Question: Part (II) Case Study (20 points each) George Markov eagerly awaited his first day at his new job with Bigquiz Corporation in a major metropolitan

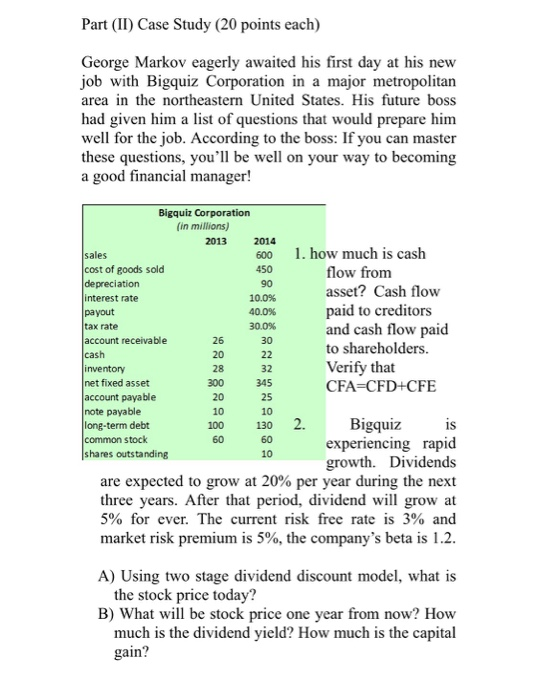

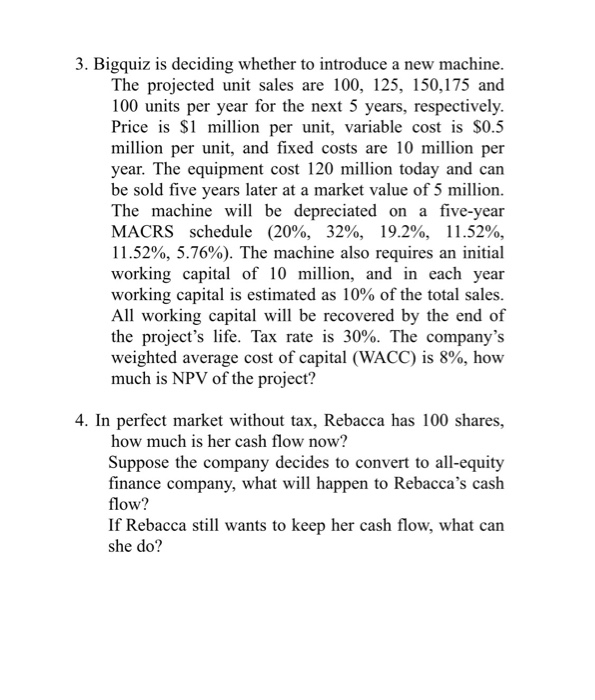

Part (II) Case Study (20 points each) George Markov eagerly awaited his first day at his new job with Bigquiz Corporation in a major metropolitan area in the northeastern United States. His future boss had given him a list of questions that would prepare him well for the job. According to the boss: If you can master these questions, you'll be well on your way to becoming a good financial manager! Bigquiz Corporation (in millions) 2013 2014 1. how much is cash flow from asset? Cash flow sales 600 cost of goods sold depreciation interest rate payout tax rate account receivable cash inventory net fixed asset account payable note payable long-term debt common stock shares outstanding 450 90 10.0 % 40.0 % paid to creditors and cash flow paid to shareholders Verify that CFA-CFD+CFE 30.0% 30 26 20 22 28 32 345 300 20 25 10 10 2. Bigquiz is 100 130 60 60 experiencing rapid growth. Dividends are expected to grow at 20% per year during the next three years. After that period, dividend will grow at 5% for ever. The current risk free rate is 3% and market risk premium is 5%, the company's beta is 1.2 10 A) Using two stage dividend discount model, what is the stock price today? B) What will be stock price one year from now? How much is the dividend yield? How much is the capital gain? 3. Bigquiz is deciding whether to introduce a new machine. The projected unit sales are 100, 125, 150,175 and 100 units per year for the next 5 years, respectively Price is $1 milion per unit, variable cost is $0.5 million per unit, and fixed costs are 10 million per year. The equipment cost 120 million today and can be sold five years later at a market value of 5 million. The machine wil be depreciated on a five-year MACRS schedule (20%, 32%, 19.2%, 11.52%, 11.52%, 5.76%). The machine also requires an initial working capital of 10 million, and in each year working capital is estimated as 10% of the total sales All working capital will be recovered by the end of the project's life. Tax rate is 30%. The company's weighted average cost of capital (WACC) is 8%, how much is NPV of the project? 4. In perfect market without tax, Rebacca has 100 shares, how much is her cash flow now? Suppose the company decides to convert to all-equity finance company, what will happen to Rebacca's cash flow? If Rebacca still wants to keep her cash flow, what can she do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts