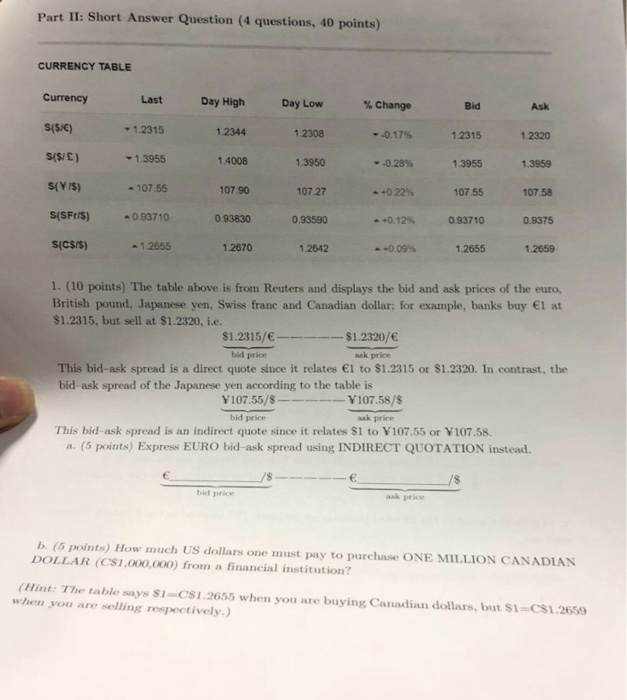

Question: Part II: Short Answer Question (4 questions, 40 points) CURRENCY TABLE Currency Last - 1.2315 1.3955 -107.55 % Change Bid 1.2315 1.3955 Ask $(sic) 1.2344

Part II: Short Answer Question (4 questions, 40 points) CURRENCY TABLE Currency Last - 1.2315 1.3955 -107.55 % Change Bid 1.2315 1.3955 Ask $(sic) 1.2344 1.4008 107.90 0.93830 1.2670 1.2308 1.3950 107.27 +0.17% 1.2320 1.3959 107.58 0.9375 1.2659 -0.28% +0.22% ^+0.12% ^+0.09% 107.55 S(SFris) 093710 0.93590 093710 s(cSiS) 1.2655 1.2642 1.2655 1. (10 points) The table above is from Reuters and displays the bid and ask prices of the euro, British pound, Japanese yen, Swiss frane and Canadian dollar; for example, banks buy 1 at $1.2315, but sell at $1.2320, i.e. $1.2315/-$1.2320/ ask price bid price This bid-ask spread is a direct quote since it relates 1 to $1.2315 or $1.2320. In contrast, the bid-ask spread of the Japanese yen according to the table is bid price ask price This bid ask spread is an indirect quote since it relates $1 to Y107.55 or Y107.58. a. (5 points) Express EURO bid-ask spread using INDIRECT QUOTATION instead. bid price ask price b. (5 points) How much US dollars one must pay to purchase ONE MILLION CANADIAN DOLLAR (C$1,000,000) from a financial institution? Hint: The table says $1-CS1.2655 when you are buying Canadian dollars, but S1- CS1.2659 when you are selling respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts