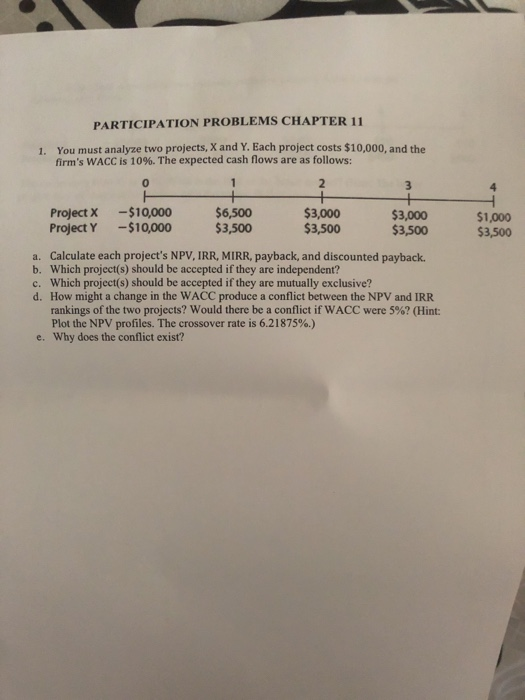

Question: PARTICIPATION PROBLEMS CHAPTER 11 You must analyze two projects, X and Y. Each project costs $10,000, and the firm's WACC is 10%. The expected cash

PARTICIPATION PROBLEMS CHAPTER 11 You must analyze two projects, X and Y. Each project costs $10,000, and the firm's WACC is 10%. The expected cash flows are as follows: 1. 0 2 Project X -$10,000 Project Y $10,000 $3,500 $6,500 $3,000 $3,500 $3,000 $3,500 $1,000 $3,500 Calculate each project's NPV, IRR, MIRR, payback, and discounted payback. a. b. Which project(s) should be accepted if they are independent? c. d. How might a change in the WACC produce a conflict between the NPV and IRR Which project(s) should be accepted if they are mutually exclusive? rankings of the two projects? Would there be a conflict if WACC were 5%2 (Hint: Plot the NPV profiles. The crossover rate is 6.21875%.) Why does the conflict exist? e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts