Question: Part III - Problems - Job and Activity Based Costing. Total = 20 points. 1. Manufacturing overhead was estimated to be $400,000 for the year

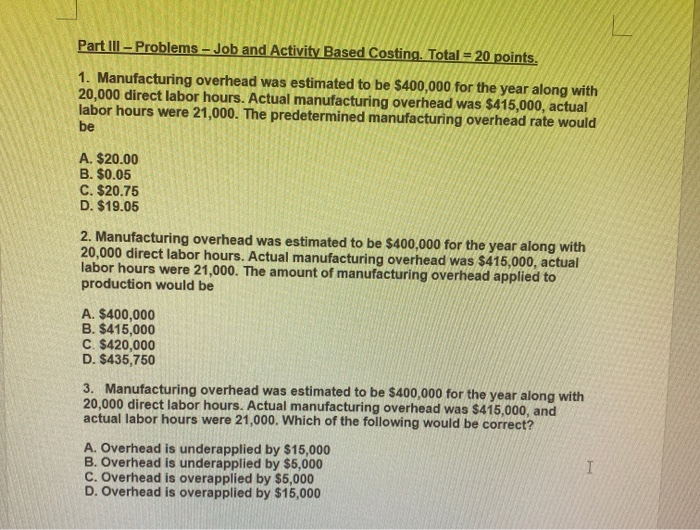

Part III - Problems - Job and Activity Based Costing. Total = 20 points. 1. Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, actual labor hours were 21,000. The predetermined manufacturing overhead rate would be A. $20.00 B. $0.05 C. $20.75 D. $19.05 2. Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, actual labor hours were 21,000. The amount of manufacturing overhead applied to production would be A. $400,000 B. $415,000 C. $420,000 D. $435,750 3. Manufacturing overhead was estimated to be $400,000 for the year along with 20.000 direct labor hours. Actual manufacturing overhead was $415,000, and actual labor hours were 21,000. Which of the following would be correct? A. Overhead is underapplied by $15,000 B. Overhead is underapplied by $5,000 C. Overhead is overapplied by $5,000 D. Overhead is overapplied by $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts