Question: Please help me with this accounting question. It is one entire question. Please solve correctly. Thank you! ABC Sales Company sells electronics. The following transactions

Please help me with this accounting question. It is one entire question. Please solve correctly. Thank you!

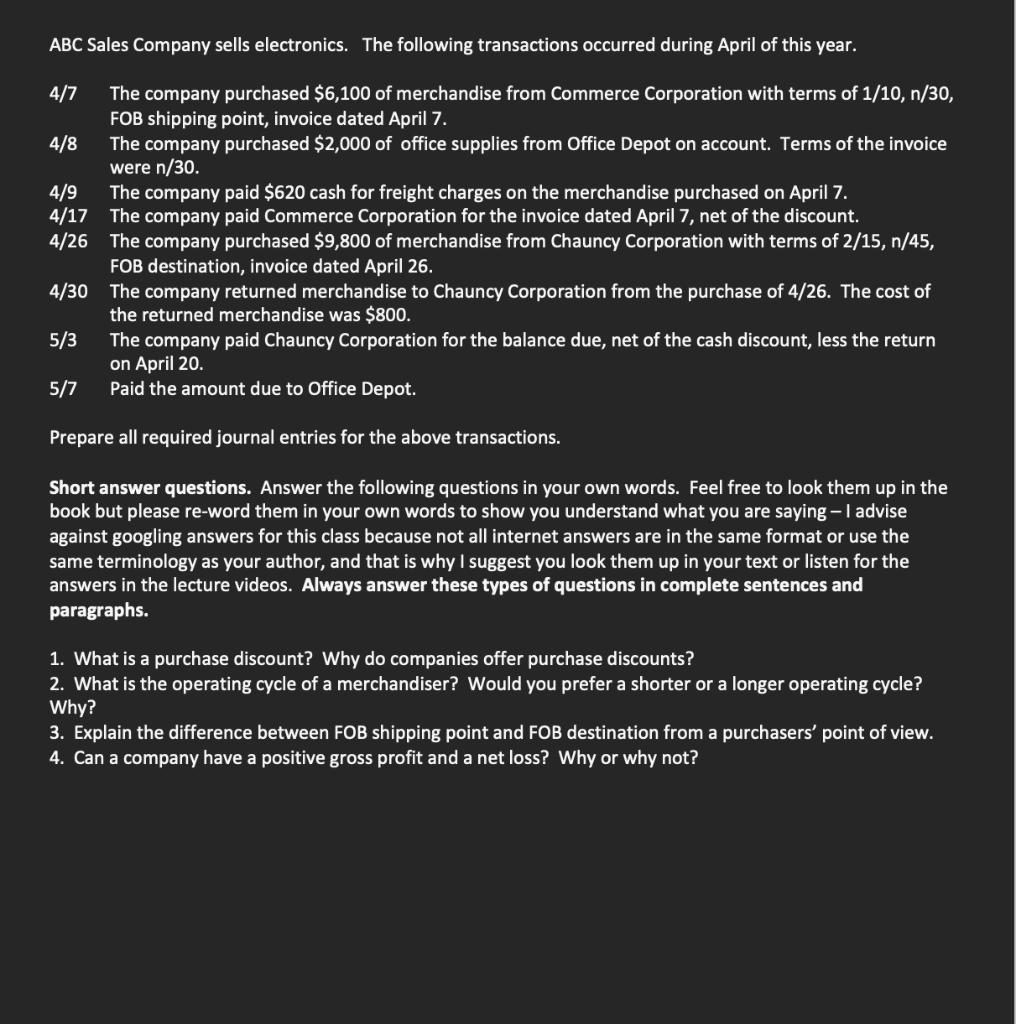

ABC Sales Company sells electronics. The following transactions occurred during April of this year. 4/7 The company purchased $6,100 of merchandise from Commerce Corporation with terms of 1/10, n/30, FOB shipping point, invoice dated April 7. 4/8 The company purchased $2,000 of office supplies from Office Depot on account. Terms of the invoice were n/30. 4/9 The company paid $620 cash for freight charges on the merchandise purchased on April 7. 4/17 The company paid Commerce Corporation for the invoice dated April 7, net of the discount. 4/26 The company purchased $9,800 of merchandise from Chauncy Corporation with terms of 2/15,n/45, FOB destination, invoice dated April 26. 4/30 The company returned merchandise to Chauncy Corporation from the purchase of 4/26. The cost of the returned merchandise was $800. 5/3 The company paid Chauncy Corporation for the balance due, net of the cash discount, less the return on April 20. 5/7 Paid the amount due to Office Depot. Prepare all required journal entries for the above transactions. Short answer questions. Answer the following questions in your own words. Feel free to look them up in the book but please re-word them in your own words to show you understand what you are saying I advise against googling answers for this class because not all internet answers are in the same format or use the same terminology as your author, and that is why I suggest you look them up in your text or listen for the answers in the lecture videos. Always answer these types of questions in complete sentences and paragraphs. 1. What is a purchase discount? Why do companies offer purchase discounts? 2. What is the operating cycle of a merchandiser? Would you prefer a shorter or a longer operating cycle? Why? 3. Explain the difference between FOB shipping point and FOB destination from a purchasers' point of view. 4. Can a company have a positive gross profit and a net loss? Why or why not? ABC Sales Company sells electronics. The following transactions occurred during April of this year. 4/7 The company purchased $6,100 of merchandise from Commerce Corporation with terms of 1/10, n/30, FOB shipping point, invoice dated April 7. 4/8 The company purchased $2,000 of office supplies from Office Depot on account. Terms of the invoice were n/30. 4/9 The company paid $620 cash for freight charges on the merchandise purchased on April 7. 4/17 The company paid Commerce Corporation for the invoice dated April 7, net of the discount. 4/26 The company purchased $9,800 of merchandise from Chauncy Corporation with terms of 2/15,n/45, FOB destination, invoice dated April 26. 4/30 The company returned merchandise to Chauncy Corporation from the purchase of 4/26. The cost of the returned merchandise was $800. 5/3 The company paid Chauncy Corporation for the balance due, net of the cash discount, less the return on April 20. 5/7 Paid the amount due to Office Depot. Prepare all required journal entries for the above transactions. Short answer questions. Answer the following questions in your own words. Feel free to look them up in the book but please re-word them in your own words to show you understand what you are saying I advise against googling answers for this class because not all internet answers are in the same format or use the same terminology as your author, and that is why I suggest you look them up in your text or listen for the answers in the lecture videos. Always answer these types of questions in complete sentences and paragraphs. 1. What is a purchase discount? Why do companies offer purchase discounts? 2. What is the operating cycle of a merchandiser? Would you prefer a shorter or a longer operating cycle? Why? 3. Explain the difference between FOB shipping point and FOB destination from a purchasers' point of view. 4. Can a company have a positive gross profit and a net loss? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts