Question: Shell is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 15% during the next 2 years, at 13% the

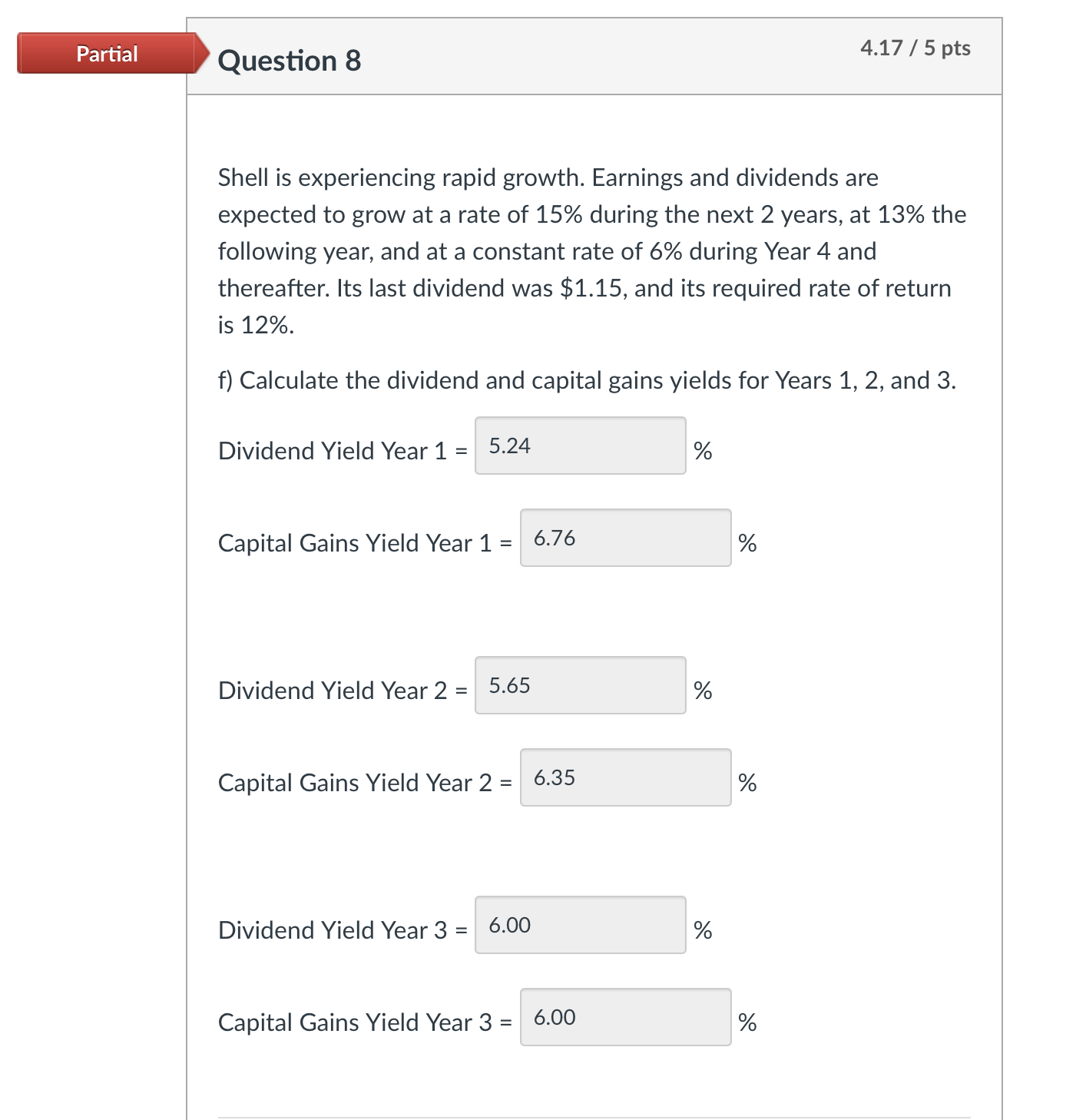

Shell is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 15% during the next 2 years, at 13% the following year, and at a constant rate of 6% during Year 4 and thereafter. Its last dividend was $1.15, and its required rate of return is 12%.

f) Calculate the dividend and capital gains yields for Years 1, 2, and 3.

Dividend Yield Year 1 = %

Capital Gains Yield Year 1 = %

Dividend Yield Year 2 = %

Capital Gains Yield Year 2 = %

Dividend Yield Year 3 = %

Capital Gains Yield Year 3 = %

THERE IS 1 INCORRECT, BUT IT DOES NOT TELL ME WHICH ONE.

THERE IS 1 INCORRECT, BUT IT DOES NOT TELL ME WHICH ONE.

Partial 4.17 / 5 pts Question 8 Shell is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 15% during the next 2 years, at 13% the following year, and at a constant rate of 6% during Year 4 and thereafter. Its last dividend was $1.15, and its required rate of return is 12%. f) Calculate the dividend and capital gains yields for Years 1, 2, and 3. Dividend Yield Year 1 = 5.24 % Capital Gains Yield Year 1 = 6.76 = % Dividend Yield Year 2 = 5.65 % Capital Gains Yield Year 2 = 6.35 % Dividend Yield Year 3 6.00 % Capital Gains Yield Year 3 = 6.00 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts