Question: Part one has been answered. Please see below for answer Please help with at least question 2 if not more. Thank you Morrison Corporation is

Part one has been answered. Please see below for answer

Please help with at least question 2 if not more.

Thank you

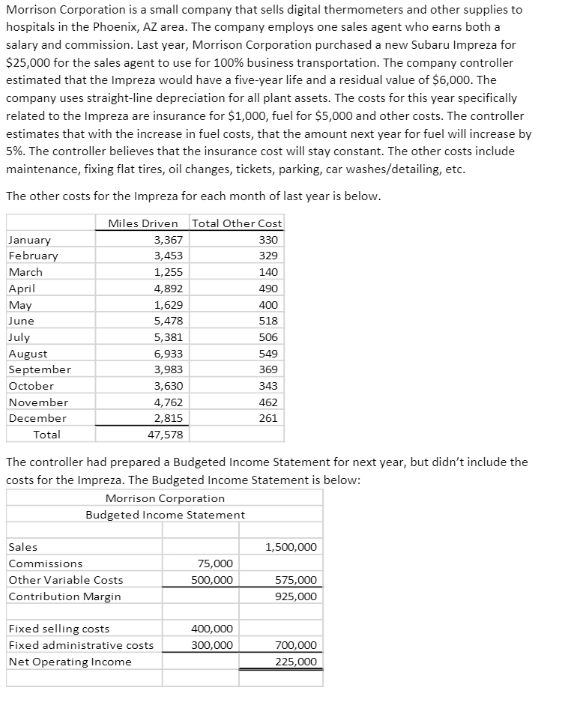

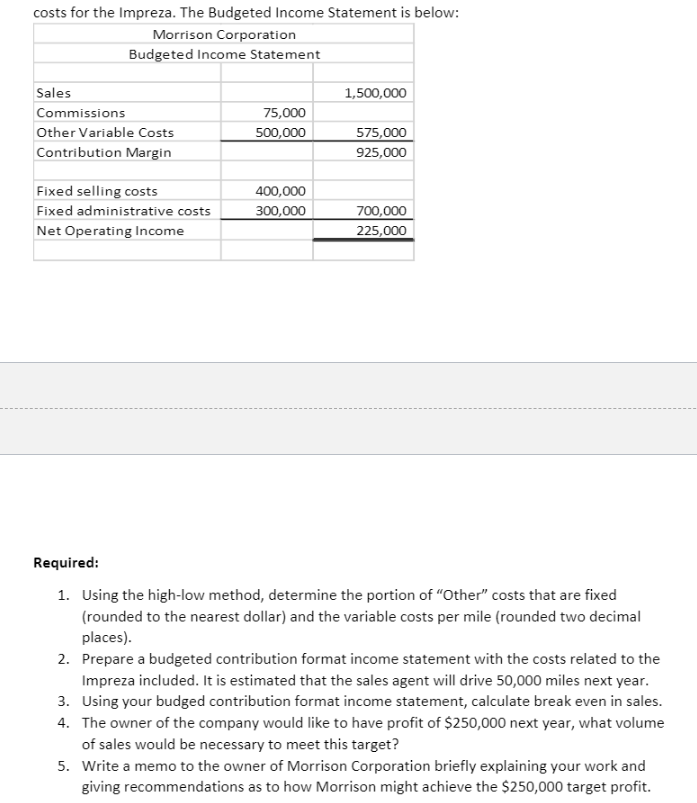

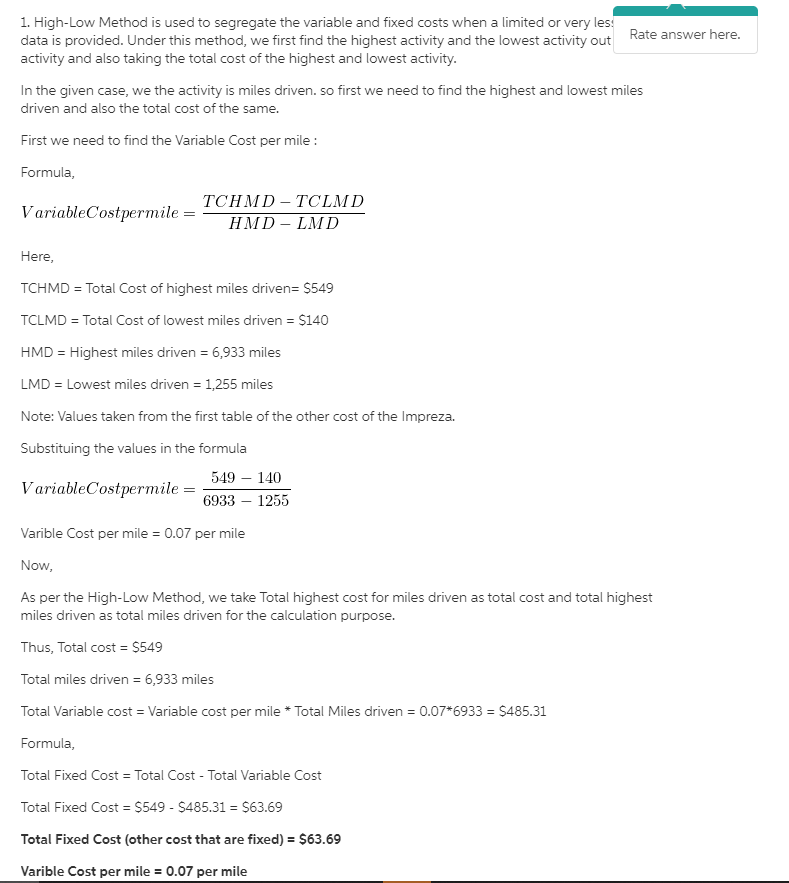

Morrison Corporation is a small company that sells digital thermometers and other supplies to hospitals in the Phoenix, AZ area. The company employs one sales agent who earns both a salary and commission. Last year, Morrison Corporation purchased a new Subaru Impreza for $25,000 for the sales agent to use for 100% business transportation. The company controller estimated that the Impreza would have a five-year life and a residual value of $6,000. The company uses straight-line depreciation for all plant assets. The costs for this year specifically related to the Impreza are insurance for $1,000, fuel for $5,000 and other costs. The controller estimates that with the increase in fuel costs, that the amount next year for fuel will increase by 5%. The controller believes that the insurance cost will stay constant. The other costs include maintenance, fixing flat tires, oil changes, tickets, parking, car washes/detailing, etc. The other costs for the Impreza for each month of last year is below. Miles Driven Total Other Cost January 3,367 330 February 3,453 March 1,255 140 April 4,892 May 1,629 400 June 5,478 518 July 5,381 August 6,933 549 September 3,983 October 3,630 343 November 4,762 December 2,815 261 Total 47,578 329 490 506 369 462 The controller had prepared a Budgeted Income Statement for next year, but didn't include the costs for the Impreza. The Budgeted Income Statement is below: Morrison Corporation Budgeted Income Statement 1,500,000 Sales Commissions Other Variable Costs Contribution Margin 75,000 500,000 575,000 925,000 Fixed selling costs Fixed administrative costs Net Operating Income 400,000 300,000 700,000 225,000 costs for the Impreza. The Budgeted Income Statement is below: Morrison Corporation Budgeted Income Statement 1,500,000 Sales Commissions Other Variable Costs Contribution Margin 75,000 500,000 575,000 925,000 Fixed selling costs Fixed administrative costs Net Operating Income 400,000 300,000 700,000 225,000 Required: 1. Using the high-low method, determine the portion of "Other costs that are fixed (rounded to the nearest dollar) and the variable costs per mile (rounded two decimal places). 2. Prepare a budgeted contribution format income statement with the costs related to the Impreza included. It is estimated that the sales agent will drive 50,000 miles next year. 3. Using your budged contribution format income statement, calculate break even in sales. 4. The owner of the company would like to have profit of $250,000 next year, what volume of sales would be necessary to meet this target? 5. Write a memo to the owner of Morrison Corporation briefly explaining your work and giving recommendations as to how Morrison might achieve the $250,000 target profit. 1. High-Low Method is used to segregate the variable and fixed costs when a limited or very les data is provided. Under this method, we first find the highest activity and the lowest activity out Rate answer here. activity and also taking the total cost of the highest and lowest activity. In the given case, we the activity is miles driven. so first we need to find the highest and lowest miles driven and also the total cost of the same. First we need to find the Variable Cost per mile : Formula, TCHMD-TCLMD VariableCostpermile = HMD - LMD Here, TCHMD = Total Cost of highest miles driven= $549 TCLMD = Total Cost of lowest miles driven = $140 HMD = Highest miles driven = 6,933 miles LMD = Lowest miles driven = 1,255 miles Note: Values taken from the first table of the other cost of the Impreza. Substituing the values in the formula 549 140 VariableCostpermile = 6933 - 1255 Varible Cost per mile = 0.07 per mile Now, As per the High-Low Method, we take Total highest cost for miles driven as total cost and total highest miles driven as total miles driven for the calculation purpose. Thus, Total cost = $549 Total miles driven = 6,933 miles Total Variable cost = Variable cost per mile * Total Miles driven = 0.07*6933 = $485.31 Formula, Total Fixed Cost = Total Cost - Total Variable Cost Total Fixed Cost = $549 - 5485.31 = $63.69 Total Fixed Cost (other cost that are fixed) = $63.69 Varible Cost per mile = 0.07 per mile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts