Question: PART III: SHORT PROBLEMS (SHOW YOUR WORK.) (37 Points) 1. As Financial Analyst of FalconGolf.com, you are evaluating the performance of three divisions of your

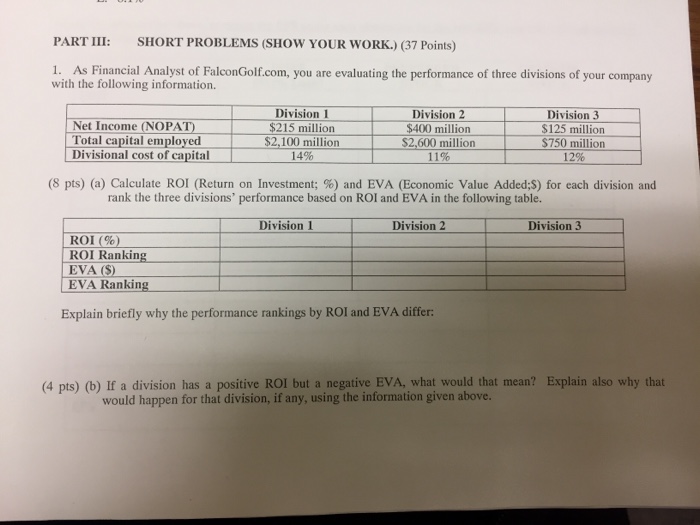

PART III: SHORT PROBLEMS (SHOW YOUR WORK.) (37 Points) 1. As Financial Analyst of FalconGolf.com, you are evaluating the performance of three divisions of your company with the following information. Net Income (NOPAT Total capital employed Divisional cost of capital Division 1 $215 million $2,100 million 14% Division 2 $400 million S2,600 million 11% Division 3 $125 million $750 million 12% (8 pts) (a) Calculate ROI (Return on Investment; %) and EVA (Economic Value Added; ) for each division and rank the three divisions' performance based on ROI and EVA in the following table. Division2 Division 3 ROI (%) ROI Ranking EVA (S) EVA Ranking Explain briefly why the performance rankings by ROI and EVA differ (4 pts) (b) If a division has a positive ROI but a negative EVA, what would that mean? Explain also why that would happen for that division, if any, using the information given above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts