Question: Part IV. Capstone Problem (40 points total) You have just received this memo from your boss, the CFO of Electrolux, the world's largest maker of

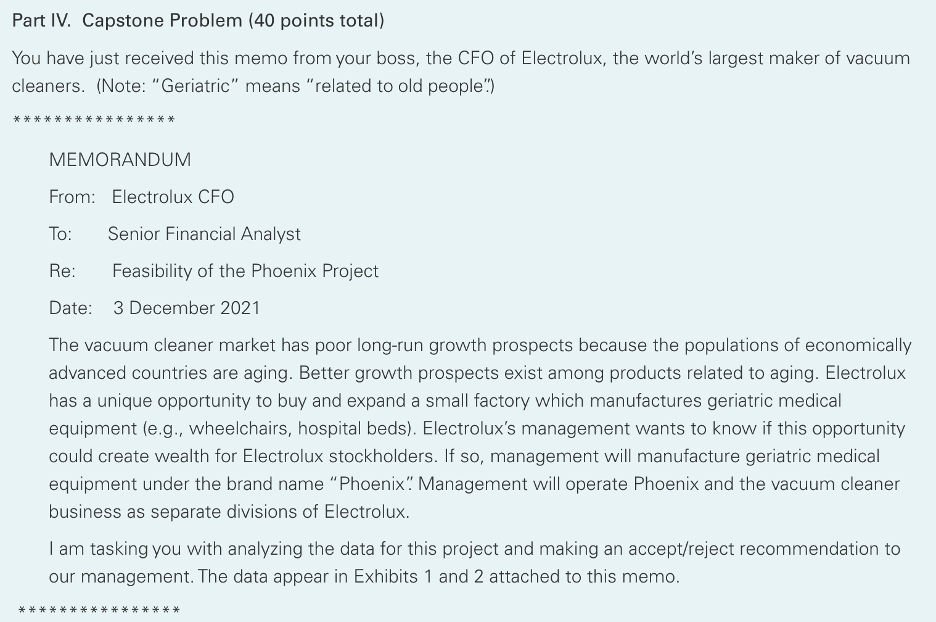

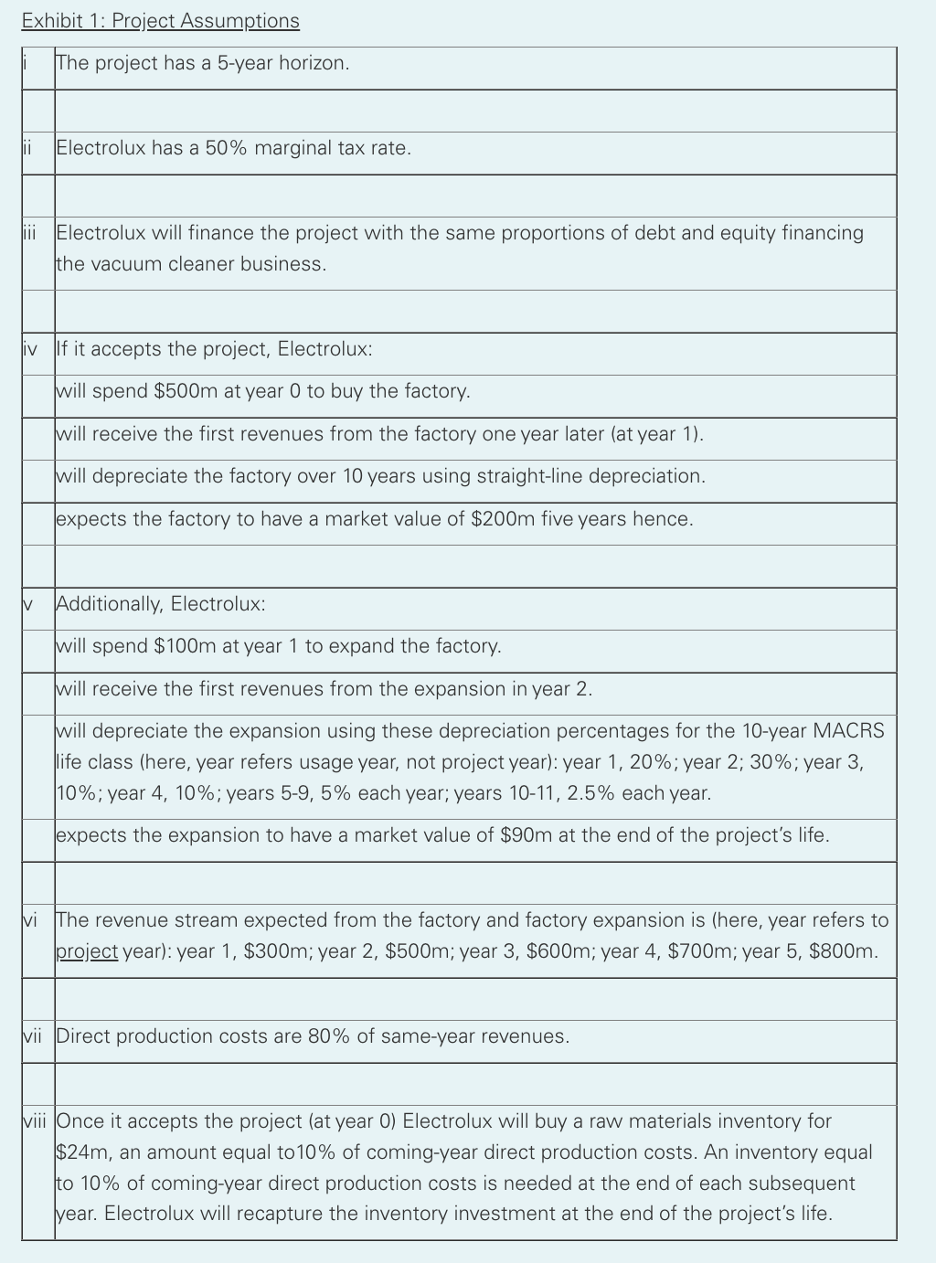

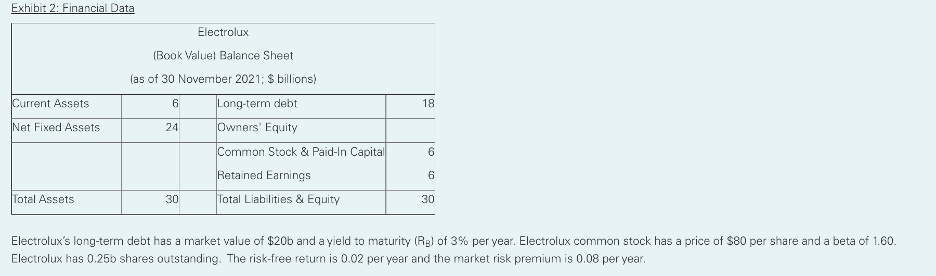

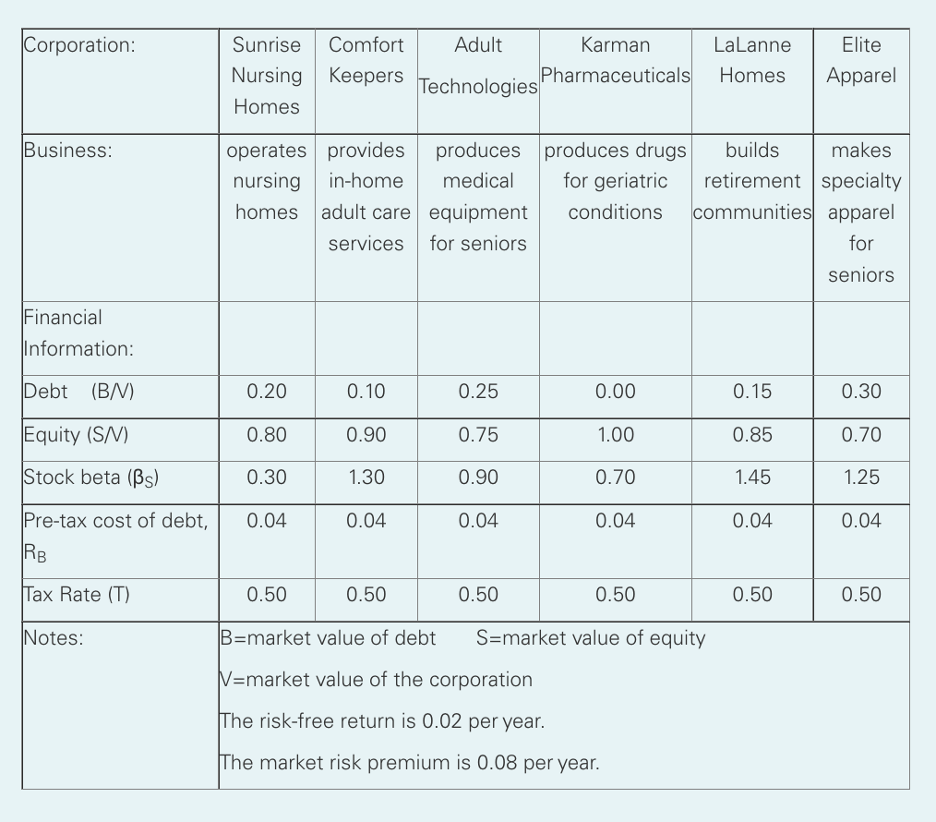

Part IV. Capstone Problem (40 points total) You have just received this memo from your boss, the CFO of Electrolux, the world's largest maker of vacuum cleaners. (Note: "Geriatric" means "related to old people") **** *** MEMORANDUM From: Electrolux CFO To: Senior Financial Analyst Re: Feasibility of the Phoenix Project Date: 3 December 2021 The vacuum cleaner market has poor long-run growth prospects because the populations of economically advanced countries are aging. Better growth prospects exist among products related to aging. Electrolux has a unique opportunity to buy and expand a small factory which manufactures geriatric medical equipment (e.g., wheelchairs, hospital beds). Electrolux's management wants to know if this opportunity could create wealth for Electrolux stockholders. If so, management will manufacture geriatric medical equipment under the brand name "Phoenix" Management will operate Phoenix and the vacuum cleaner business as separate divisions of Electrolux. I am tasking you with analyzing the data for this project and making an accept/reject recommendation to our management. The data appear in Exhibits 1 and 2 attached to this memo. Exhibit 1: Project Assumptions The project has a 5-year horizon. lii Electrolux has a 50% marginal tax rate. i Electrolux will finance the project with the same proportions of debt and equity financing the vacuum cleaner business. iv If it accepts the project, Electrolux: will spend $500m at year 0 to buy the factory. will receive the first revenues from the factory one year later (at year 1). will depreciate the factory over 10 years using straight-line depreciation. expects the factory to have a market value of $200m five years hence. V Additionally, Electrolux: will spend $100m at year 1 to expand the factory. will receive the first revenues from the expansion in year 2. will depreciate the expansion using these depreciation percentages for the 10-year MACRS life class (here, year refers usage year, not project year): year 1, 20%; year 2; 30%; year 3, 10%; year 4, 10%; years 5-9, 5% each year; years 10-11, 2.5% each year. expects the expansion to have a market value of $90m at the end of the project's life. vi The revenue stream expected from the factory and factory expansion is (here, year refers to project year): year 1, $300m; year 2, $500m; year 3, $600m; year 4, $700m; year 5, $800m. vii Direct production costs are 80% of same-year revenues. viii Once it accepts the project (at year 0) Electrolux will buy a raw materials inventory for $24m, an amount equal to 10% of coming-year direct production costs. An inventory equal to 10% of coming-year direct production costs is needed at the end of each subsequent year. Electrolux will recapture the inventory investment at the end of the project's life. Exhibit 2: Financial Data Electrolux Current Assets 18 Net Fixed Assets (Book Valuel Balance Sheet (as of 30 November 2021; $ billions) 6 Long-term debt 24 Owners' Equity Common Stock & Paid-In Capital Retained Earnings 30 Total Liabilities & Equity S | 6 Total Assets 30 Electrolux's long-term debt has a market value of $200 and a yield to maturity (RBof 3% per year. Electrolux common stock has a price of $80 per share and a beta of 1.60 Electrolux has 0.250 shares outstanding. The risk-free return is 0.02 per year and the market risk premium is 0.08 per year. Corporation: Sunrise Comfort Adult Karman Nursing Keepers Technologies Pharmaceuticals Homes LaLanne Homes Elite Apparel Business: operates provides produces produces drugs builds makes nursing in-home medical for geriatric retirement specialty homes adult care equipment conditions communities apparel services for seniors for seniors Financial Information: Debt (B/V) ( 0.20 0.10 0.25 0.00 0.15 0.30 Equity (SN) 0.80 0.90 0.75 1.00 0.85 0.70 Stock beta (Bs) 0.30 1.30 0.90 0.70 1.45 1.25 0.04 0.04 0.04 0.04 0.04 0.04 Pre-tax cost of debt, RB Tax Rate (T) 0.50 0.50 0.50 0.50 0.50 0.50 INotes: B=market value of debt S=market value of equity N=market value of the corporation The risk-free return is 0.02 per year. The market risk premium is 0.08 per year. Part IV. Capstone Problem (40 points total) You have just received this memo from your boss, the CFO of Electrolux, the world's largest maker of vacuum cleaners. (Note: "Geriatric" means "related to old people") **** *** MEMORANDUM From: Electrolux CFO To: Senior Financial Analyst Re: Feasibility of the Phoenix Project Date: 3 December 2021 The vacuum cleaner market has poor long-run growth prospects because the populations of economically advanced countries are aging. Better growth prospects exist among products related to aging. Electrolux has a unique opportunity to buy and expand a small factory which manufactures geriatric medical equipment (e.g., wheelchairs, hospital beds). Electrolux's management wants to know if this opportunity could create wealth for Electrolux stockholders. If so, management will manufacture geriatric medical equipment under the brand name "Phoenix" Management will operate Phoenix and the vacuum cleaner business as separate divisions of Electrolux. I am tasking you with analyzing the data for this project and making an accept/reject recommendation to our management. The data appear in Exhibits 1 and 2 attached to this memo. Exhibit 1: Project Assumptions The project has a 5-year horizon. lii Electrolux has a 50% marginal tax rate. i Electrolux will finance the project with the same proportions of debt and equity financing the vacuum cleaner business. iv If it accepts the project, Electrolux: will spend $500m at year 0 to buy the factory. will receive the first revenues from the factory one year later (at year 1). will depreciate the factory over 10 years using straight-line depreciation. expects the factory to have a market value of $200m five years hence. V Additionally, Electrolux: will spend $100m at year 1 to expand the factory. will receive the first revenues from the expansion in year 2. will depreciate the expansion using these depreciation percentages for the 10-year MACRS life class (here, year refers usage year, not project year): year 1, 20%; year 2; 30%; year 3, 10%; year 4, 10%; years 5-9, 5% each year; years 10-11, 2.5% each year. expects the expansion to have a market value of $90m at the end of the project's life. vi The revenue stream expected from the factory and factory expansion is (here, year refers to project year): year 1, $300m; year 2, $500m; year 3, $600m; year 4, $700m; year 5, $800m. vii Direct production costs are 80% of same-year revenues. viii Once it accepts the project (at year 0) Electrolux will buy a raw materials inventory for $24m, an amount equal to 10% of coming-year direct production costs. An inventory equal to 10% of coming-year direct production costs is needed at the end of each subsequent year. Electrolux will recapture the inventory investment at the end of the project's life. Exhibit 2: Financial Data Electrolux Current Assets 18 Net Fixed Assets (Book Valuel Balance Sheet (as of 30 November 2021; $ billions) 6 Long-term debt 24 Owners' Equity Common Stock & Paid-In Capital Retained Earnings 30 Total Liabilities & Equity S | 6 Total Assets 30 Electrolux's long-term debt has a market value of $200 and a yield to maturity (RBof 3% per year. Electrolux common stock has a price of $80 per share and a beta of 1.60 Electrolux has 0.250 shares outstanding. The risk-free return is 0.02 per year and the market risk premium is 0.08 per year. Corporation: Sunrise Comfort Adult Karman Nursing Keepers Technologies Pharmaceuticals Homes LaLanne Homes Elite Apparel Business: operates provides produces produces drugs builds makes nursing in-home medical for geriatric retirement specialty homes adult care equipment conditions communities apparel services for seniors for seniors Financial Information: Debt (B/V) ( 0.20 0.10 0.25 0.00 0.15 0.30 Equity (SN) 0.80 0.90 0.75 1.00 0.85 0.70 Stock beta (Bs) 0.30 1.30 0.90 0.70 1.45 1.25 0.04 0.04 0.04 0.04 0.04 0.04 Pre-tax cost of debt, RB Tax Rate (T) 0.50 0.50 0.50 0.50 0.50 0.50 INotes: B=market value of debt S=market value of equity N=market value of the corporation The risk-free return is 0.02 per year. The market risk premium is 0.08 per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts