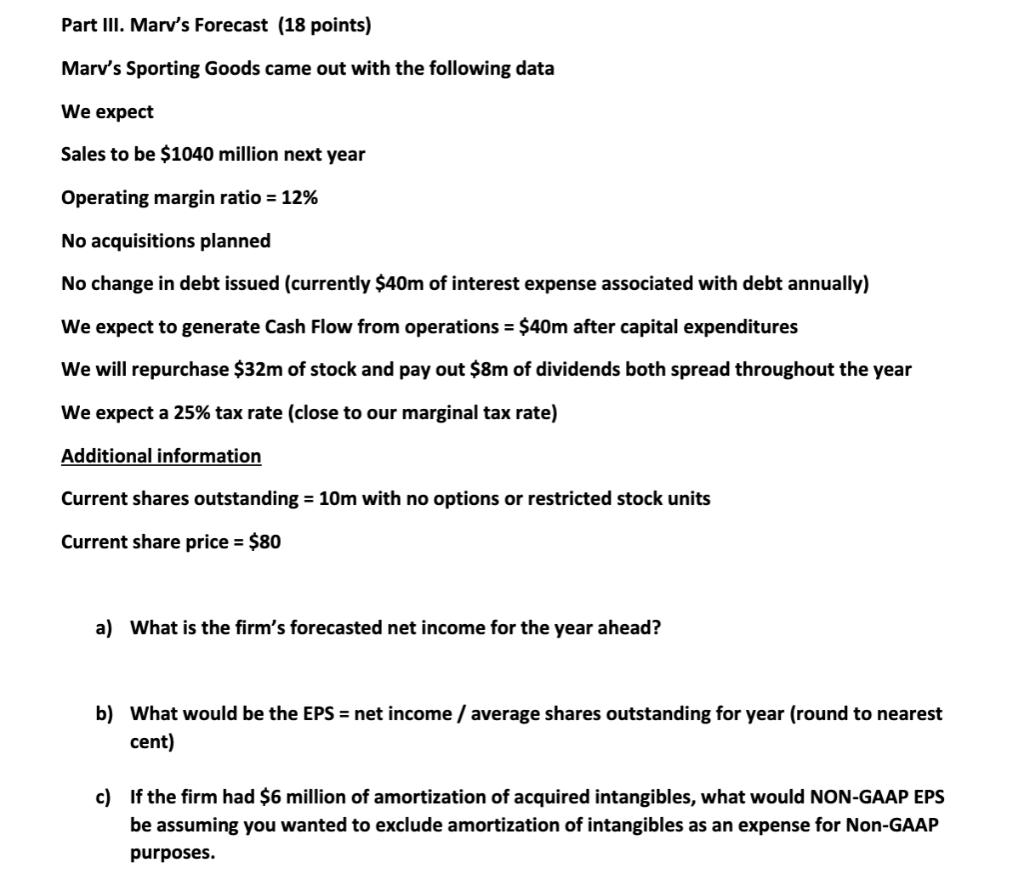

Question: Part III. Marv's Forecast (18 points) Marv's Sporting Goods came out with the following data We expect Sales to be $1040 million next year

Part III. Marv's Forecast (18 points) Marv's Sporting Goods came out with the following data We expect Sales to be $1040 million next year Operating margin ratio = 12% No acquisitions planned No change in debt issued (currently $40m of interest expense associated with debt annually) We expect to generate Cash Flow from operations = $40m after capital expenditures We will repurchase $32m of stock and pay out $8m of dividends both spread throughout the year We expect a 25% tax rate (close to our marginal tax rate) Additional information Current shares outstanding = 10m with no options or restricted stock units Current share price = $80 a) What is the firm's forecasted net income for the year ahead? b) What would be the EPS = net income / average shares outstanding for year (round to nearest cent) c) If the firm had $6 million of amortization of acquired intangibles, what would NON-GAAP EPS be assuming you wanted to exclude amortization of intangibles as an expense for Non-GAAP purposes.

Step by Step Solution

There are 3 Steps involved in it

a Net income Sales x Operating margin ratio 10 40 million x 12 1... View full answer

Get step-by-step solutions from verified subject matter experts