Question: Part IV: Problems (36 points) I. (10 points) Orca Bay Chemical stock has a beta of 1.30. The company retains 65% of their net income

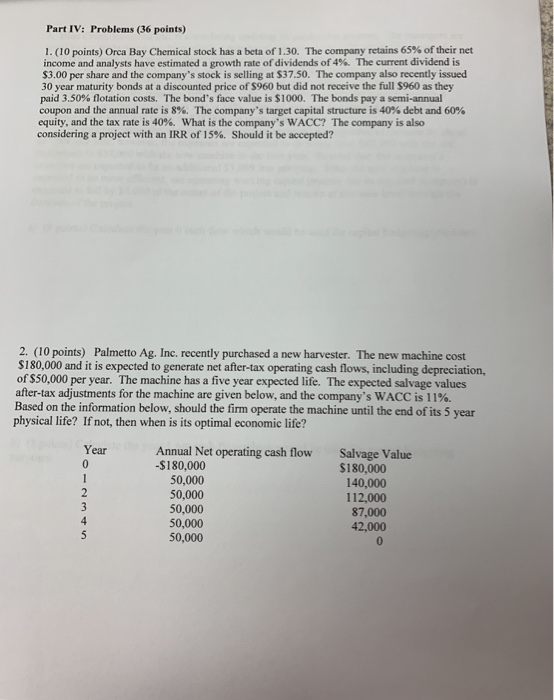

Part IV: Problems (36 points) I. (10 points) Orca Bay Chemical stock has a beta of 1.30. The company retains 65% of their net income and analysts have estimated a growth rate ofdividends of 4%. The current dividend is $3.00 per share and the company's stock is selling at $37.50. The company also recently issued 30 year maturity bonds at a discounted price of $960 but did not receive the full S960 as they paid 3.50% flotation costs. The bond's face value is $1000. The bonds pay a semi-annual coupon and the annual rate is 8%. The company's target capital structure is 40% debt and 60% equity, and the tax rate is 40%. What is the company's WACC? The company is also considering a project with an IRR of 15%. Should it be accepted? 2. (10 points) Palmetto Ag. Inc. recently purchased a new harvester. The new machine cost $180,000 and it is expected to generate net after-tax operating cash flows, including depreciation, of $50,000 per year. The machine has a five year expected life. The expected salvage values after-tax adjustments for the machine are given below, and the company's WACC is 1 i%, Based on the information below, should the firm operate the machine until the end of its 5 year physical life? If not, then when is its optimal economic life? Year Annual Net operating cash flow -$180,000 Salvage Value 50,000 50,000 50,000 50,000 50,000 $180,000 140,000 112,000 87,000 42,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts