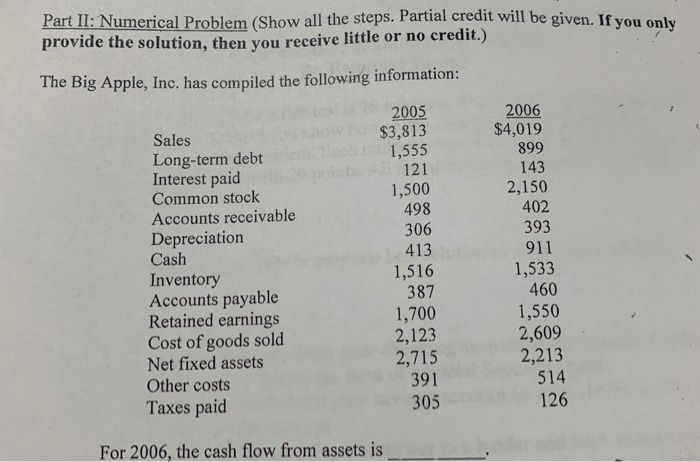

Question: Part II: Numerical Problem (Show all the steps. Partial m(Show all the steps. Partial credit will be given. If you only provide the solution, then

Part II: Numerical Problem (Show all the steps. Partial m(Show all the steps. Partial credit will be given. If you only provide the solution, then you receive little or no credit.) The Big Apple, Inc. has compiled the following information: D Sales Long-term debt Interest paid Common stock Accounts receivable Depreciation Cash Inventory Accounts payable Retained earnings Cost of goods sold Net fixed assets Other costs Taxes paid 2005 $3,813 1,555 121 1,500 498 306 413 1,516 387 1,700 2,123 2,715 391 305 2006 $4,019 899 143 2,150 402 393 911 1,533 460 1,550 2,609 2,213 514 126 For 2006, the cash flow from assets is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts