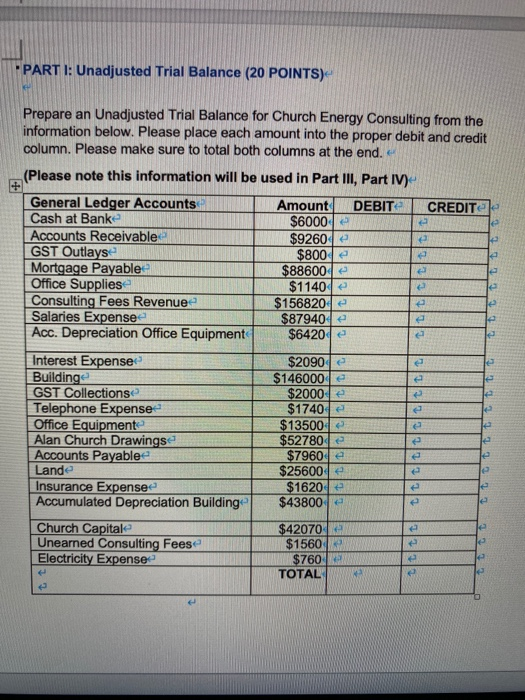

Question: PART I: Unadjusted Trial Balance (20 POINTS) e le Prepare an Unadjusted Trial Balance for Church Energy Consulting from the information below. Please place each

PART I: Unadjusted Trial Balance (20 POINTS) e le Prepare an Unadjusted Trial Balance for Church Energy Consulting from the information below. Please place each amount into the proper debit and credit column. Please make sure to total both columns at the end. (Please note this information will be used in Part III, Part IV) General Ledger Accounts Amount DEBIT CREDITS Cash at Bank $60004 Accounts Receivable $92604 GST Outlays $800 Mortgage Payable $88600 Office Suppliese $1140 Consulting Fees Revenue- $156820 e Salaries Expense $87940 Acc. Depreciation Office Equipment $6420 Interest Expense $2090 Building $146000e GST Collections $2000e Telephone Expense- $1740 Office Equipment $13500 Alan Church Drawings $52780 Accounts Payable $7960e Lande $25600, Insurance Expense $1620 Accumulated Depreciation Building $43800 Church Capital $42070 Unearned Consulting Fees $1560 Electricity Expense $760 TOTAL CALL e e e le 1:13 tit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts