Question: Partial Question 8 3.33 / 5 pts Shell is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 15% during

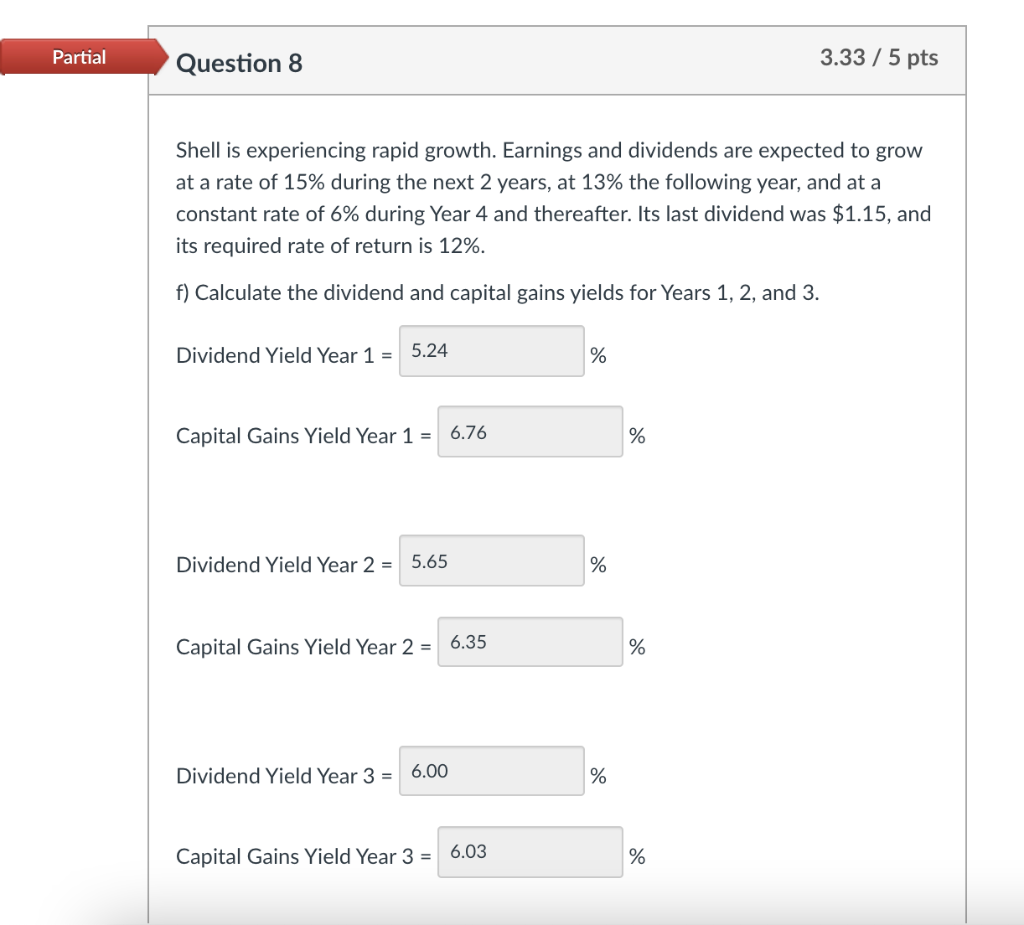

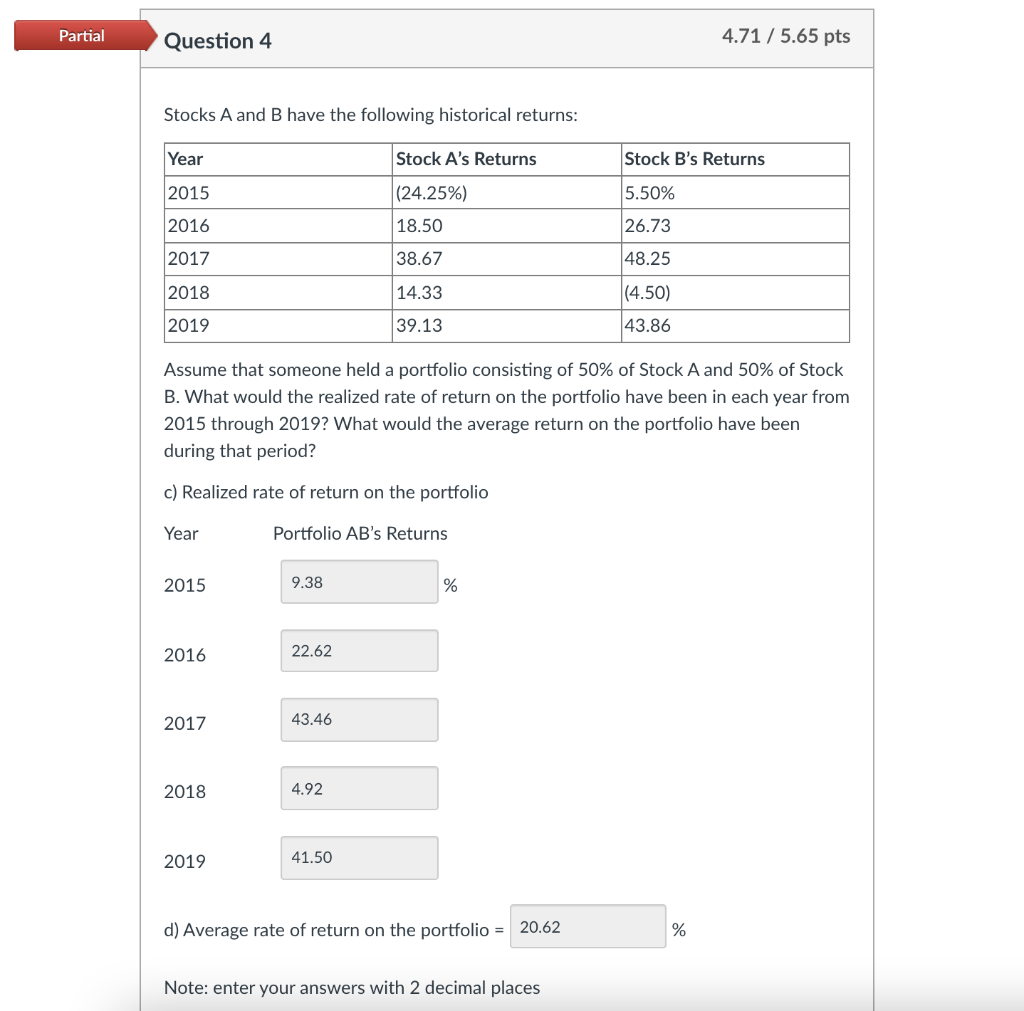

Partial Question 8 3.33 / 5 pts Shell is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 15% during the next 2 years, at 13% the following year, and at a constant rate of 6% during Year 4 and thereafter. Its last dividend was $1.15, and its required rate of return is 12%. f) Calculate the dividend and capital gains yields for Years 1, 2, and 3. Dividend Yield Year 1 = 5.24 % Capital Gains Yield Year 1 = 6.76 % Dividend Yield Year 2 = 5.65 % Capital Gains Yield Year 2 = 6.35 % Dividend Yield Year 3 = 6.00 % Capital Gains Yield Year 3 = 6.03 % Partial Question 4 4.71 / 5.65 pts Stocks A and B have the following historical returns: Year Stock A's Returns Stock B's Returns 2015 (24.25%) 5.50% 2016 18.50 26.73 2017 38.67 48.25 2018 14.33 (4.50) 2019 39.13 43.86 Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would the realized rate of return on the portfolio have been in each year from 2015 through 2019? What would the average return on the portfolio have been during that period? c) Realized rate of return on the portfolio Year Portfolio AB's Returns 2015 9.38 % 2016 22.62 2017 43.46 2018 4.92 2019 41.50 d) Average rate of return on the portfolio = 20.62 % Note: enter your answers with 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts