Question: Part Two Net Present Value Method Net present value (NPV) is one method that can be used to evaluate the financial viability of potential projects.

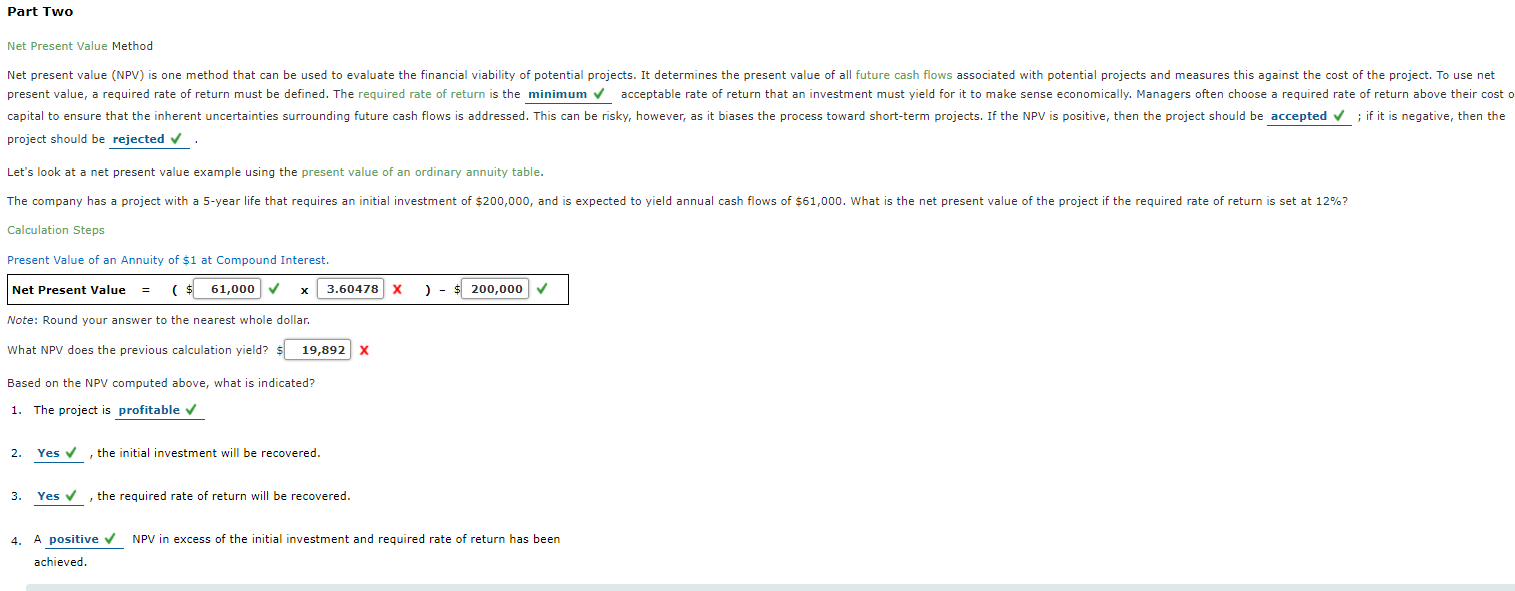

Part Two Net Present Value Method Net present value (NPV) is one method that can be used to evaluate the financial viability of potential projects. It determines the present value of all future cash flows associated with potential projects and measures this against the cost of the project. To use net present value, a required rate of return must be defined. The required rate of return is the minimum acceptable rate of return that an investment must yield for it to make sense economically. Managers often choose a required rate of return above their costo capital to ensure that the inherent uncertainties surrounding future cash flows is addressed. This can be risky, however, as it biases the process toward short-term projects. If the NPV is positive, then the project should be accepted ; if it is negative, then the project should be rejected Let's look at a net present value example using the present value of an ordinary annuity table. The company has a project with a 5-year life that requires an initial investment of $200,000, and is expected to yield annual cash flows of $61,000. What is the net present value of the project if the required rate of return is set at 12%? Calculation Steps Present Value of an Annuity of $1 at Compound Interest. Net Present Value = 61,000 3.60478 ) 200,000 Note: Round your answer to the nearest whole dollar. What NPV does the previous calculation yield? 19,892 X Based on the NPV computed above, what is indicated? 1. The project is profitable 2. Yes, the initial investment will be recovered. 3. Yes the required rate of return will be recovered. NPV in excess of the initial investment and required rate of return has been 4. A positive achieved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts