Question: Part II. Problems (50 points) Problem #1. (25 points) You are considering an investment in a mutual fund with a 4% load and an expense

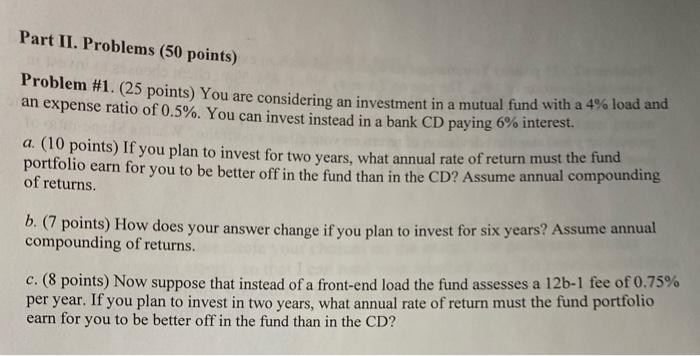

Part II. Problems (50 points) Problem #1. (25 points) You are considering an investment in a mutual fund with a 4% load and an expense ratio of 0.5%. You can invest instead in a bank CD paying 6% interest. a. (10 points) If you plan to invest for two years, what annual rate of return must the fund portfolio earn for you to be better off in the fund than in the CD? Assume annual compounding of returns. b. (7 points) How does your answer change if you plan to invest for six years? Assume annual compounding of returns. c. (8 points) Now suppose that instead of a front-end load the fund assesses a 126-1 fee of 0.75% per year. If you plan to invest in two years, what annual rate of return must the fund portfolio earn for you to be better off in the fund than in the CD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts