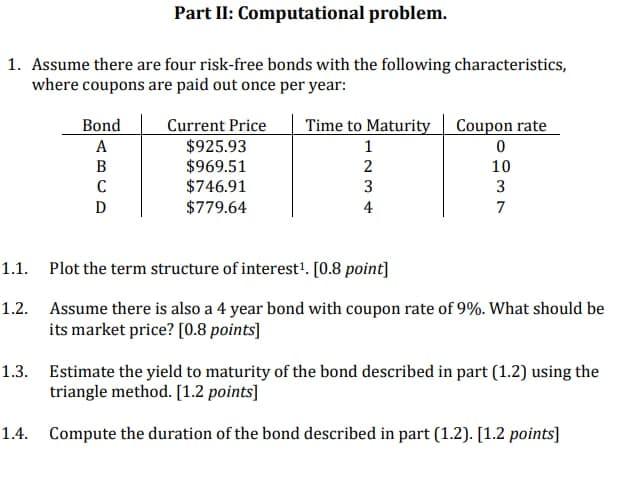

Question: Part II: Computational problem. 1. Assume there are four risk-free bonds with the following characteristics, where coupons are paid out once per year: Bond Current

Part II: Computational problem. 1. Assume there are four risk-free bonds with the following characteristics, where coupons are paid out once per year: Bond Current Price Time to Maturity Coupon rate A $925.93 1 0 B $969.51 2 10 $746.91 3 3 D $779.64 4 7 1.1. Plot the term structure of interest1. [0.8 point] 1.2. Assume there is also a 4 year bond with coupon rate of 9%. What should be its market price? [0.8 points) 1.3. Estimate the yield to maturity of the bond described in part (1.2) using the triangle method. (1.2 points] 1.4. Compute the duration of the bond described in part (1.2). [1.2 points) Part II: Computational problem. 1. Assume there are four risk-free bonds with the following characteristics, where coupons are paid out once per year: Bond Current Price Time to Maturity Coupon rate A $925.93 1 0 B $969.51 2 10 $746.91 3 3 D $779.64 4 7 1.1. Plot the term structure of interest1. [0.8 point] 1.2. Assume there is also a 4 year bond with coupon rate of 9%. What should be its market price? [0.8 points) 1.3. Estimate the yield to maturity of the bond described in part (1.2) using the triangle method. (1.2 points] 1.4. Compute the duration of the bond described in part (1.2). [1.2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts