Question: Part (iii) please Consider a mean-variance portfolio model with two risky assets, A and B, where the expected return and standard deviation of return for

Part (iii) please

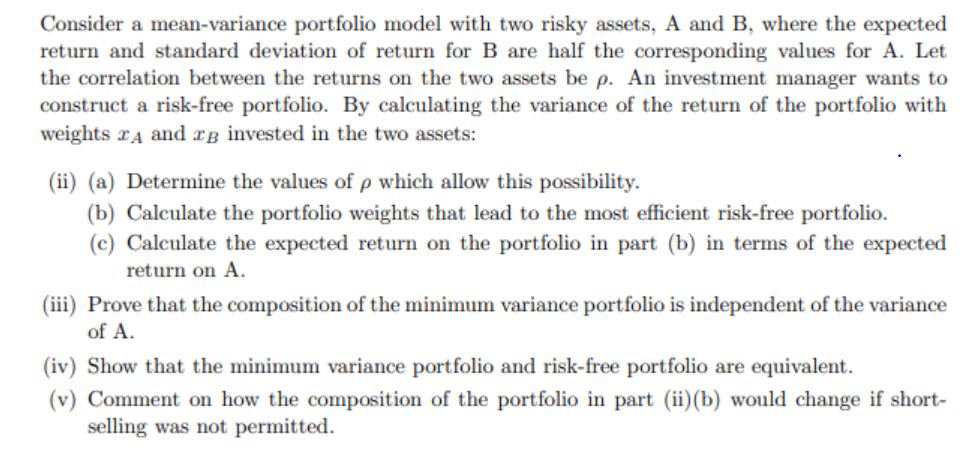

Consider a mean-variance portfolio model with two risky assets, A and B, where the expected return and standard deviation of return for B are half the corresponding values for A. Let the correlation between the returns on the two assets be p. An investment manager wants to construct a risk-free portfolio. By calculating the variance of the return of the portfolio with weights r A and ab invested in the two assets: (ii) (a) Determine the values of p which allow this possibility. (b) Calculate the portfolio weights that lead to the most efficient risk-free portfolio. (c) Calculate the expected return on the portfolio in part (b) in terms of the expected return on A. (iii) Prove that the composition of the minimum variance portfolio is independent of the variance of A (iv) Show that the minimum variance portfolio and risk-free portfolio are equivalent. (v) Comment on how the composition of the portfolio in part (ii)(b) would change if short- selling was not permitted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts