Question: PART II: PROBLEMS - Compute a final numerical answer for each of the following problems. You should work out your solutions on loose leaf paper,

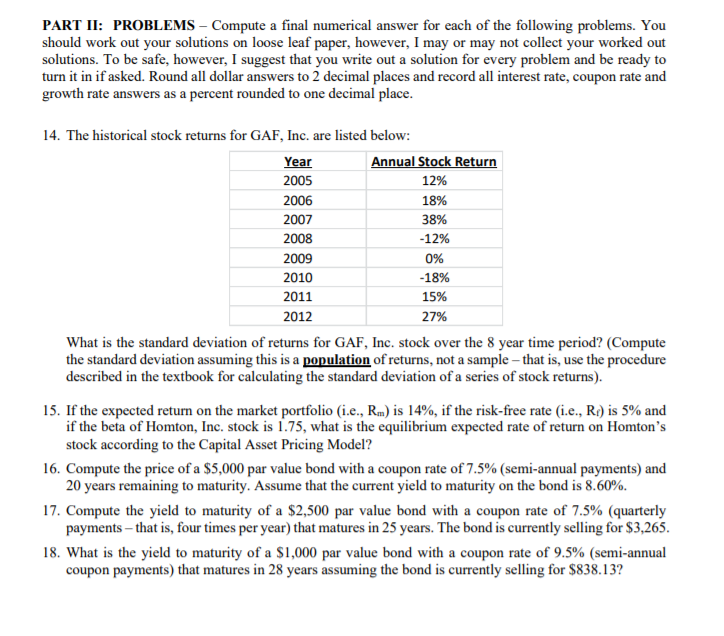

PART II: PROBLEMS - Compute a final numerical answer for each of the following problems. You should work out your solutions on loose leaf paper, however, I may or may not collect your worked out solutions. To be safe, however, I suggest that you write out a solution for every problem and be ready to turn it in if asked. Round all dollar answers to 2 decimal places and record all interest rate, coupon rate and growth rate answers as a percent rounded to one decimal place. -18% 14. The historical stock returns for GAF, Inc. are listed below: Year Annual Stock Return 2005 12% 2006 18% 2007 38% 2008 -12% 2009 0% 2010 2011 15% 2012 27% What is the standard deviation of returns for GAF, Inc. stock over the 8 year time period? (Compute the standard deviation assuming this is a population of returns, not a sample - that is, use the procedure described in the textbook for calculating the standard deviation of a series of stock returns). 15. If the expected return on the market portfolio i.e., Rm) is 14%, if the risk-free rate (i.e., Re) is 5% and if the beta of Homton, Inc. stock is 1.75, what is the equilibrium expected rate of return on Homton's stock according to the Capital Asset Pricing Model? 16. Compute the price of a $5,000 par value bond with a coupon rate of 7.5% (semi-annual payments) and 20 years remaining to maturity. Assume that the current yield to maturity on the bond is 8.60%. 17. Compute the yield to maturity of a $2,500 par value bond with a coupon rate of 7.5% (quarterly payments - that is, four times per year) that matures in 25 years. The bond is currently selling for $3,265. 18. What is the yield to maturity of a $1,000 par value bond with a coupon rate of 9.5% (semi-annual coupon payments) that matures in 28 years assuming the bond is currently selling for $838.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts